Answered step by step

Verified Expert Solution

Question

1 Approved Answer

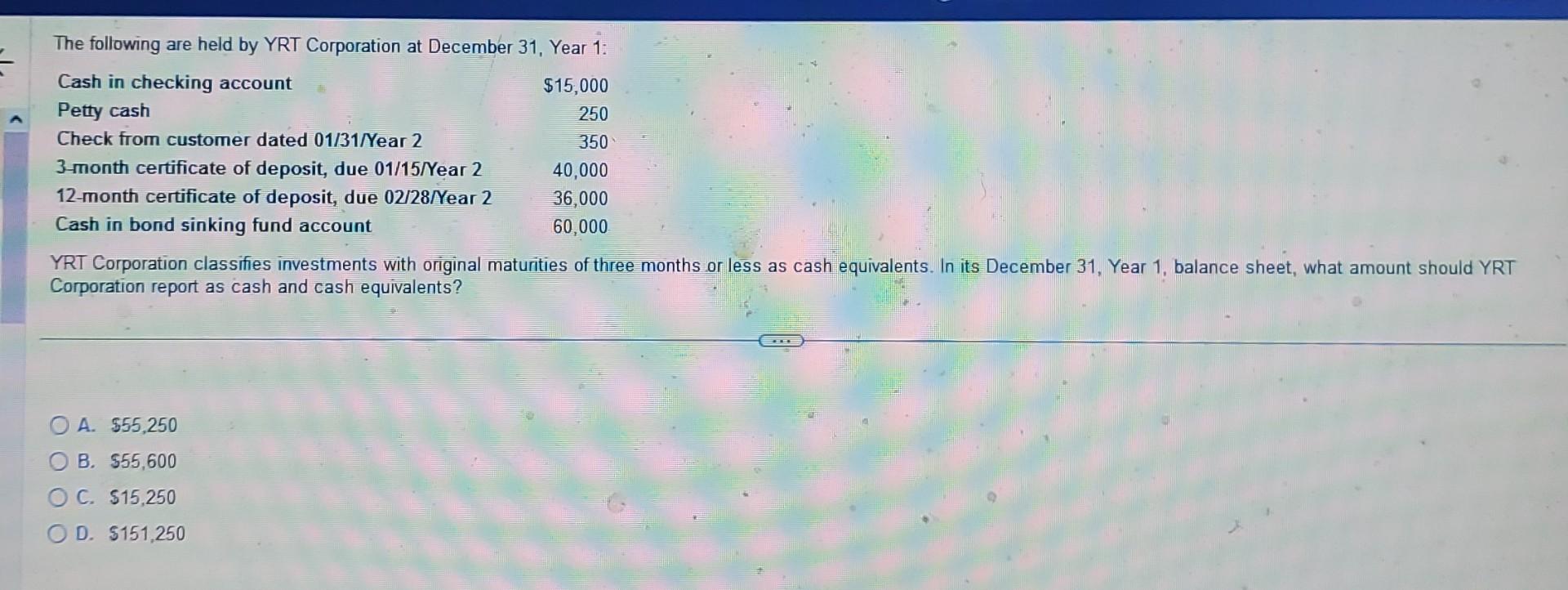

The followina are held bv YRT Cornoration at Decomher 31 Yoar 1 . YRT Corporation classifies investments with original maturities of three months or less

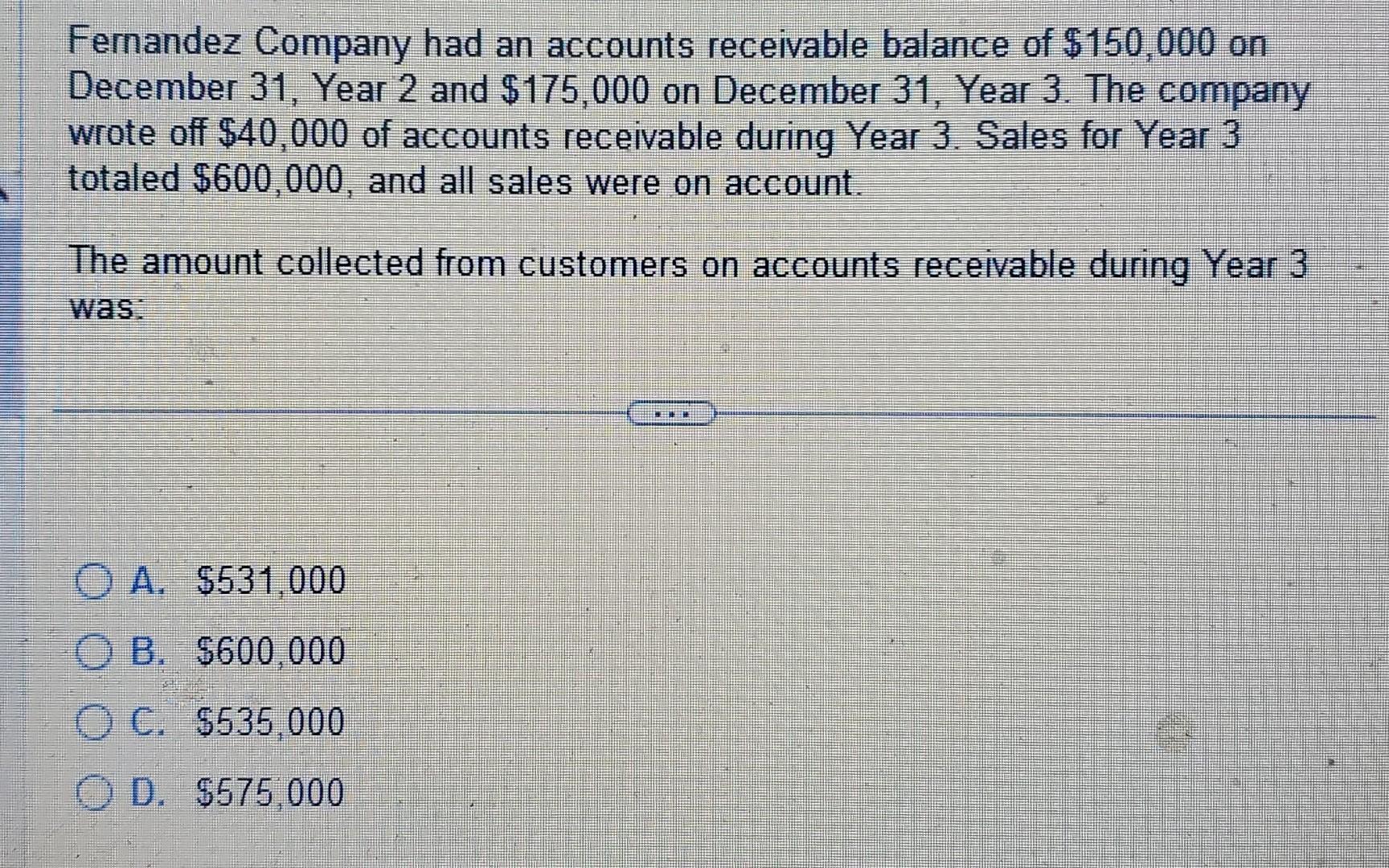

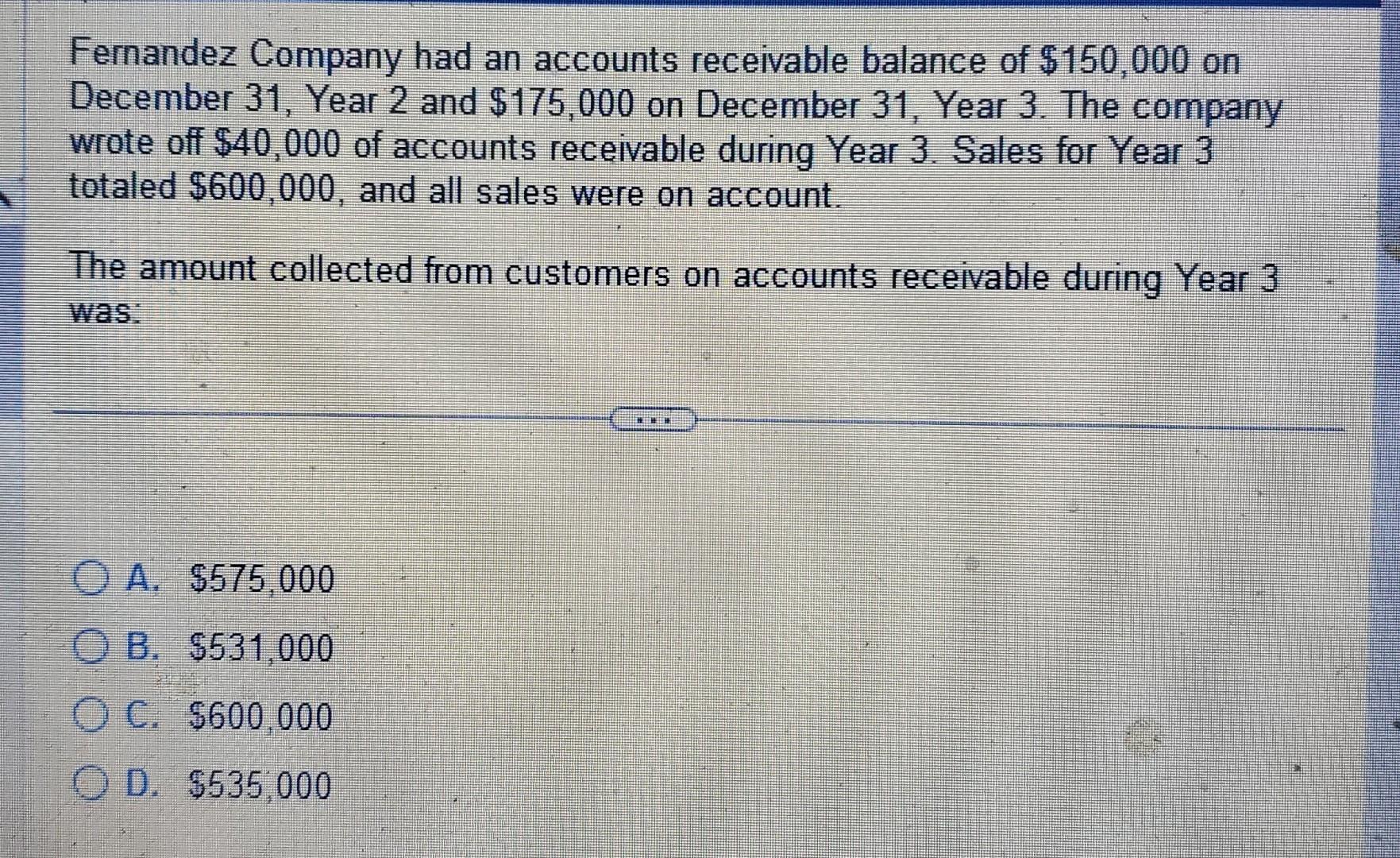

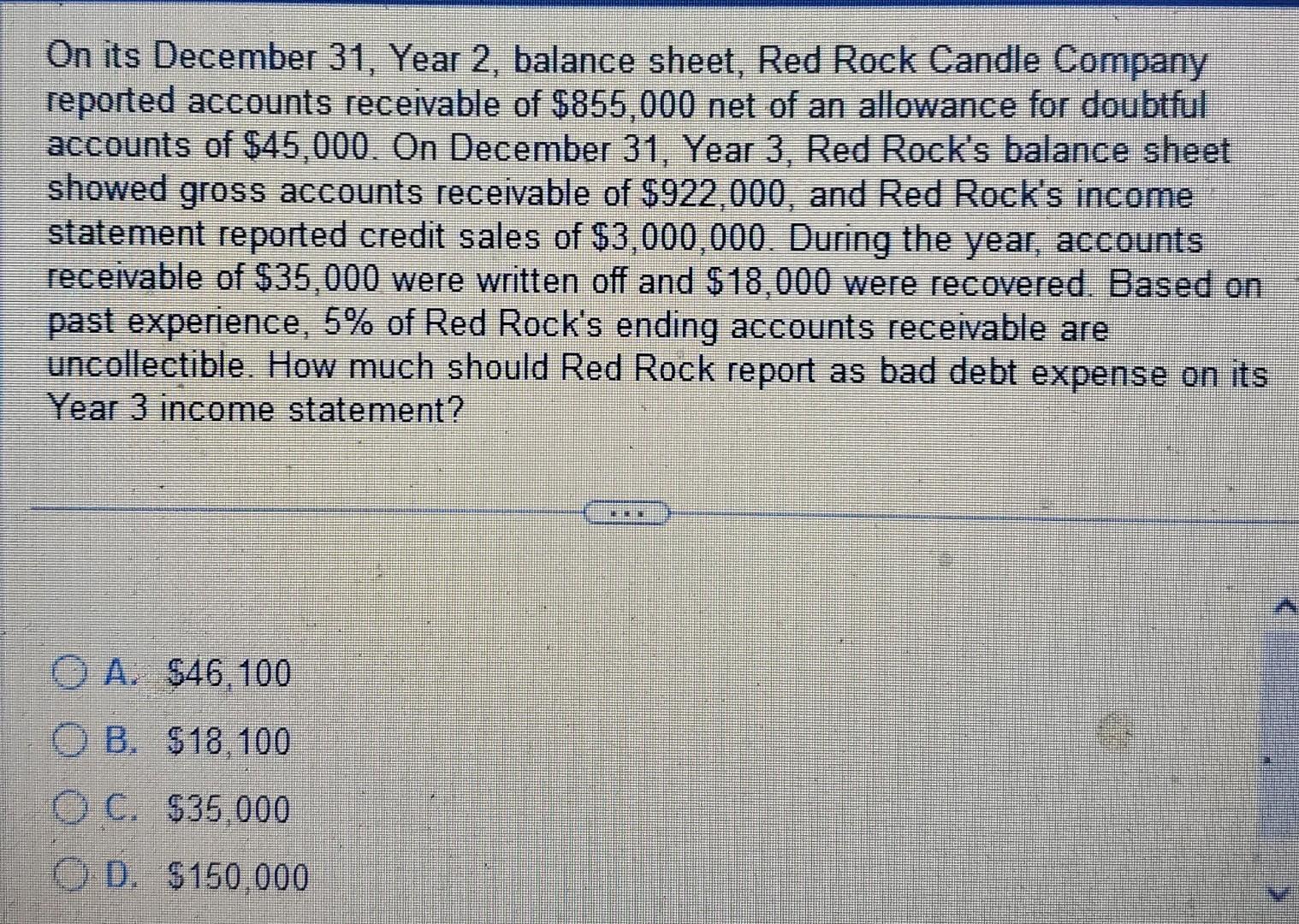

The followina are held bv YRT Cornoration at Decomher 31 Yoar 1 . YRT Corporation classifies investments with original maturities of three months or less as cash equivalents. In its December 31 , Year 1 , balance sheet, what amount should YRT Corporation report as cash and cash equivalents? A. 555,250 B. $55,600 C. $15,250 D. 5151,250 Fernandez Company had an accounts receivable balance of $150,000 on December 31, Year 2 and $175,000 on December 31 , Year 3 . The company wrote off $40,000 of accounts receivable during Year 3. Sales for Year 3 totaled $600,000, and all sales were on account. The amount collected from customers on accounts receivable during Year 3 was: A. $531,000 B. $600,000 C. $535,000 D. $575,000 Fernandez Company had an accounts receivable balance of $150,000 on December 31, Year 2 and $175,000 on December 31, Year 3. The company wrote off $40,000 of accounts receivable during Year 3 . Sales for Year 3 totaled $600,000, and all sales were on account. The amount collected from customers on accounts receivable during Year 3 was: A. $575,000 B. $531,000 C. $600,000 D. $535,000 On its December 31, Year 2, balance sheet, Red Rock Candle Company reported accounts receivable of $855,000 net of an allowance for doubtful accounts of $45,000. On December 31 , Year 3, Red Rock's balance sheet showed gross accounts receivable of $922,000, and Red Rock's income statement reported credit sales of $3,000,000. During the year, accounts receivable of $35,000 were written off and $18,000 were recovered. Based on past experience, 5% of Red Rock's ending accounts receivable are uncollectible. How much should Red Rock report as bad debt expense on its Year 3 income statement? A. $46,100 B. $18,100 C. $35,000 D. $150,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started