Answered step by step

Verified Expert Solution

Question

1 Approved Answer

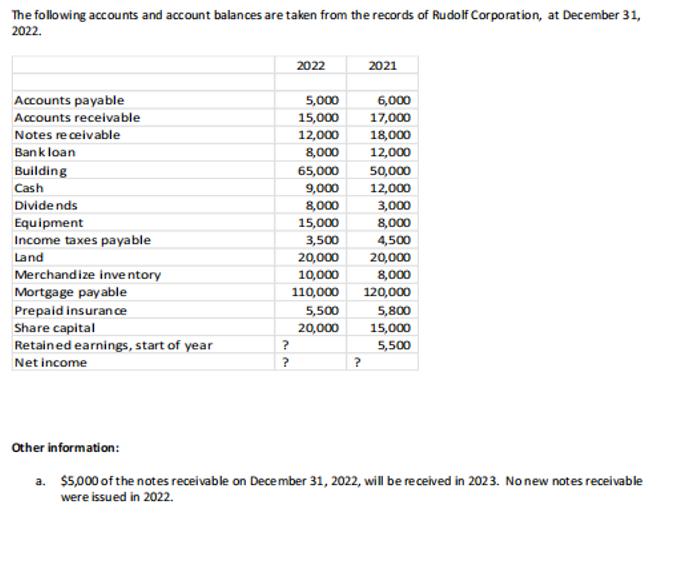

The following accounts and account balances are taken from the records of Rudolf Corporation, at December 31, 2022. Accounts payable Accounts receivable Notes receivable

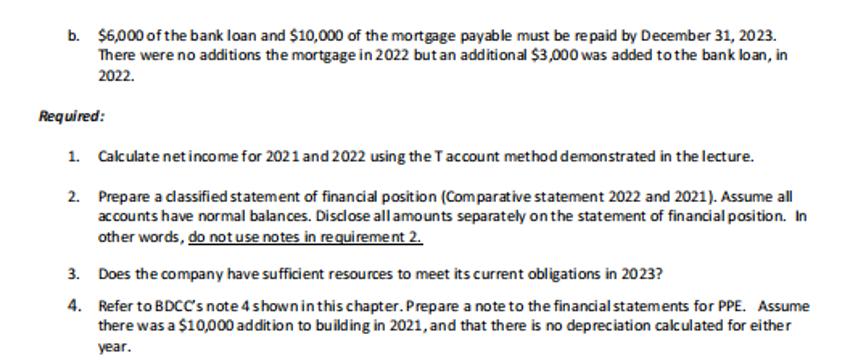

The following accounts and account balances are taken from the records of Rudolf Corporation, at December 31, 2022. Accounts payable Accounts receivable Notes receivable Bank loan Building Cash Dividends Equipment Income taxes payable Land Merchandize inventory Mortgage payable Prepaid insurance Share capital Retained earnings, start of year Net income ? ? 2022 5,000 15,000 12,000 8,000 5,500 20,000 2021 65,000 9,000 8,000 15,000 3,500 20,000 10,000 110,000 120,000 ? 6,000 17,000 18,000 12,000 50,000 12,000 3,000 8,000 4,500 20,000 8,000 5,800 15,000 5,500 Other information: a. $5,000 of the notes receivable on December 31, 2022, will be received in 2023. No new notes receivable were issued in 2022. b. $6,000 of the bank loan and $10,000 of the mortgage payable must be repaid by December 31, 2023. There were no additions the mortgage in 2022 but an additional $3,000 was added to the bank loan, in 2022. Required: 1. Calculate net income for 2021 and 2022 using the T account method demonstrated in the lecture. 2. Prepare a classified statement of financial position (Comparative statement 2022 and 2021). Assume all accounts have normal balances. Disclose all amounts separately on the statement of financial position. In other words, do not use notes in requirement 2. 3. Does the company have sufficient resources to meet its current obligations in 2023? 4. Refer to BDCC's note 4 shown in this chapter. Prepare a note to the financial statements for PPE. Assume there was a $10,000 addition to building in 2021, and that there is no depreciation calculated for either year.

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Calculate net income for 2021 and 2022 using the T account method Net Income for 2021 Starting Retained Earnings 2021 5500 Ending Retained Ea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started