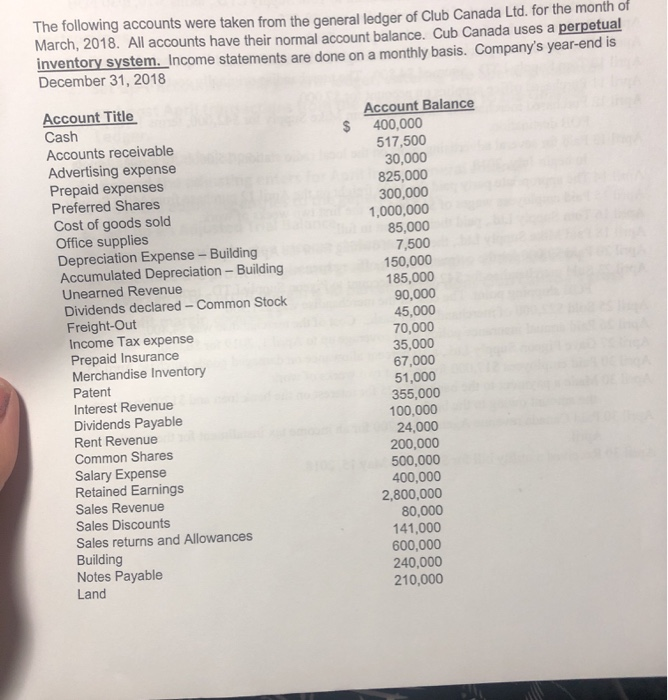

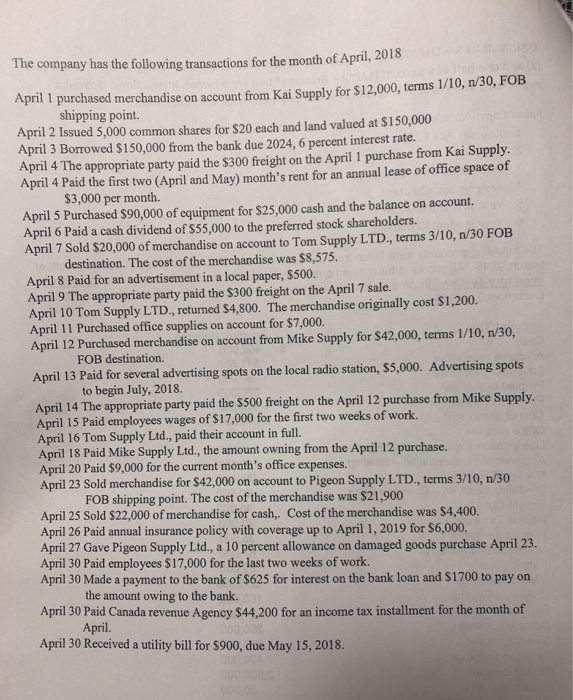

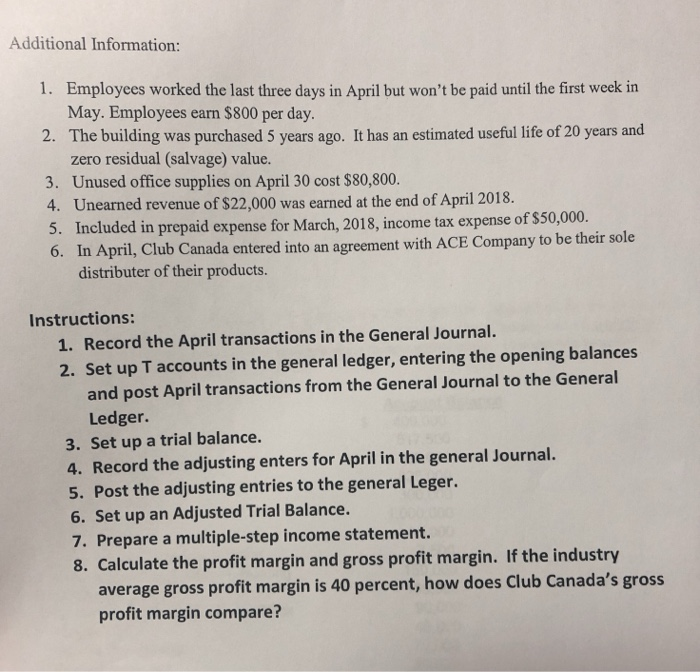

The following accounts were taken from the general ledger of Club Canada Ltd. for the month of March, 2018. All accounts have their normal account balance. Cub Canada uses a perpetual inventory system. Income statements are done on a monthly basis. Company's year-end is December 31, 2018 $ Account Title Cash Accounts receivable Advertising expense Prepaid expenses Preferred Shares Cost of goods sold Office supplies Depreciation Expense - Building Accumulated Depreciation - Building Unearned Revenue Dividends declared - Common Stock Freight-Out Income Tax expense Prepaid Insurance Merchandise Inventory Patent Interest Revenue Dividends Payable Rent Revenue Common Shares Salary Expense Retained Earnings Sales Revenue Sales Discounts Sales returns and Allowances Building Notes Payable Land Account Balance 400,000 517,500 30,000 825,000 300,000 1,000,000 85,000 7,500 150,000 185,000 90,000 45,000 70,000 35,000 67,000 51,000 355,000 100,000 24,000 200,000 500,000 400,000 2,800,000 80,000 141,000 600,000 240,000 210,000 The company has the following transactions for the month of April, 2018 April 1 purchased merchandise on account from Kai Supply for $12,000, terms 1/10, n/30, FOB shipping point. April 2 Issued 5,000 common shares for $20 each and land valued at $150,000 April 3 Borrowed $150,000 from the bank due 2024, 6 percent interest rate. April 4 The appropriate party paid the $300 freight on the April 1 purchase from Kai Supply. April 4 Paid the first two (April and May) month's rent for an annual lease of office space of $3,000 per month April 5 Purchased $90,000 of equipment for $25,000 cash and the balance on account. April 6 Paid a cash dividend of $55,000 to the preferred stock shareholders. April 7 Sold $20,000 of merchandise on account to Tom Supply LTD., terms 3/10, n/30 FOB destination. The cost of the merchandise was $8,575. April 8 Paid for an advertisement in a local paper, $500. April 9 The appropriate party paid the $300 freight on the April 7 sale. April 10 Tom Supply LTD., returned $4,800. The merchandise originally cost $1,200. April 11 Purchased office supplies on account for $7,000. April 12 Purchased merchandise on account from Mike Supply for $42,000, terms 1/10, n/30, FOB destination April 13 Paid for several advertising spots on the local radio station, $5,000. Advertising spots to begin July, 2018. April 14 The appropriate party paid the $500 freight on the April 12 purchase from Mike Supply. April 15 Paid employees wages of $17,000 for the first two weeks of work. April 16 Tom Supply Ltd., paid their account in full. April 18 Paid Mike Supply Ltd., the amount owning from the April 12 purchase. April 20 Paid $9,000 for the current month's office expenses. April 23 Sold merchandise for $42,000 on account to Pigeon Supply LTD., terms 3/10, n/30 FOB shipping point. The cost of the merchandise was $21,900 April 25 Sold $22,000 of merchandise for cash, Cost of the merchandise was $4,400. April 26 Paid annual insurance policy with coverage up to April 1, 2019 for $6,000. April 27 Gave Pigeon Supply Ltd., a 10 percent allowance on damaged goods purchase April 23. April 30 Paid employees $17,000 for the last two weeks of work. April 30 Made a payment to the bank of $625 for interest on the bank loan and S1700 to pay on the amount owing to the bank. April 30 Paid Canada revenue Agency $44,200 for an income tax installment for the month of April. April 30 Received a utility bill for $900, due May 15, 2018. Additional Information: 1. Employees worked the last three days in April but won't be paid until the first week in May. Employees earn $800 per day. 2. The building was purchased 5 years ago. It has an estimated useful life of 20 years and zero residual (salvage) value. 3. Unused office supplies on April 30 cost $80,800. 4. Unearned revenue of $22,000 was earned at the end of April 2018. 5. Included in prepaid expense for March, 2018, income tax expense of $50,000. 6. In April, Club Canada entered into an agreement with ACE Company to be their sole distributer of their products. Instructions: 1. Record the April transactions in the General Journal. 2. Set up T accounts in the general ledger, entering the opening balances and post April transactions from the General Journal to the General Ledger. 3. Set up a trial balance. 4. Record the adjusting enters for April in the general Journal. 5. Post the adjusting entries to the general Leger. 6. Set up an Adjusted Trial Balance. 7. Prepare a multiple-step income statement. 8. Calculate the profit margin and gross profit margin. If the industry average gross profit margin is 40 percent, how does Club Canada's gross profit margin compare