Answered step by step

Verified Expert Solution

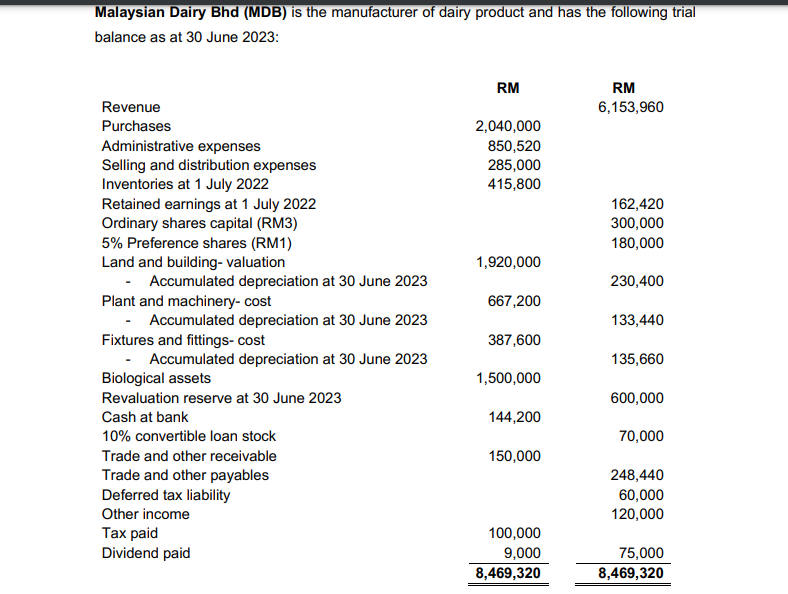

Question

1 Approved Answer

The following additional information is available 1 ) Inventories at 3 0 June 2 0 2 3 were valued correctly at RM 4 5 0

The following additional information is available

Inventories at June were valued correctly at RM

Depreciation on property, plant and equipment has yet to be charged and should be presented in administrative expenses. MDB charges depreciation as follows:

Buildings on a straight line basis over a total useful life of years.

Fixtures and fittings on a straight line basis over a total useful life of years. During the year, the company has decided to reduce the useful life to years.

Plant and machinery at rate of per annum on reducing balance method.

The board of MDB approves a plan to sell its manufacturing plant that have been used for years. Management has initiated an active programme to locate a buyer and it expects to complete the sale within one year. The cost of plant was RM The fair value for this plant was RM MDB incurred incidental cost related to the plant amounted RM

MDB constructed a building for the purpose of conducting scientific research. The building was completed on July at a cost of RM It received a grant of RM from the Federal Government. The expected useful life is according to the company policies. MDB adopts the grant as deferred income.

The fair value of the biological assets is RM The company estimates that the commission to dealers is RM

On October MDB issued of one new share for each five existing ordinary shares at an exercise price of RM The fair value immediately prior to the right issue was RM

The terms of conversion of the loan stock is ordinary shares per RM of loan stock. During the year, there was no loan stock had yet been converted.

Dividend paid is refer to the payment of dividends for the preference shares.

The income tax charged for the year has been estimated at RM which excludes changes in deferred tax liability. The deferred tax liability on June was estimated at RM The income tax rate was

Required:

Prepare the Statement of Comprehensive Income for the year ended June including Basic EPS and Diluted EPS. Comparative figure is not required.

Prepare the Statement of Changes in Equity for the year ended June ; and

Prepare the Statement of Financial Position as at June

Prepare accounting policies together with the notes account for additional information related.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started