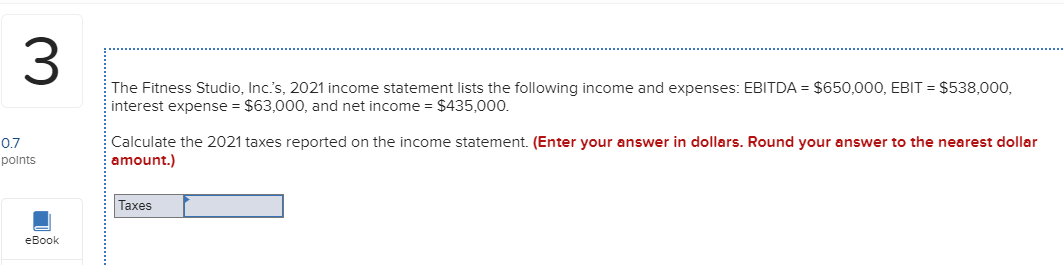

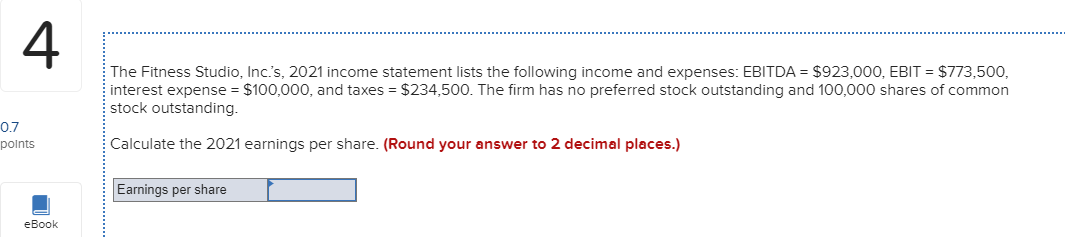

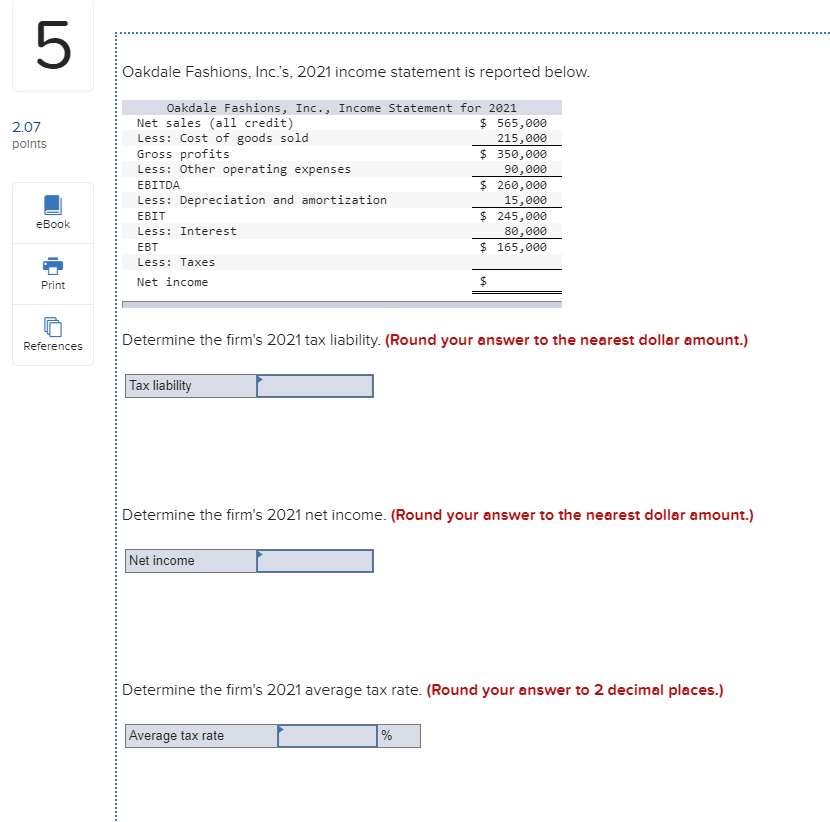

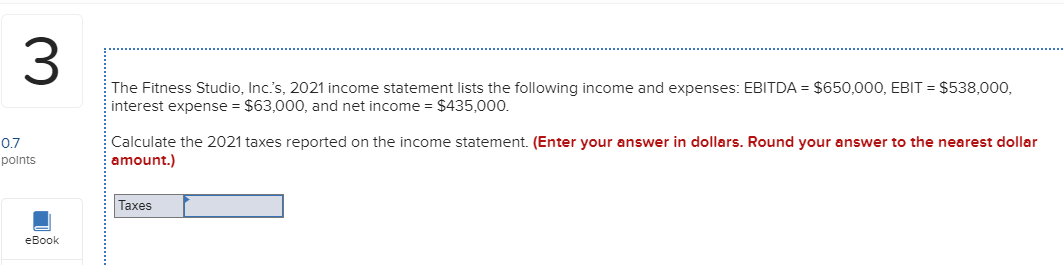

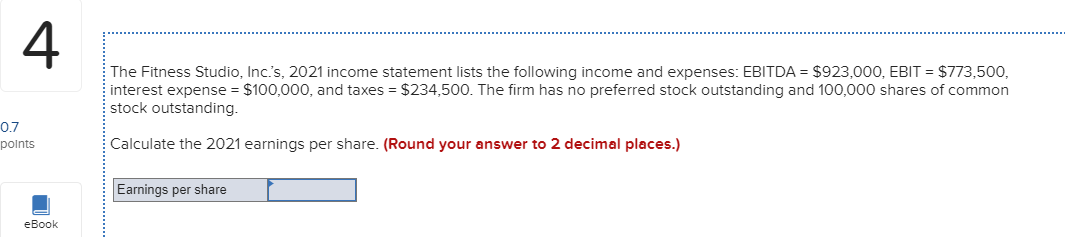

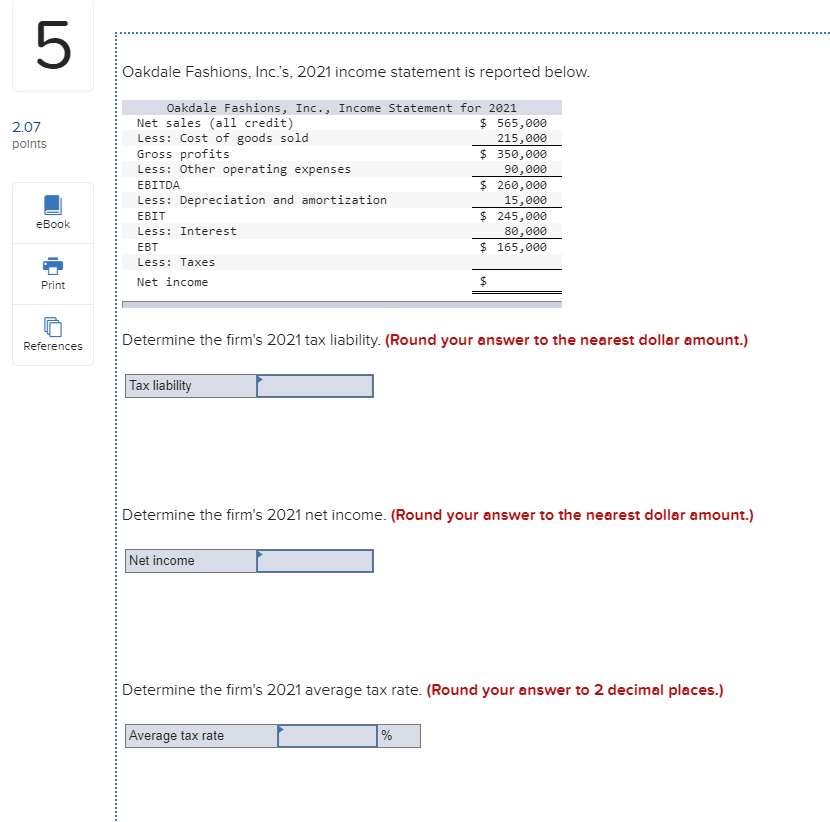

The Fitness Studio, Inc.'s, 2021 income statement lists the following income and expenses: EBITDA = $650,000, EBIT = $538,000, interest expense = $63,000, and net income = $435,000. 0.7 points Calculate the 2021 taxes reported on the income statement. (Enter your answer in dollars. Round your answer to the nearest dollar amount.) Taxes eBook The Fitness Studio, Inc.'s, 2021 income statement lists the following income and expenses: EBITDA = $923,000, EBIT = $773,500, interest expense = $100,000, and taxes = $234,500. The firm has no preferred stock outstanding and 100,000 shares of common stock outstanding. 0.7 points Calculate the 2021 earnings per share. (Round your answer to 2 decimal places.) Earnings per share eBook Oakdale Fashions, Inc.'s, 2021 income statement is reported below. 2.07 points Oakdale Fashions, Inc., Income Statement for 2021 Net sales (all credit) $ 565,000 Less: Cost of goods sold 215,000 Gross profits $ 350,000 Less: Other operating expenses 90,000 EBITDA $ 260,000 Less: Depreciation and amortization 15,000 EBIT $ 245,000 Less: Interest 80,000 EBT $ 165,000 Less: Taxes Net income eBook Print References Determine the firm's 2021 tax liability. (Round your answer to the nearest dollar amount.) Tax liability Determine the firm's 2021 net income. (Round your answer to the nearest dollar amount.) Net income income Determine the firm's 2021 average tax rate. (Round your answer to 2 decimal places.) Average tax rate The Fitness Studio, Inc.'s, 2021 income statement lists the following income and expenses: EBITDA = $650,000, EBIT = $538,000, interest expense = $63,000, and net income = $435,000. 0.7 points Calculate the 2021 taxes reported on the income statement. (Enter your answer in dollars. Round your answer to the nearest dollar amount.) Taxes eBook The Fitness Studio, Inc.'s, 2021 income statement lists the following income and expenses: EBITDA = $923,000, EBIT = $773,500, interest expense = $100,000, and taxes = $234,500. The firm has no preferred stock outstanding and 100,000 shares of common stock outstanding. 0.7 points Calculate the 2021 earnings per share. (Round your answer to 2 decimal places.) Earnings per share eBook Oakdale Fashions, Inc.'s, 2021 income statement is reported below. 2.07 points Oakdale Fashions, Inc., Income Statement for 2021 Net sales (all credit) $ 565,000 Less: Cost of goods sold 215,000 Gross profits $ 350,000 Less: Other operating expenses 90,000 EBITDA $ 260,000 Less: Depreciation and amortization 15,000 EBIT $ 245,000 Less: Interest 80,000 EBT $ 165,000 Less: Taxes Net income eBook Print References Determine the firm's 2021 tax liability. (Round your answer to the nearest dollar amount.) Tax liability Determine the firm's 2021 net income. (Round your answer to the nearest dollar amount.) Net income income Determine the firm's 2021 average tax rate. (Round your answer to 2 decimal places.) Average tax rate