Question

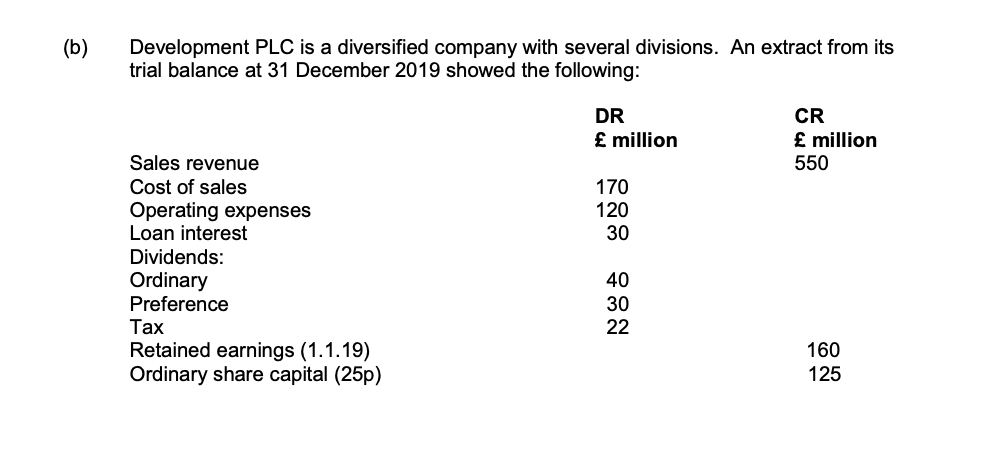

The following additional information is provided: (i) During 2019, the directors of Development PLC decided to close down the Green Energy division which was not

The following additional information is provided:

-

(i) During 2019, the directors of Development PLC decided to close down the Green Energy division which was not performing as well as planned. The Green Energy division had contributed 20% of revenue, but had produced 30% of operating expenses and 40% of the cost of sales.

-

(ii) Closing the Green Energy division involved selling equipment with a carrying value of 50 million for 20 million. It also led to Development PLC settling compensation claims for cancelled contracts totaling 15 million. Three quarters of the staff employed in the Green Energy division were made redundant by 31 December 2019 at a cost of 25 million. The remaining staff were redeployed and retrained to work in the remaining business at a cost of 15 million.

(ii) In 2019, some of Developments buildings were revalued for the first time by an independent surveyor. The original cost of the buildings was 100 million, and the revalued cost was 180% of this figure. The accumulated depreciation to 31 December 2019 represented 30% of the original cost.

-

(iv) At the end of 2019, it was discovered that goodwill with a current carrying amount of 50 million had a net fair value of 80% of the current carrying amount and a value in use of 60% of the current carrying amount.

-

(v) On 1 January 2019, Development PLC acquired new land and buildings for 200 million. The company decided to depreciate the buildings in the year of purchase using the straight-line method, assuming one quarter of the cost related to land. The buildings have an estimated economic life of 50 years.

Required:

Prepare the statement of profit or loss and other comprehensive income for Development PLC for the year ending 31 December 2019 in accordance with IAS 1, showing the analysis of continued and discontinued operations in a column format.

[10 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started