Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The first year PGI is equal to $3,283,200 Vacancy rate is expected at 6% First year operating expense are $1,176,344.01 *This would make year one

The first year PGI is equal to $3,283,200

Vacancy rate is expected at 6%

First year operating expense are $1,176,344.01

*This would make year one NOI $1,909,863,99* (before the growth rates listed above)

Loan Terms are as follows:

30 years, 4.5% interest, w/ monthly payments

Loan Amount = $19,588,3448.62, Annual Debt Service = $1,191,015.42

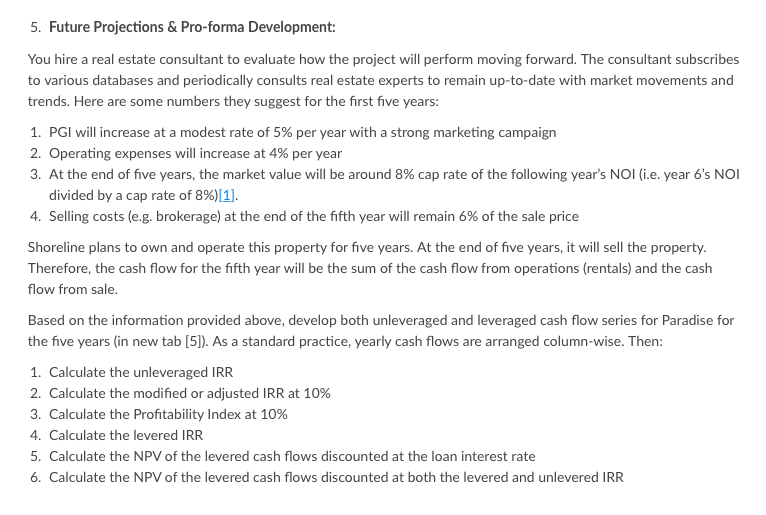

5. Future Projections & Pro-forma Development: You hire a real estate consultant to evaluate how the project will perform moving forward. The consultant subscribes to various databases and periodically consults real estate experts to remain up-to-date with market movements and trends. Here are some numbers they suggest for the first five years: 1. PGI will increase at a modest rate of 5% per year with a strong marketing campaign 2. Operating expenses will increase at 4% per year 3. At the end of five years, the market value will be around 8% cap rate of the following year's NOI (i.e. year 6's NOI divided by a cap rate of 8%)[1]. 4. Selling costs (e.g. brokerage) at the end of the fifth year will remain 6% of the sale price Shoreline plans to own and operate this property for five years. At the end of five years, it will sell the property. Therefore, the cash flow for the fifth year will be the sum of the cash flow from operations (rentals) and the cash flow from sale. Based on the information provided above, develop both unleveraged and leveraged cash flow series for Paradise for the five years (in new tab [5]). As a standard practice, yearly cash flows are arranged column-wise. Then: 1. Calculate the unleveraged IRR 2. Calculate the modified or adjusted IRR at 10% 3. Calculate the Profitability Index at 10% 4. Calculate the levered IRR 5. Calculate the NPV of the levered cash flows discounted at the loan interest rate 6. Calculate the NPV of the levered cash flows discounted at both the levered and unlevered IRR 5. Future Projections & Pro-forma Development: You hire a real estate consultant to evaluate how the project will perform moving forward. The consultant subscribes to various databases and periodically consults real estate experts to remain up-to-date with market movements and trends. Here are some numbers they suggest for the first five years: 1. PGI will increase at a modest rate of 5% per year with a strong marketing campaign 2. Operating expenses will increase at 4% per year 3. At the end of five years, the market value will be around 8% cap rate of the following year's NOI (i.e. year 6's NOI divided by a cap rate of 8%)[1]. 4. Selling costs (e.g. brokerage) at the end of the fifth year will remain 6% of the sale price Shoreline plans to own and operate this property for five years. At the end of five years, it will sell the property. Therefore, the cash flow for the fifth year will be the sum of the cash flow from operations (rentals) and the cash flow from sale. Based on the information provided above, develop both unleveraged and leveraged cash flow series for Paradise for the five years (in new tab [5]). As a standard practice, yearly cash flows are arranged column-wise. Then: 1. Calculate the unleveraged IRR 2. Calculate the modified or adjusted IRR at 10% 3. Calculate the Profitability Index at 10% 4. Calculate the levered IRR 5. Calculate the NPV of the levered cash flows discounted at the loan interest rate 6. Calculate the NPV of the levered cash flows discounted at both the levered and unlevered IRRStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started