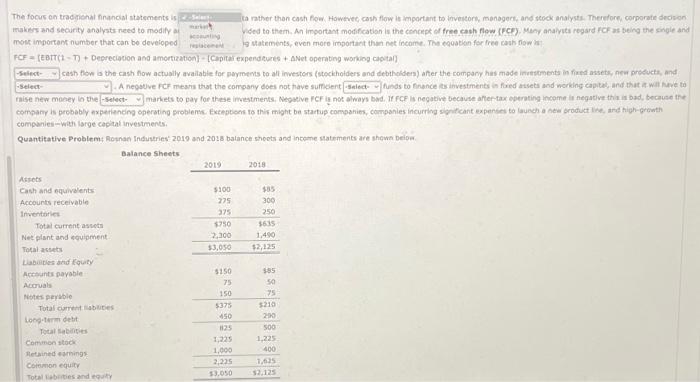

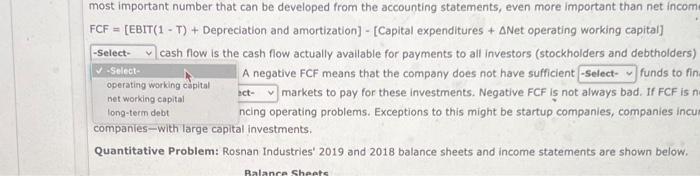

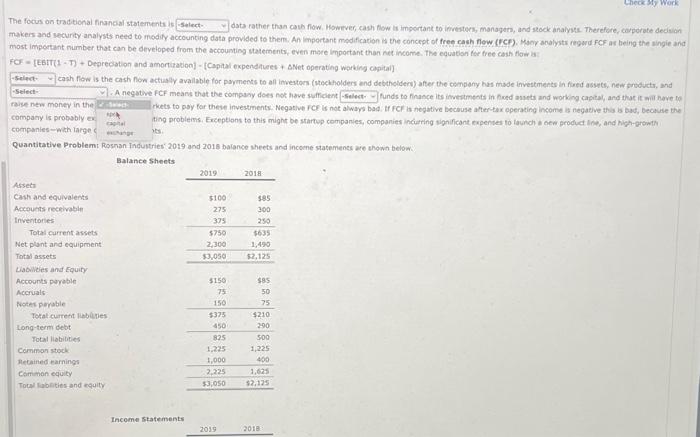

The focus on tradrional financial statements is makers and security analysts need to modify mour importan number that can be deveioped a rather then cash fow. Howtvec, cash flow is important to taveitork, managers, and seock analysts. Therefore, corporate deciscr Ided to them. An important modification is the concrek of free cash flow. (FCF). Meny analyuta regard fof as being the single and 9 satements, even more important than net income. The equabkan for free cash fiow in: FCF = [EBrTC T]+ Depreciovion and amortization] - [Capitar expendeuces + ANet operabing workiog capital] 1. A negotve FCF mesis that the company does not have suffolent raise new mosey in the comparies-with large capital investments. Quantitative Problem: Rosnan Industries: 2019 and 2025 balance shoots and inceme satements are shewn belipa Thinel most important number that can be developed from the accounting statements, even more important than net incom FCF = [EBIT (1T)+ Depreciation and amortization] [ [Capital expenditures + Net operating working capital] cash flow is the cash flow actually avallable for payments to all investors (stockholders and debtholders) A negative FCF means that the company does not have sufficient funds to fir markets to pay for these investments. Negative FCF is not always bad. If FCF is ncing operating problems. Exceptions to this might be startup companies, companies incu companies-with large capital investments. Quantitative Problem: Rosnan Industries' 2019 and 2018 balance sheets and income statements are shown below. Labillties and Equity Accounts payable Accruals Notes payable Total current llabitues Long-tern debt Total liabilities Common stock Retained earnings Common equity Fotal labalies and equity \begin{tabular}{rr} $150 & $85 \\ 75 & 50 \\ 150 & 75 \\ \hline$375 & $210 \\ 450 & 290 \\ \hline 625 & 500 \\ 1,225 & 1,225 \\ 1,000 & 400 \\ \hline 2,225 & 1,625 \\ \hline$3,050 & $2,125 \\ \hline \end{tabular} Inceme statements sales Operating costs exduding deprecistion and amertiration IDITDA Depreciation and amortuation earr Interest EBT. Taxes (25w) Net income \begin{tabular}{rr} 2019 & 2011 \\ \hline 17,265 & $1,435 \\ 1,250 & 1,000 \\ & \\ \hline 51,015 & $445 \\ 100 & 75 \\ \hline 5915 & $410 \\ 63 & 46 \\ \hline 5852 & $364 \\ 213 & 91 \\ \hline 5639 & $273 \\ \hline \end{tabular} Dividends paid Addition to retained earaings 15415951401225 Shares outstanding Pnce 100125.00100$22.50 wace 10.00% 4 The focus on tradional finsncial statements is most important number that can be developed from the accounting statements, even more important than net income. The equation for free cash flow as FCF = [EEIT(1 - T] + Depreciation and amortiratioo] - [Capial expenditues + SNet operating working capitai] raise new moner in the company is probably en companies - with large thets to pay for these investments. Negative fCe is not alway bad. tf FCF is negative becouse antertix operating income is negaeve this is bad, becasise the Quantitative Problemt Rosnan Incuitries: 2019 and 2018 balance sheets and income statemencs are thown below. The balance in the firm's cash and equivalents account is needed for operations and is not considered "excess' cash. Using the financlal statements given above, whot is Rosnan's 2019 free cash now (FCF)? Use a minus sign to inglcate a negative FCF. Round vour atswer to the nearett cene. The focus on tradrional financial statements is makers and security analysts need to modify mour importan number that can be deveioped a rather then cash fow. Howtvec, cash flow is important to taveitork, managers, and seock analysts. Therefore, corporate deciscr Ided to them. An important modification is the concrek of free cash flow. (FCF). Meny analyuta regard fof as being the single and 9 satements, even more important than net income. The equabkan for free cash fiow in: FCF = [EBrTC T]+ Depreciovion and amortization] - [Capitar expendeuces + ANet operabing workiog capital] 1. A negotve FCF mesis that the company does not have suffolent raise new mosey in the comparies-with large capital investments. Quantitative Problem: Rosnan Industries: 2019 and 2025 balance shoots and inceme satements are shewn belipa Thinel most important number that can be developed from the accounting statements, even more important than net incom FCF = [EBIT (1T)+ Depreciation and amortization] [ [Capital expenditures + Net operating working capital] cash flow is the cash flow actually avallable for payments to all investors (stockholders and debtholders) A negative FCF means that the company does not have sufficient funds to fir markets to pay for these investments. Negative FCF is not always bad. If FCF is ncing operating problems. Exceptions to this might be startup companies, companies incu companies-with large capital investments. Quantitative Problem: Rosnan Industries' 2019 and 2018 balance sheets and income statements are shown below. Labillties and Equity Accounts payable Accruals Notes payable Total current llabitues Long-tern debt Total liabilities Common stock Retained earnings Common equity Fotal labalies and equity \begin{tabular}{rr} $150 & $85 \\ 75 & 50 \\ 150 & 75 \\ \hline$375 & $210 \\ 450 & 290 \\ \hline 625 & 500 \\ 1,225 & 1,225 \\ 1,000 & 400 \\ \hline 2,225 & 1,625 \\ \hline$3,050 & $2,125 \\ \hline \end{tabular} Inceme statements sales Operating costs exduding deprecistion and amertiration IDITDA Depreciation and amortuation earr Interest EBT. Taxes (25w) Net income \begin{tabular}{rr} 2019 & 2011 \\ \hline 17,265 & $1,435 \\ 1,250 & 1,000 \\ & \\ \hline 51,015 & $445 \\ 100 & 75 \\ \hline 5915 & $410 \\ 63 & 46 \\ \hline 5852 & $364 \\ 213 & 91 \\ \hline 5639 & $273 \\ \hline \end{tabular} Dividends paid Addition to retained earaings 15415951401225 Shares outstanding Pnce 100125.00100$22.50 wace 10.00% 4 The focus on tradional finsncial statements is most important number that can be developed from the accounting statements, even more important than net income. The equation for free cash flow as FCF = [EEIT(1 - T] + Depreciation and amortiratioo] - [Capial expenditues + SNet operating working capitai] raise new moner in the company is probably en companies - with large thets to pay for these investments. Negative fCe is not alway bad. tf FCF is negative becouse antertix operating income is negaeve this is bad, becasise the Quantitative Problemt Rosnan Incuitries: 2019 and 2018 balance sheets and income statemencs are thown below. The balance in the firm's cash and equivalents account is needed for operations and is not considered "excess' cash. Using the financlal statements given above, whot is Rosnan's 2019 free cash now (FCF)? Use a minus sign to inglcate a negative FCF. Round vour atswer to the nearett cene