The Focus Company does not maintain backup documents for its computer files. In June, some of the current data were lost, and you have been

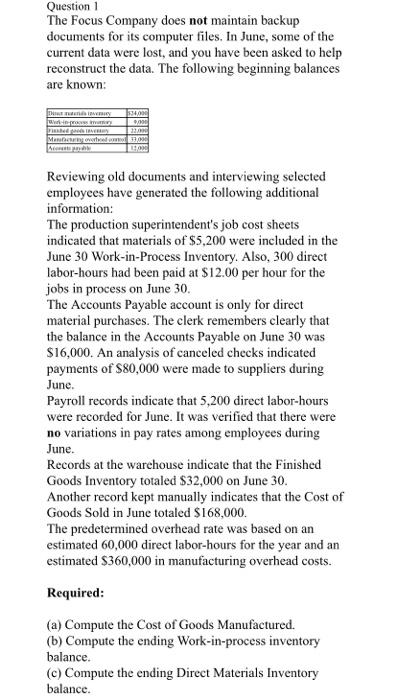

The Focus Company does not maintain backup documents for its computer files. In June, some of the current data were lost, and you have been asked to help reconstruct the data. The following beginning balances are known:

Direct materials inventory | $24,000 |

Work-in-process inventory | 9,000 |

Finished goods inventory | 22,000 |

Manufacturing overhead control | 33,000 |

Accounts payable | 12,000 |

Reviewing old documents and interviewing selected employees have generated the following additional information: The production superintendent's job cost sheets indicated that materials of $5,200 were included in the June 30 Work-in-Process Inventory. Also, 300 direct labor-hours had been paid at $12.00 per hour for the jobs in process on June 30. The Accounts Payable account is only for direct material purchases. The clerk remembers clearly that the balance in the Accounts Payable on June 30 was $16,000. An analysis of canceled checks indicated payments of $80,000 were made to suppliers during June. Payroll records indicate that 5,200 direct labor-hours were recorded for June. It was verified that there were no variations in pay rates among employees during June. Records at the warehouse indicate that the Finished Goods Inventory totaled $32,000 on June 30. Another record kept manually indicates that the Cost of Goods Sold in June totaled $168,000. The predetermined overhead rate was based on an estimated 60,000 direct labor-hours for the year and an estimated $360,000 in manufacturing overhead costs. Required: (a) Compute the Cost of Goods Manufactured. (b) Compute the ending Work-in-process inventory balance. (c) Compute the ending Direct Materials Inventory balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started