Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following additional information is also provided: Closing stock Raw material 6 5 , 0 0 0 , Indirect Material 3 5 , 0 0

The following additional information is also provided:

Closing stock

Raw material Indirect Material Work in Progress Finished

Goods

Wages owing by insurance prepaid by

Depreciation is to be charges on the non current assets as follows

Property plant and equipment on the reducing balance Motor vehicle on the

straight line basis. All depreciation charges are to be applied equally in the factory and

the office

The provision for bad debts is to be adjusted to of the debtors

The commission income is owing by while the rent income is prepaid by

The goods produced are to be marked up by in the factory before being

transferred as finished goods

The wages is to be applied to the office, indirectly to the factory, and

directly in the factory

Apportion the insurance and the utilities cost to the factory and the remainder

to the office Required

Prepare the Manufacturing Account and Income Statement for the year ending

December ; as well as the Statement of Financial Position as at December

marks

Explain the classification of closing stock as used in the manufacturing enterprise

marks

Given that the goods produced are to be marked up by a percentage rate before being

transferred as finished goods, briefly explain

a the accounting treatment for the amount calculated based on the mark up marks

b the accounting implications if the finished goods are not all sold off at the end of

the year marks Question One

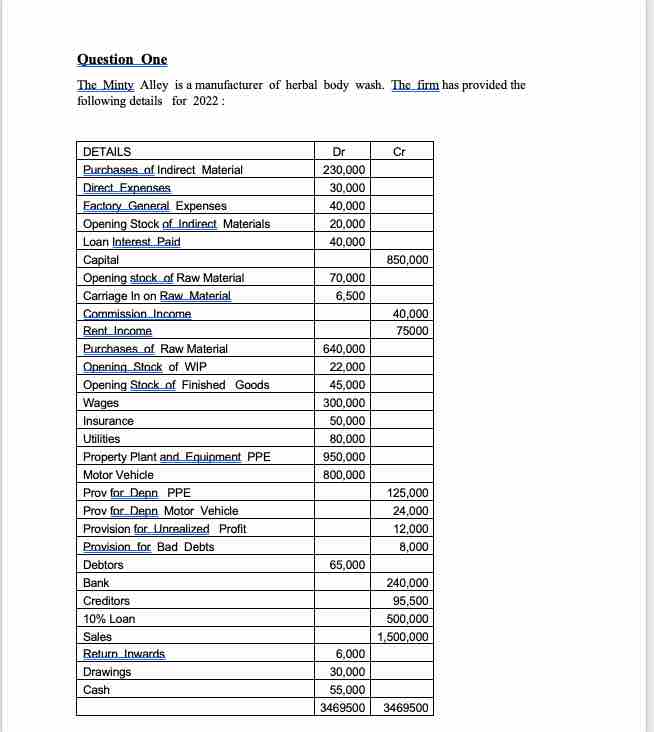

The Minty Alley is a manufacturer of herbal body wash. The firm has provided the following details for :

tableDETAILSDrCrPurchases of Indirect Material,Dirent Expenses:,Eactory General Expenses,Opening Stock of Indirect Materials,Loan Interest. Pain,CapitalOpening stnck of Raw Material,Carriage In on Raw Material,Commission Income,,Rent Income,,Purchases of Raw Material,OneningStnck of WIP,Opening Stock af Finished Goods,WagesInsurance:UtilitiesProperty Plant and Fquinment PPE,Motor Vehicle,Prov for Denn PPE,,Prov for Denn Motor Vehicle,,Provision for Unrealized Profit,,Pmvision foc Bad Debts:,,DebtorsBank:Creditors Loan,,SalesReturn Inwards,DrawingsCash

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started