Question

The following additional information is relevant: I. Following the risk based minimum capital regulatory regime, the doubtful debts provision is expected to GH 21,292,500 II.

The following additional information is relevant: I. Following the risk based minimum capital regulatory regime, the doubtful debts provision is expected to GH 21,292,500 II. Depreciation on non-current assets is computed at net book value on the following rates: Land and Buildings 5% Furniture and Equipment 20% Computers 10% Motor Vehicles 10% The depreciation charges for the current year has not been calculated and has therefore not been posted to the financial records. III. Provision is to be made for audit fees of GH 1,500,000. IV. The Reserve fund set aside from annual net profit is 12.5% of the net profit V. Corporation tax is to be provided at a flat rate of 25% of net profit. The provision for the corporate tax for 2017 financial year was made at GH 5,000,000. This was agreed with the domestic tax revenue division of Ghana Revenue Authority at GH 5,500,000 and fully settled in March 2018. Interim tax payment made in 2018 based on 2018 self-assessment was GH 4,000,000. VI. The management of the bank wishes to pay end of year bonus estimated at GH1,800,000 to staff. This has not reflected in the list of balances. VII. The bank is registered with 500,000 equity shares of no-par value. As at 31/12/18, 300,000 shares have been issued and fully paid all ranking for dividend. The directors declared dividend of GH 0.075 per share in November 2018 but payment was not yet effected as at 31/12/18 Required (Clearly show all workings) (a) Prepare the statement of profit or loss and other comprehensive Income for Skynolim Universal Bank for the year ended 31 December 2018. (12 marks) (b) Prepare the statement of financial Position as at 31st December 2018 ( 12 marks) (c) Explain three clarification and complementary policies on areas of seeming conflicts between IFRS 9 and the Bank of Ghana guide on preparation of banks financial statement. (6 marks)

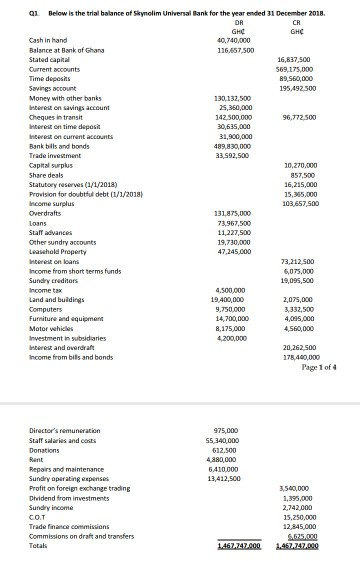

Q1 Below is the trial balance of Skynolim Universal Bank for the year ended 31 December 2018 OR CR GHE GHC Cash in hand 40,740,000 Balance at Bank of Ghana 116,657,500 Stated capital 16,837,500 Ourrent accounts 569,175,000 Time deposits 89,560,000 Savings account 195.492.500 Money with other banks 130, 132,500 Interest on savings account 25,350,000 Cheques in transit 142,500,000 96.772.500 Interest on time deposit 30,635,000 Interest on current accounts 31,900,000 Bank bills and bonds 489,830,000 Trade investment 33,592,500 Capital surplus 10,270.000 Share deals 857,500 Statutory reserves (1/1/2018) 16,215,000 Provision for doubt debt (1/1/2018) 15,365.000 Income surplus 103,657,500 Overdrafts 131,875,000 Loans 73,967,500 Stall advances 11,227,500 Other sundry accounts 19,730,000 Leasehold Property 47,245.000 Interest on loans 73,212,500 Income from short terms funds 6,075,000 Sundry creditors 19,095,500 Income tax 4,500,000 Land and buildings 19,400,000 2,075,000 Computers 9.750.000 3,332,500 Furniture and equipment 14,700,000 4,095,000 Motor vehicles 8,175.000 4,560,000 Investment in subsidiaries 4,200,000 Interest and overdraft 20,262,500 Income from bills and bonds 178,460,000 Page 1 of 4 975,000 55 340,000 612.500 4,880,000 6,410,000 13,412,500 Director's remuneration Stalf salaries and costs Donations Rent Repairs and maintenance Sunday operating expenses Profit on foreign exchange trading Dividend from investments Sundry income COT Trade finance commissions Commissions on draft and transfers Totals 3,500,000 1,395,000 2,742.000 15,250,000 12,845.000 5.625.000 1.457.747.000 1.467.747.000 Q1. Below is the trial balance of Skynolim Universal Bank for the year ended 31 December 2018. DR CR GHC GHC Cash in hand 40,740,000 Balance at Bank of Ghana 116,657,500 Stated capital 16,837,500 Current accounts 569,175,000 Time deposits 89,560,000 Savings account 195,492,500 Money with other banks 130,132,500 Interest on savings account 25,360,000 Cheques in transit 142,500,000 96,772,500 Interest on time deposit 30,635,000 Interest on current accounts 31,900,000 Bank bills and bonds 489,830,000 Trade investment 33,592,500 Capital surplus 10,270,000 Share deals 857,500 Statutory reserves (1/1/2018) 16,215,000 Provision for doubtful debt (1/1/2018) 15,365,000 Income surplus 103,657,500 Overdrafts 131,875,000 Loans 73,967,500 Staff advances 11,227,500 Other sundry accounts 19,730,000 Leasehold Property 47,245,000 Interest on loans 73,212,500 Income from short terms funds 6,075,000 Sundry creditors 19,095,500 Income tax 4,500,000 Land and buildings 19,400,000 2,075,000 Computers 9,750,000 3,332,500 Furniture and equipment 14,700,000 4,095,000 Motor vehicles 8,175,000 4,560,000 Investment in subsidiaries 4,200,000 Interest and overdraft 20,262,500 Income from bills and bonds 178,440,000 975,000 55,340,000 612,500 4,880,000 6,410,000 13,412,500 Director's remuneration Staff salaries and costs Donations Rent Repairs and maintenance Sundry operating expenses Profit on foreign exchange trading Dividend from investments Sundry income C.O.T Trade finance commissions Commissions on draft and transfers Totals 3,540,000 1,395,000 2,742,000 15,250,000 12,845,000 6,625,000 1,467,747,000 1,467,747,000 1. II. The following additional information is relevant: Following the risk based minimum capital regulatory regime, the doubtful debts provision is expected to GH 21,292,500 Depreciation on non-current assets is computed at net book value on the following rates: Land and Buildings 5% Furniture and Equipment 20% Computers 10% Motor Vehicles 10% The depreciation charges for the current year has not been calculated and has therefore not been posted to the financial records. III. Provision is to be made for audit fees of GH 1,500,000. IV. The Reserve fund set aside from annual net profit is 12.5% of the net profit v. Corporation tax is to be provided at a flat rate of 25% of net profit. The provision for the corporate tax for 2017 financial year was made at GH 5,000,000. This was agreed with the domestic tax revenue division of Ghana Revenue Authority at GH 5,500,000 and fully settled in March 2018. Interim tax payment made in 2018 based on 2018 self-assessment was GH 4,000,000. The management of the bank wishes to pay end of year bonus estimated at GH1,800,000 to staff. This has not reflected in the list of balances. VII. The bank is registered with 500,000 equity shares of no-par value. As at 31/12/18, 300,000 shares have been issued and fully paid all ranking for dividend. The directors declared dividend of GH 0.075 per share in November 2018 but payment was not yet effected as at 31/12/18 Required (Clearly show all workings) (a) Prepare the statement of profit or loss and other comprehensive Income for Skynolim Universal Bank for the year ended 31 December 2018. (12 marks) (b) Prepare the statement of financial Position as at 31st December 2018 (12 marks) (c) Explain three clarification and complementary policies on areas of seeming conflicts between IFRS 9 and the Bank of Ghana guide on preparation of bank's financial statement. (6 marks) VIStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started