Question

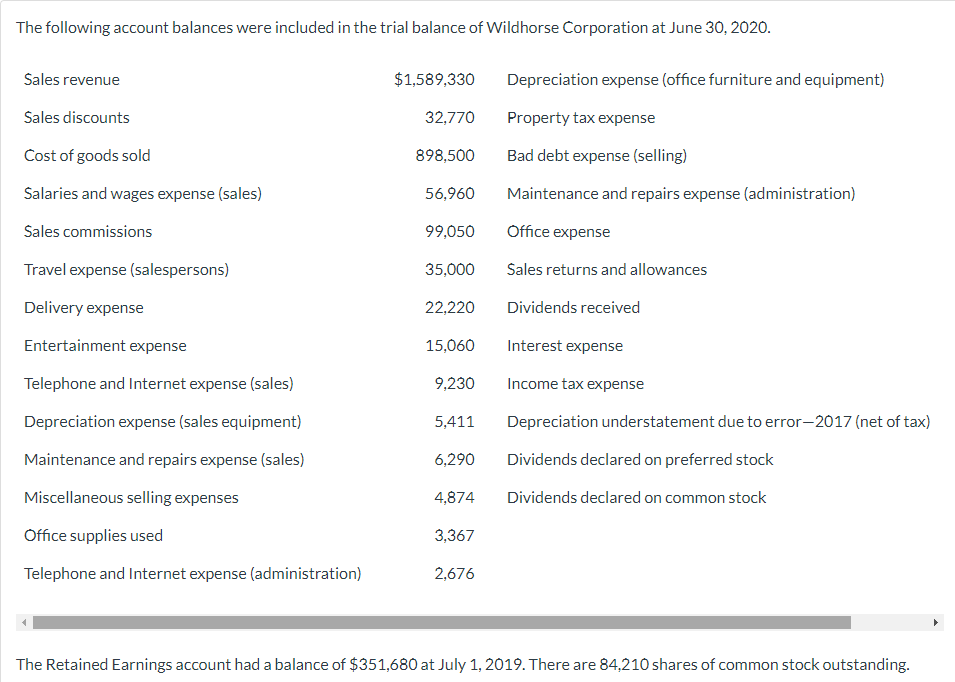

The following account balances were included in the trial balance of Wildhorse Corporation at June 30, 2020. Sales revenue Sales discounts Cost of goods sold

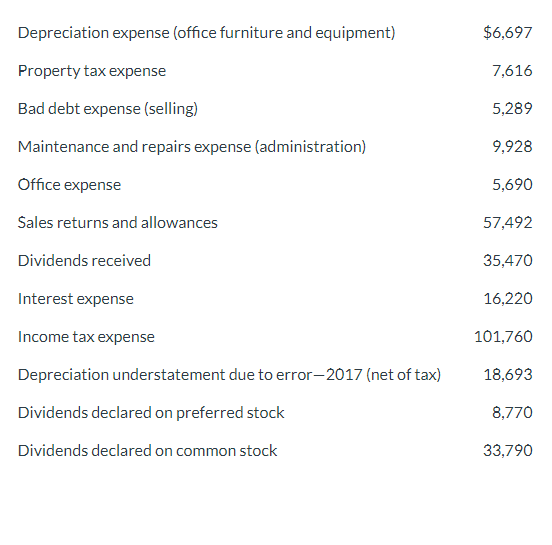

The following account balances were included in the trial balance of Wildhorse Corporation at June 30, 2020. Sales revenue Sales discounts Cost of goods sold Salaries and wages expense (sales) Sales commissions Travel expense (salespersons) Delivery expense Entertainment expense Telephone and Internet expense (sales) Depreciation expense (sales equipment) Maintenance and repairs expense (sales) Miscellaneous selling expenses Office supplies used Telephone and Internet expense (administration) $1,589,330 32.770 898,500 56,960 99,050 35,000 22,220 15,060 9,230 5,411 6,290 4,874 3,367 2,676 Depreciation expense (office furniture and equipment) Property tax expense Bad debt expense (selling) Maintenance and repairs expense (administration) Office expense Sales returns and allowances Dividends received Interest expense Income tax expense Depreciation understatement due to error-2017 (net of tax) Dividends declared on preferred stock Dividends declared on common stock 0310shares of common stock outstanding.

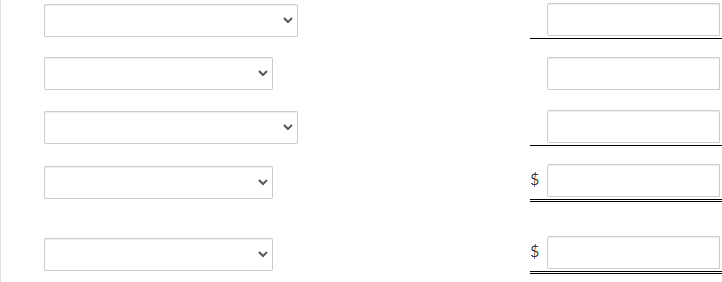

The following account balances were included in the trial balance of Wildhorse Corporation at June 30, 2020. The Retained Earnings account had a balance of $351,680 at July 1,2019 . There are 84,210 shares of common stock outstanding. Depreciation expense (office furniture and equipment) $6,697 Property tax expense 7,616 Bad debt expense (selling) 5,289 Maintenance and repairs expense (administration) 9,928 Office expense 5,690 Sales returns and allowances Dividends received Interest expense 57,492 Income tax expense 35,470 Depreciation understatement due to error-2017 (net of tax) 18,693 Dividends declared on preferred stock 8,770 Dividends declared on common stock 33,790 Using the multiple-step form, prepare an income statement for the year ended June 30,2020 . (Round earnings per share to 2 decimal places, e.g. 1.48.) WILDHORSE CORPORATION Income Statement $ $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started