Answered step by step

Verified Expert Solution

Question

1 Approved Answer

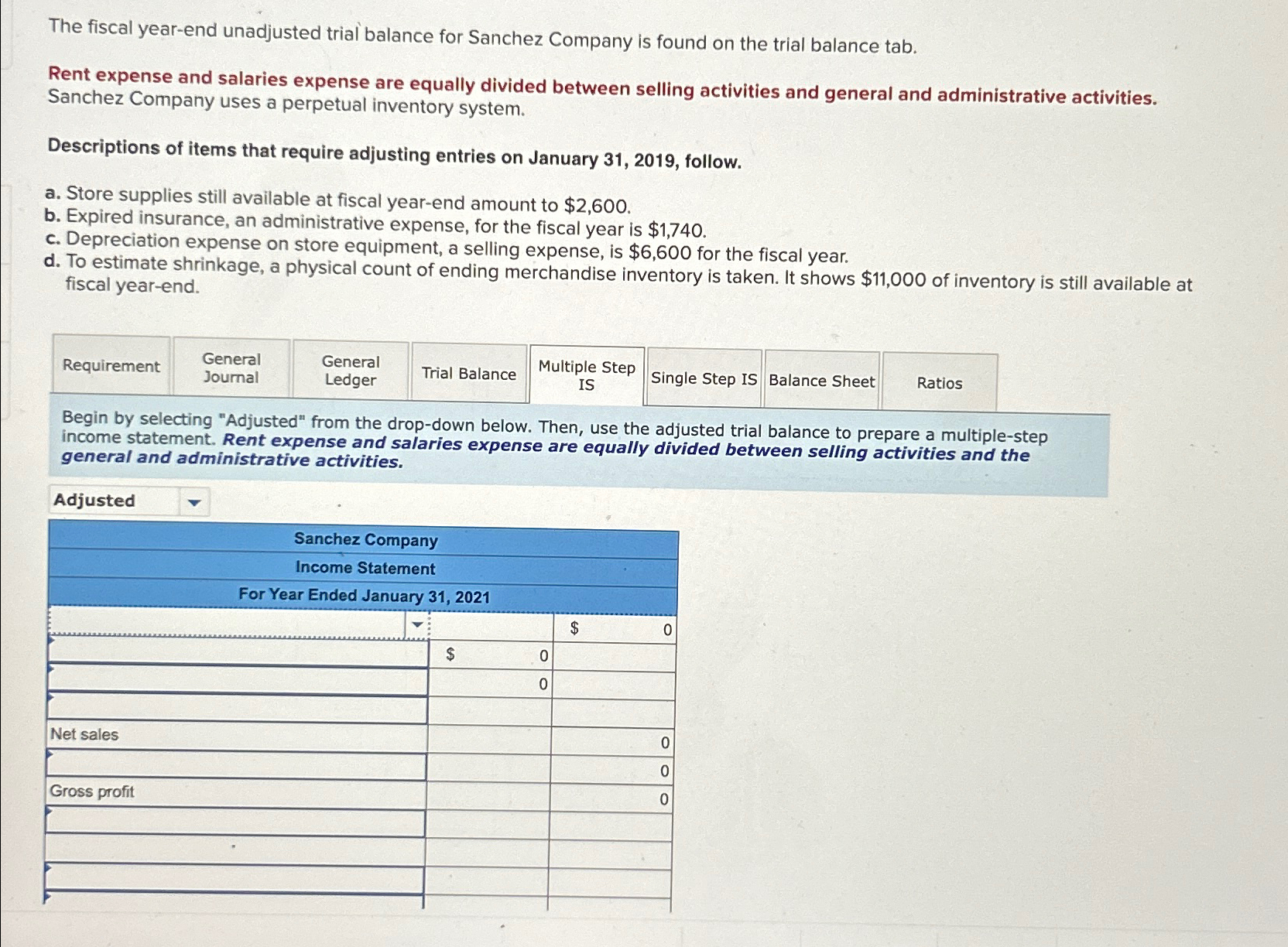

The fiscal year - end unadjusted trial balance for Sanchez Company is found on the trial balance tab. Rent expense and salaries expense are equally

The fiscal yearend unadjusted trial balance for Sanchez Company is found on the trial balance tab.

Rent expense and salaries expense are equally divided between selling activities and general and administrative activities. Sanchez Company uses a perpetual inventory system.

Descriptions of items that require adjusting entries on January follow.

a Store supplies still available at fiscal yearend amount to $

b Expired insurance, an administrative expense, for the fiscal year is $

c Depreciation expense on store equipment, a selling expense, is $ for the fiscal year.

d To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $ of inventory is still available at fiscal yearend.

Requirement

General

General

Trial Balance

Multiple Step

IS

Single Step IS

Balance Sheet

Begin by selecting "Adjusted" from the dropdown below. Then, use the adjusted trial balance to prepare a multiplestep income statement. Rent expense and salaries expense are equally divided between selling activities and the general and administrative activities.

Adjusted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started