Question

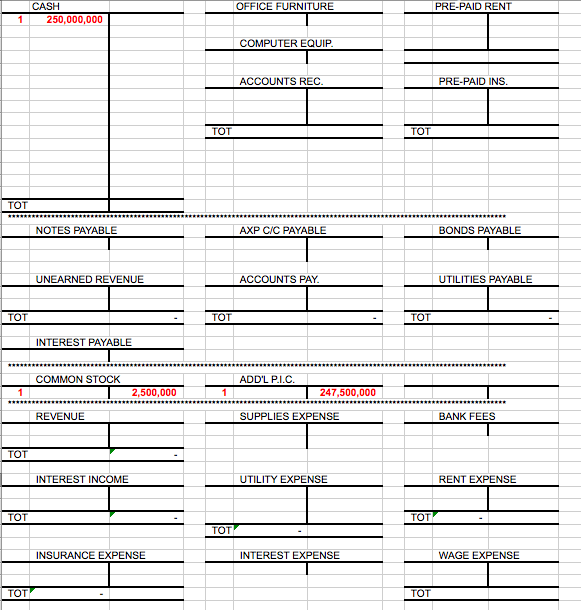

The following 25 transactions took place between October 31 and December 31 for Green Planet, Inc., an environmental consulting company. Using T accounts, post each

The following 25 transactions took place between October 31 and December 31 for Green Planet, Inc., an environmental consulting company. Using T accounts, post each transaction to the general ledger. Then develop a final trail balance, an income statement and a year-end balance sheet. Finally, include all closing entries to the temporary accounts needed to finalize your balance sheets with the retained earnings.

October 31

1. Stockholders purchased 25,000,000 shares of Green Planet, Inc. for $10.00 per share. The stated Par Value is $0.10 per share.

October 31

2. Bondholders purchased $10,000,000 of 20-year, 6% coupon par value bonds.

November 1

3. Office furniture is purchased for $50,000, which includes sales tax and a delivery charge. Green Planet pays $5,000 down and finances $45,000, signing a note for 8%. Interest will be due quarterly for three years, and the principal will be paid in full three years from today. The first interest payment is due 3 months from today.

November 1

4. Signed a one-year lease for office space in the amount of $48,000. The company paid one year in advance by check.

November 1

5. Purchased a one-year liability insurance policy. Paid entire amount of $7,200 in advance by electronic transfer. There was a $20 bank wire fee incurred on the transaction.

November 15

6. Purchased computer aided design equipment for the landfill restoration projects. The cost of the equipment was $125,000, and the company used their American Express Plum corporate credit card to pay for the equipment.

November 20

7. Purchased $700 of di-minimus office supplies (staples, pens, paper, etc.) on credit. The vendor offered 2/10, net 30 payment terms.

November 25

8. For a project that is tentatively scheduled to begin in early December, Green Planet collected a deposit of $120,000 in cash from ABC Company. Either party reserves the right to cancel the project prior to its commencement.

November 28

9. Received an electric bill for $120. The company plans to pay next month after receiving the next bill.

November 30

10. Received the credit card bill from American Express. In addition to the equipment charge on November 15, there was a $40 charge made by the company executive at Staples (an office supply store) in the amount of $40. The terms are to pay immediately for a 2% discount, or pay the balance in full in 60 days from the date of the purchase. Green Planet plans to pay the full balance in 44 days.

November 30

11. The companys money market account increased by $650,000 for monthly interest that was posted to account.

12. The company posted entries for the month of November for rent expense.

13. The company posted entries for the month of November for insurance expense.

14. Paid $24,000 of salaries to employees for the month of November.

December 16

15. Paid the $700 of office supplies purchased November 20.

December 20

16. Invoiced a customer (XYZ Company) for a 5 day project that has just been completed. The invoice is for $220,000 and has payment terms of due in full in 10 days.

December22

17. Completed the project with ABC that began in early December. Green Planet invoiced ABC for $80,000, which reflected the fact that the total project revenue was $200,000 of which $120,000 was already collected via the initial deposit.

December 31

18. Paid $24,000 of salaries to employees for the month of December.

19. Received the full $220,000 payment from XYZ Company.

20. Received & paid the current electric bill for $135, as well as paid the old electric bill of $120.

21. Received and paid a phone bill of $405.

22. Recorded rent expense for the month of December.

23. Recorded insurance expense for the month of December.

24. Recorded interest income in the money market account of $645,000.

25. Recorded interest expense on the companys 6%, $10,000,000 debt.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started