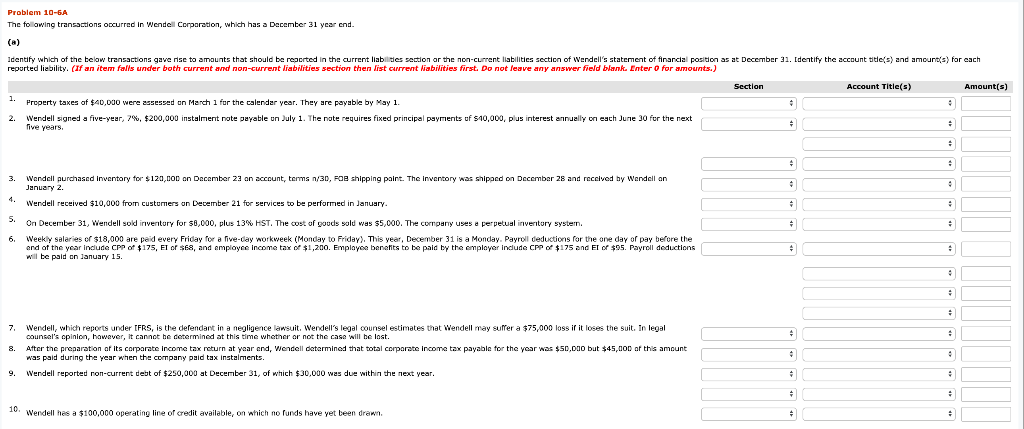

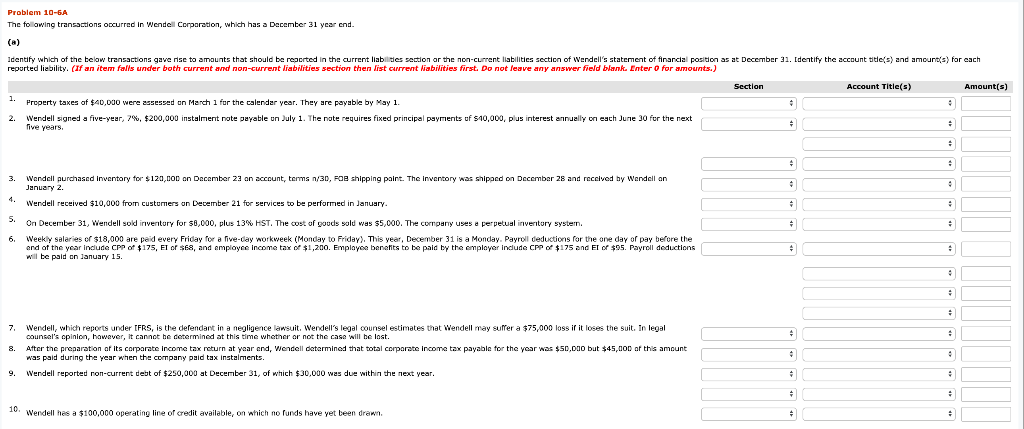

The fol owing transactions occurred in Wende Corparation, which has a December 31 year end. dentify whi of the beow transactions gave nse to amounts that should be crted in thn current liabildes section arthe non-current liabilities secticn of wnndell's statement offinancial po 0n as at December 31. ldetify the account de(s) and amount(s) for each reported liebility. (lf n item falls under both current 8/d non-current liabilit es section then list current liabilities first. Do not leave ary nswer feeld blank. Enter 0 for mounts.) Scction Account Title(s) Amountis) Property taxes of $4D,030 were assessed an March 1 for the calender year. They are payable by May 1 2. wendell signed a five-year, 7%,200.000 imstalment note geyable un July 1. The note requires fixed principal payments uf$40,000, plus interest annually on each June 30 for the next five years 3. wandell purchased inventory for January z Wendell received $10,000 from custurmers on December 21 for services to be performed in January 12a,non on Dcamber 23 nn account, terms n/3D, Fae shipping paint. The inventory was shipped on Decembar 28 and received by w ndell an On December 31, Wendell sold nventory for $8,000, plus 13% HSTThe cost of goods sold was $5,000. The corrodny uses d perpetual inventory system. 6. Weeky salaries of $18,000 are peid every Friday for a five-day workweek (Monday to Friday This year, December 31 is a Monday. Payroll deductions for the one day of pay before the end of the year indude CPp of $175, E1ar $68, and emp ovee income tax of $1,2no Emplaye e benefits to be pald by the e player indude Cpp or will be paid on january 15. 175nd Er or $95 Payroll deductions 7. Wendell, which reports under IFRS, is the defendant in a negligence lasuit, Werdell's legal oounsel estimates that Wendell may suffer a $75,000 loss if it loses the suit. In legal counsel's cpinion, hawaver, it cant he determined at this time whether or not the casl be last. After the preparation at its carparate income tax return at Yaar end, wendell datarmined that total corparate Income tax payable for the Year was *SD,D10 but45,non nr th amount was paid during the year when th company paid tax instalments. 8. Wendell reported ron-current debt of $250,000 at December 31, of which $30,000 was due within the next year 10 Wendell hes a $100,000 operating line of credit available, on which no runds have yet been dra The fol owing transactions occurred in Wende Corparation, which has a December 31 year end. dentify whi of the beow transactions gave nse to amounts that should be crted in thn current liabildes section arthe non-current liabilities secticn of wnndell's statement offinancial po 0n as at December 31. ldetify the account de(s) and amount(s) for each reported liebility. (lf n item falls under both current 8/d non-current liabilit es section then list current liabilities first. Do not leave ary nswer feeld blank. Enter 0 for mounts.) Scction Account Title(s) Amountis) Property taxes of $4D,030 were assessed an March 1 for the calender year. They are payable by May 1 2. wendell signed a five-year, 7%,200.000 imstalment note geyable un July 1. The note requires fixed principal payments uf$40,000, plus interest annually on each June 30 for the next five years 3. wandell purchased inventory for January z Wendell received $10,000 from custurmers on December 21 for services to be performed in January 12a,non on Dcamber 23 nn account, terms n/3D, Fae shipping paint. The inventory was shipped on Decembar 28 and received by w ndell an On December 31, Wendell sold nventory for $8,000, plus 13% HSTThe cost of goods sold was $5,000. The corrodny uses d perpetual inventory system. 6. Weeky salaries of $18,000 are peid every Friday for a five-day workweek (Monday to Friday This year, December 31 is a Monday. Payroll deductions for the one day of pay before the end of the year indude CPp of $175, E1ar $68, and emp ovee income tax of $1,2no Emplaye e benefits to be pald by the e player indude Cpp or will be paid on january 15. 175nd Er or $95 Payroll deductions 7. Wendell, which reports under IFRS, is the defendant in a negligence lasuit, Werdell's legal oounsel estimates that Wendell may suffer a $75,000 loss if it loses the suit. In legal counsel's cpinion, hawaver, it cant he determined at this time whether or not the casl be last. After the preparation at its carparate income tax return at Yaar end, wendell datarmined that total corparate Income tax payable for the Year was *SD,D10 but45,non nr th amount was paid during the year when th company paid tax instalments. 8. Wendell reported ron-current debt of $250,000 at December 31, of which $30,000 was due within the next year 10 Wendell hes a $100,000 operating line of credit available, on which no runds have yet been dra