Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following accounts are taken from the records of Bill Pitt Corp. at the end of its first 12 months of operations ended December

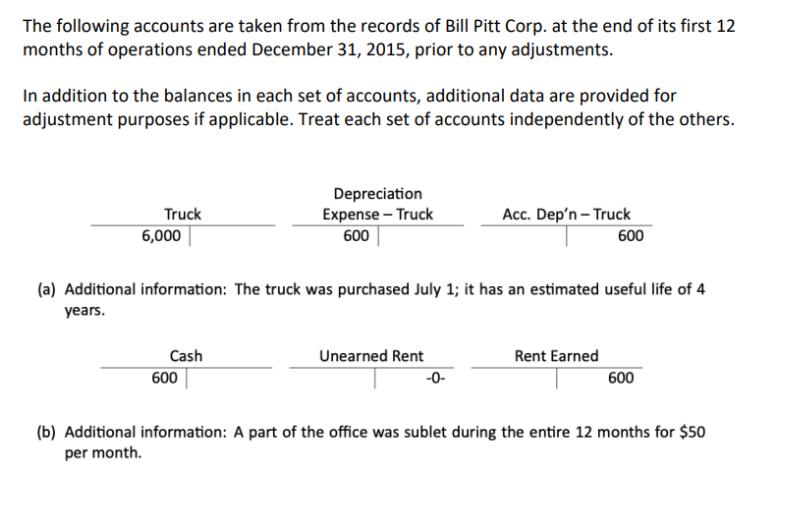

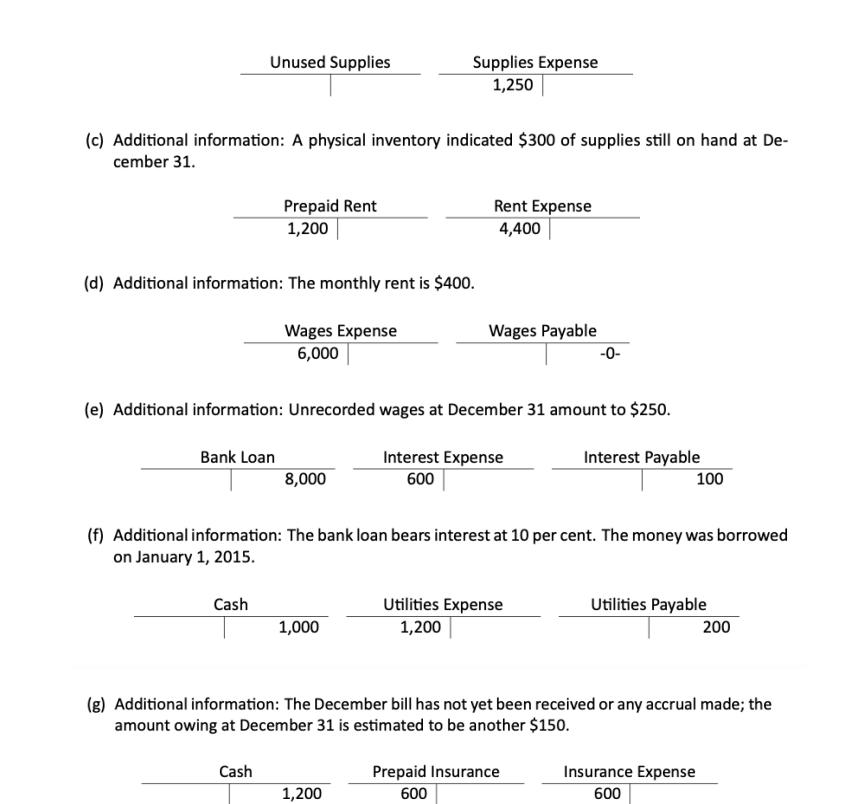

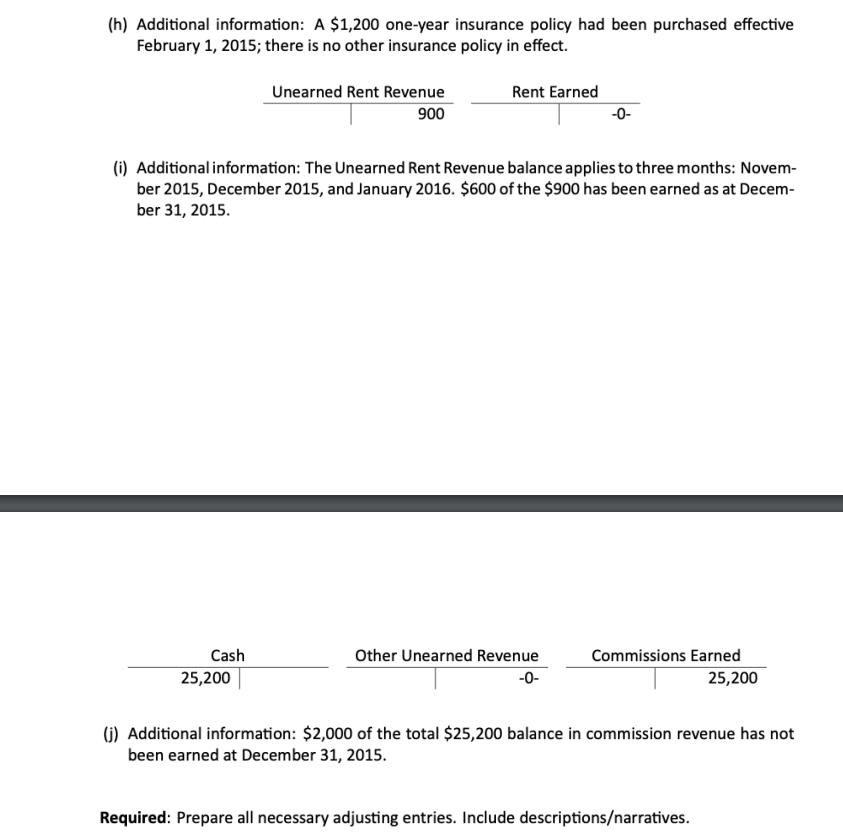

The following accounts are taken from the records of Bill Pitt Corp. at the end of its first 12 months of operations ended December 31, 2015, prior to any adjustments. In addition to the balances in each set of accounts, additional data are provided for adjustment purposes if applicable. Treat each set of accounts independently of the others. Truck 6,000 Depreciation Expense - Truck 600 Acc. Dep'n-Truck 600 (a) Additional information: The truck was purchased July 1; it has an estimated useful life of 4 years. Rent Earned Cash 600 Unearned Rent -0- 600 (b) Additional information: A part of the office was sublet during the entire 12 months for $50 per month. Unused Supplies Supplies Expense 1,250 (c) Additional information: A physical inventory indicated $300 of supplies still on hand at De- cember 31. Prepaid Rent 1,200 Rent Expense 4,400 (d) Additional information: The monthly rent is $400. Wages Expense 6,000 Wages Payable -0- (e) Additional information: Unrecorded wages at December 31 amount to $250. Bank Loan Interest Expense 600 Interest Payable 100 8,000 (f) Additional information: The bank loan bears interest at 10 per cent. The money was borrowed on January 1, 2015. Cash Utilities Expense 1,200 Utilities Payable 200 1,000 (g) Additional information: The December bill has not yet been received or any accrual made; the amount owing at December 31 is estimated to be another $150. Cash Prepaid Insurance 600 Insurance Expense 600 1,200 (h) Additional information: A $1,200 one-year insurance policy had been purchased effective February 1, 2015; there is no other insurance policy in effect. Unearned Rent Revenue 900 Rent Earned -0- (i) Additional information: The Unearned Rent Revenue balance applies to three months: Novem- ber 2015, December 2015, and January 2016. $600 of the $900 has been earned as at Decem- ber 31, 2015. Cash 25,200 Other Unearned Revenue -0- Commissions Earned 25,200 (j) Additional information: $2,000 of the total $25,200 balance in commission revenue has not been earned at December 31, 2015. Required: Prepare all necessary adjusting entries. Include descriptions/narratives.

Step by Step Solution

★★★★★

3.27 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

POSTING OF ADJUSTING JOURNAL ENTRIES The adjusting entries as and where required are posted as follo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started