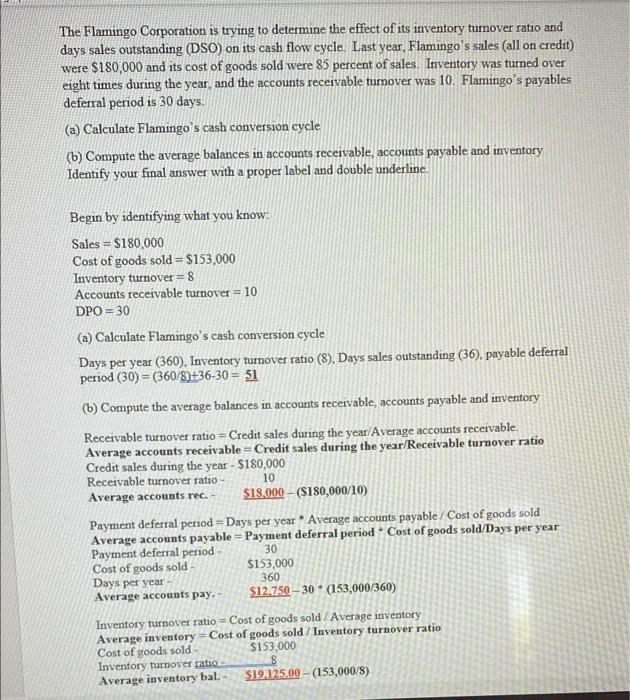

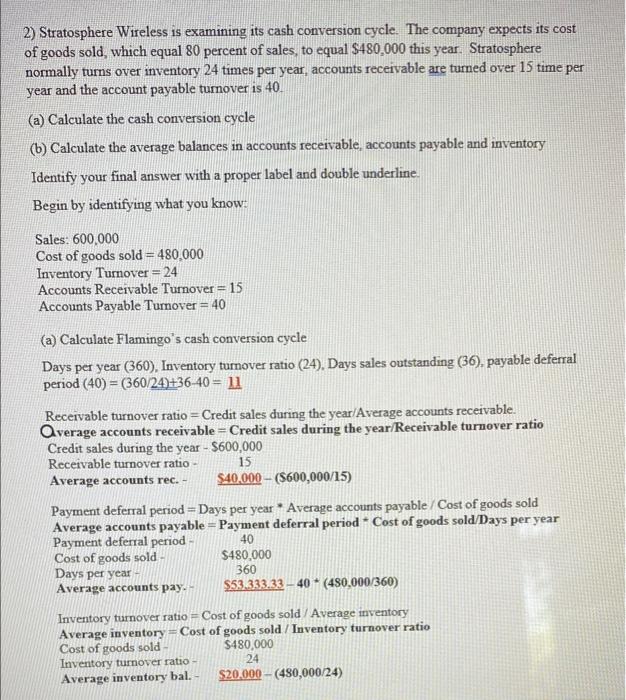

The Flamingo Corporation is trying to determine the effect of its inventory tumover ratio and days sales outstanding (DSO) on its cash flow cycle. Last year, Flamingo s sales (all on credit) were $180,000 and its cost of goods sold were 85 percent of sales. Inventory was turned over eight times during the year and the accounts receivable turnover was 10. Flamingo's payables deferral period is 30 days. (a) Calculate Flamingo's cash conversion cycle (b) Compute the average balances in accounts receivable, accounts payable and inventory Identify your final answer with a proper label and double underline. Begin by identifying what you know Sales = $180,000 Cost of goods sold = $153,000 Inventory turnover = 8 Accounts receivable turnover = 10 DPO = 30 (a) Calculate Flamingo's cash conversion cycle Days per year (360). Inventory turnover ratio (8), Days sales outstanding (36), payable deferral period (30) = (360/8)+36-30 = 51 (6) Compute the average balances in accounts receivable, accounts payable and inventory Receivable turnover ratio=Credit sales during the year/Average accounts receivable. Average accounts receivable = Credit sales during the year/Receivable turnover ratio Credit sales during the year - $180,000 Receivable turnover ratio Average accounts rec. $18,000 - ($180,000/10) Payment deferral period Days per year. Average accounts payable / Cost of goods sold Average accounts payable - Payment deferral period. Cost of goods sold/Days per year Payment deferral period Cost of goods sold $153,000 Days per year 360 Average accounts pay. $12.750 30 - (153,000/360) Inventory turnover ratio = Cost of goods sold Average inventory Average inventory Cost of goods sold / Inventory turnover ratio Cost of goods sold $153,000 Inventory turnover ratio Average inventory bal. $19.125.00 - (153,000/8) 10 30 2) Stratosphere Wireless is examining its cash conversion cycle. The company expects its cost of goods sold, which equal 80 percent of sales to equal $480,000 this year. Stratosphere normally turns over inventory 24 times per year, accounts receivable are turned over 15 time per year and the account payable turnover is 40. (a) Calculate the cash conversion cycle (b) Calculate the average balances in accounts receivable, accounts payable and inventory Identify your final answer with a proper label and double underline. Begin by identifying what you know: Sales: 600.000 Cost of goods sold = 480.000 Inventory Turnover = 24 Accounts Receivable Tumover = 15 Accounts Payable Turnover = 40 (a) Calculate Flamingo's cash conversion cycle Days per year (360), Inventory turnover ratio (24). Days sales outstanding (36). payable deferral period (40) = (360/24):36-40 = 11 Receivable turnover ratio = Credit sales during the year/Average accounts receivable. Average accounts receivable = Credit sales during the year/Receivable turnover ratio Credit sales during the year - $600,000 Receivable turnover ratio 15 Average accounts rec. $40,000 - (5600,000/15) Payment deferral period = Days per year Average accounts payable Cost of goods sold Average accounts payable = Payment deferral period Cost of goods sold/Days per year Payment deferral period - Cost of goods sold $480,000 Days per year Average accounts pay. $53.333.33 - 40 - (480,000/360) 40 360 Inventory turnover ratio=Cost of goods sold / Average inventory Average inventory = Cost of goods sold / Inventory turnover ratio Cost of goods sold $480,000 Inventory turnover ratio- 24 Average inventory bal. $20.000 - (480,000/24)