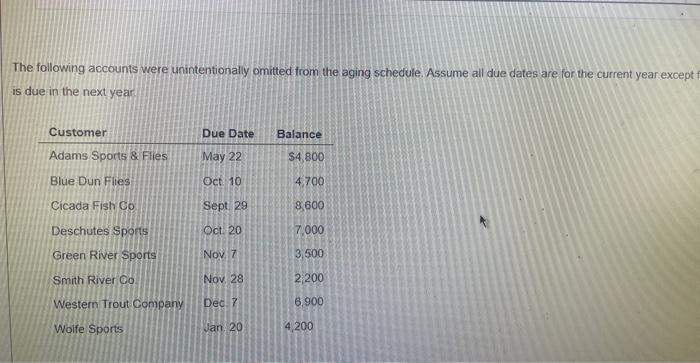

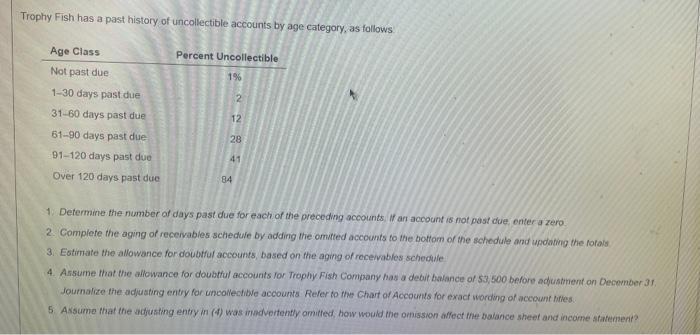

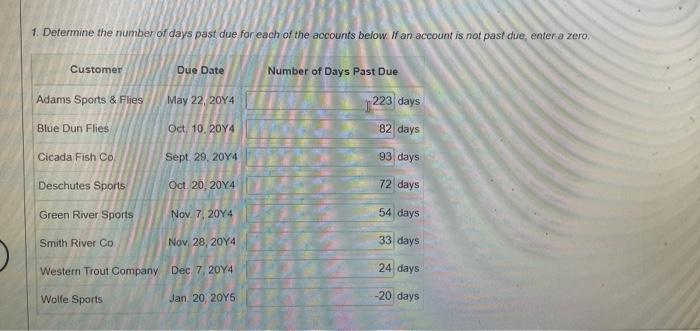

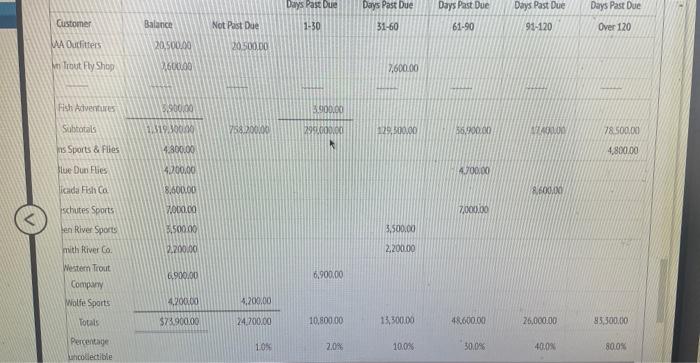

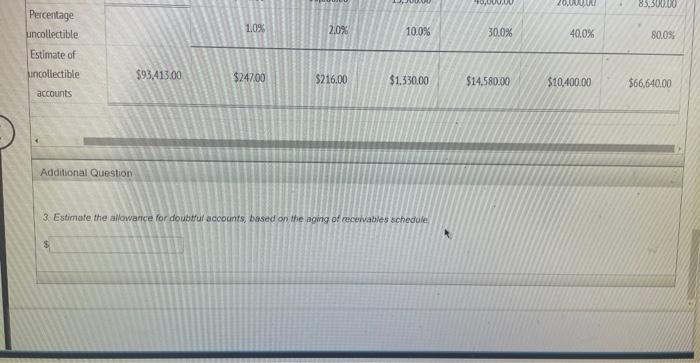

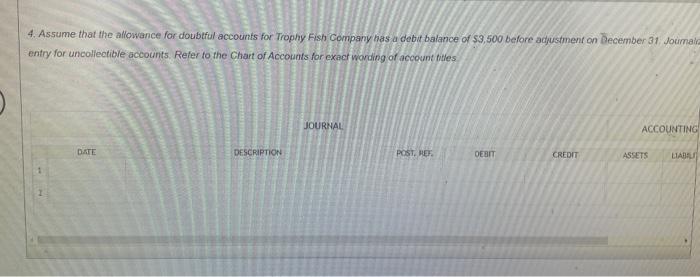

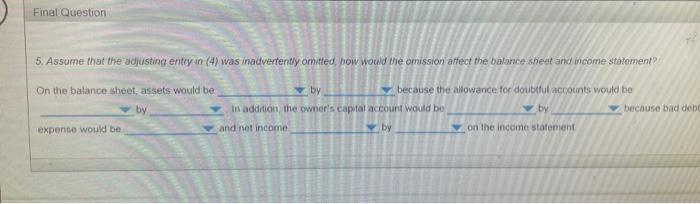

The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except is due in the next year: Trophy Fish has a past history of uncollectible accounts by age category, as follows 1. Determine the number af days past due for each of the preceding accounts If an account is not past due enter a zero. 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the fotais 3. Eotimate the allowance for doubtful accounts, based on the aging of receivables schectife 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a detit balance of 53,500 before aduatirent on December 31 . Joumalize the adjusting enty for uncollecfible accounts Fefer to the Chart of Accounts for exact wording of account hifies. 5. Axsume that the adjusting entry in (4) was imadvettently omitfed, how would the omission affect the balance sheet and income statenent? 1. Determine the number of days past due for each of the accounts below If an account is not past due, enter a zero. 3. Estimate the allowarice for doubtrul accounts, based an the aging of recervables schedule, 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of 53,500 before adjustment an December 31, foumail entry for uncollectible accounts. Refer to the Chart of Accounts for exact wording of account tittes 5. Assume that the odjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement? On the balance sheet, assets would be because the allowance for doubtful accoonts would be In addition, the owner's capital account wosld be expenee would be The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except is due in the next year: Trophy Fish has a past history of uncollectible accounts by age category, as follows 1. Determine the number af days past due for each of the preceding accounts If an account is not past due enter a zero. 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the fotais 3. Eotimate the allowance for doubtful accounts, based on the aging of receivables schectife 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a detit balance of 53,500 before aduatirent on December 31 . Joumalize the adjusting enty for uncollecfible accounts Fefer to the Chart of Accounts for exact wording of account hifies. 5. Axsume that the adjusting entry in (4) was imadvettently omitfed, how would the omission affect the balance sheet and income statenent? 1. Determine the number of days past due for each of the accounts below If an account is not past due, enter a zero. 3. Estimate the allowarice for doubtrul accounts, based an the aging of recervables schedule, 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of 53,500 before adjustment an December 31, foumail entry for uncollectible accounts. Refer to the Chart of Accounts for exact wording of account tittes 5. Assume that the odjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement? On the balance sheet, assets would be because the allowance for doubtful accoonts would be In addition, the owner's capital account wosld be expenee would be