Answered step by step

Verified Expert Solution

Question

1 Approved Answer

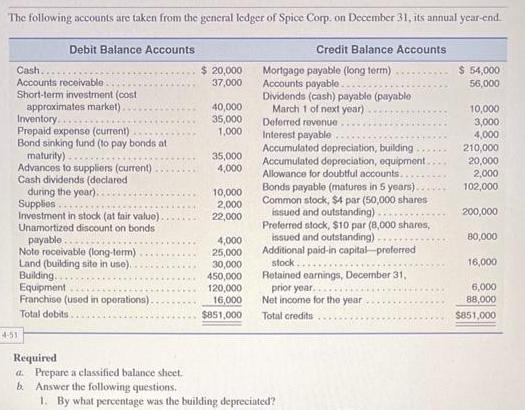

The following accounts are taken from the general ledger of Spice Corp. on December 31, its annual year-end. Debit Balance Accounts Cash... Accounts receivable

The following accounts are taken from the general ledger of Spice Corp. on December 31, its annual year-end. Debit Balance Accounts Cash... Accounts receivable Short-term investment (cost approximates market). Inventory. Prepaid expense (current) Bond sinking fund (to pay bonds at maturity) Advances to suppliers (current) Cash dividends (declared during the year). Supplies Investment in stock (at fair value) Unamortized discount on bonds payable. Note receivable (long-term) Land (building site in use). Building.. Equipment Franchise (used in operations). Total dobits i 4-51 $ 20,000 37,000 40,000 35,000 1,000 35,000 4,000 10,000 2,000 22,000 4,000 25,000 30,000 450,000 120,000 16,000 $851,000 Credit Balance Accounts Mortgage payable (long term) Accounts payable. Dividends (cash) payable (payable March 1 of next year) Deferred revenue. Interest payable Accumulated depreciation, building Accumulated depreciation, equipment. Allowance for doubtful accounts. Bonds payable (matures in 5 years). Common stock, $4 par (50,000 shares issued and outstanding) Preferred stock, $10 par (8,000 shares, issued and outstanding). Additional paid-in capital preferred stock. Retained earnings, December 31, prior year.... Net income for the year Total credits Required a. Prepare a classified balance sheet. b. Answer the following questions. 1. By what percentage was the building depreciated? $ 54,000 56,000 10,000 3,000 4,000 210,000 20,000 2,000 102,000 200,000 80,000 16,000 6,000 88,000 $851,000

Step by Step Solution

★★★★★

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started