Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following 2024 information is available for The Tea Company: Income Statement for 2024: Sales 9,000 Cost of good sold (6,000) Other expense (including

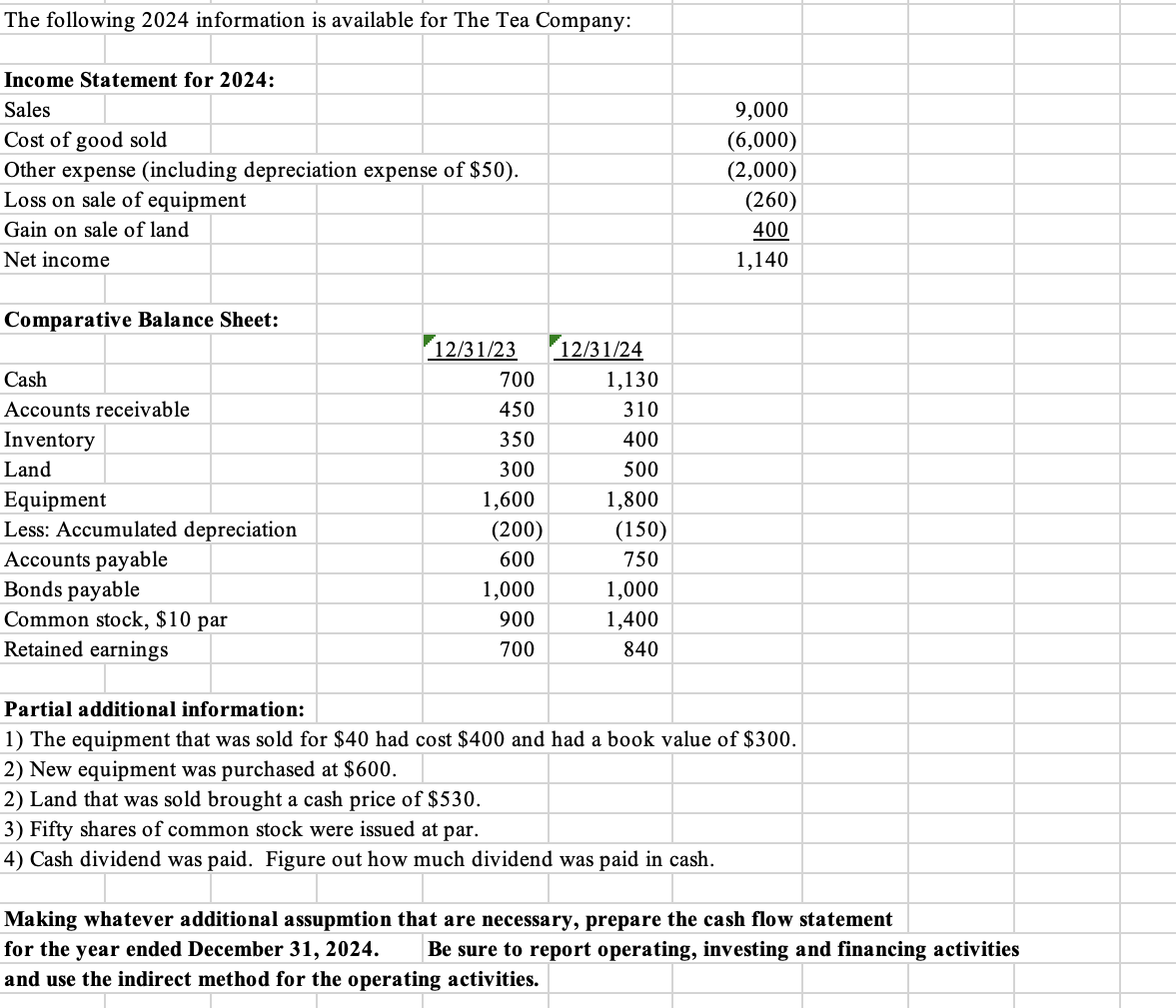

The following 2024 information is available for The Tea Company: Income Statement for 2024: Sales 9,000 Cost of good sold (6,000) Other expense (including depreciation expense of $50). (2,000) Loss on sale of equipment (260) Gain on sale of land 400 Net income 1,140 Comparative Balance Sheet: 12/31/23 12/31/24 Cash 700 1,130 Accounts receivable 450 310 Inventory 350 400 Land 300 500 Equipment 1,600 1,800 Less: Accumulated depreciation (200) (150) Accounts payable 600 750 Bonds payable 1,000 1,000 Common stock, $10 par 900 1,400 Retained earnings 700 840 Partial additional information: 1) The equipment that was sold for $40 had cost $400 and had a book value of $300. 2) New equipment was purchased at $600. 2) Land that was sold brought a cash price of $530. 3) Fifty shares of common stock were issued at par. 4) Cash dividend was paid. Figure out how much dividend was paid in cash. Making whatever additional assupmtion that are necessary, prepare the cash flow statement for the year ended December 31, 2024. Be sure to report operating, investing and financing activities and use the indirect method for the operating activities.

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the cash flow statement for the year ended December 31 2024 we need to analyze the provid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started