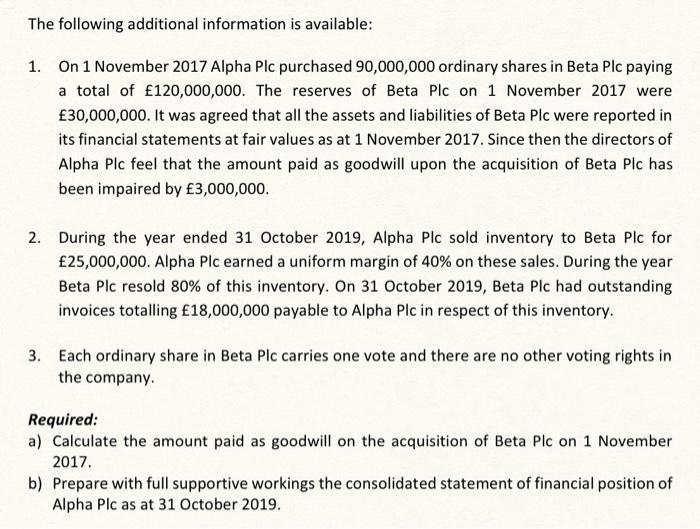

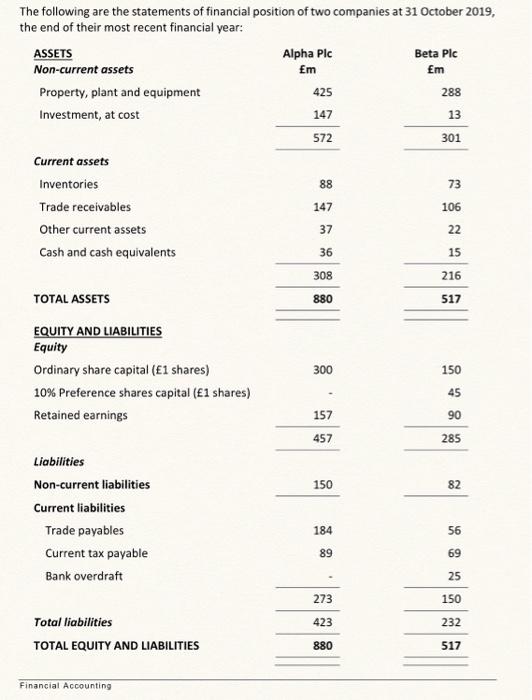

The following additional information is available: 1. On 1 November 2017 Alpha Plc purchased 90,000,000 ordinary shares in Beta Plc paying a total of 120,000,000. The reserves of Beta Plc on 1 November 2017 were 30,000,000. It was agreed that all the assets and liabilities of Beta Plc were reported in its financial statements at fair values as at 1 November 2017 . Since then the directors of Alpha Plc feel that the amount paid as goodwill upon the acquisition of Beta Plc has been impaired by 3,000,000. 2. During the year ended 31 October 2019, Alpha Plc sold inventory to Beta Plc for 25,000,000. Alpha Plc earned a uniform margin of 40% on these sales. During the year Beta Plc resold 80% of this inventory. On 31 October 2019, Beta Plc had outstanding invoices totalling 18,000,000 payable to Alpha Plc in respect of this inventory. 3. Each ordinary share in Beta Plc carries one vote and there are no other voting rights in the company. Required: a) Calculate the amount paid as goodwill on the acquisition of Beta Plc on 1 November 2017. b) Prepare with full supportive workings the consolidated statement of financial position of Alpha Plc as at 31 October 2019. The following are the statements of financial position of two companies at 31 October 2019 , the end of their most recent financial year: Financial Accounting The following additional information is available: 1. On 1 November 2017 Alpha Plc purchased 90,000,000 ordinary shares in Beta Plc paying a total of 120,000,000. The reserves of Beta Plc on 1 November 2017 were 30,000,000. It was agreed that all the assets and liabilities of Beta Plc were reported in its financial statements at fair values as at 1 November 2017 . Since then the directors of Alpha Plc feel that the amount paid as goodwill upon the acquisition of Beta Plc has been impaired by 3,000,000. 2. During the year ended 31 October 2019, Alpha Plc sold inventory to Beta Plc for 25,000,000. Alpha Plc earned a uniform margin of 40% on these sales. During the year Beta Plc resold 80% of this inventory. On 31 October 2019, Beta Plc had outstanding invoices totalling 18,000,000 payable to Alpha Plc in respect of this inventory. 3. Each ordinary share in Beta Plc carries one vote and there are no other voting rights in the company. Required: a) Calculate the amount paid as goodwill on the acquisition of Beta Plc on 1 November 2017. b) Prepare with full supportive workings the consolidated statement of financial position of Alpha Plc as at 31 October 2019. The following are the statements of financial position of two companies at 31 October 2019 , the end of their most recent financial year: Financial Accounting