Answered step by step

Verified Expert Solution

Question

1 Approved Answer

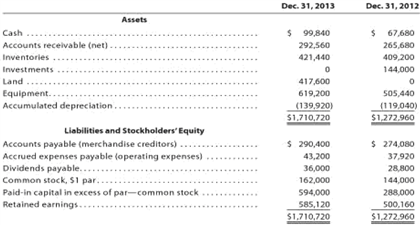

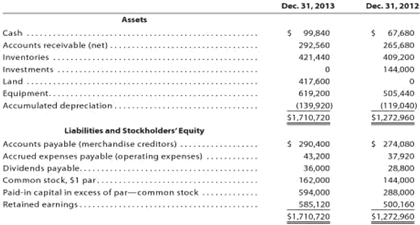

The following additional information was taken from the records of Juras equipment: a. Equipment and land were acquired for cash. There were no disposals of

The following additional information was taken from the records of Juras equipment:

- a.Equipment and land were acquired for cash.

- There were no disposals of equipment during the year.

- The investments were sold for $129,600 cash.

- The common stock was issued for cash.

- There was a $228,960 credit to Retained Earnings for net income.

- There was a $144,000 debit to Retained Earnings for cash dividends declared.

| Instructions: |

| Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. |

| My Answer: | |||||||||||||

| Cash flows from operating activities: | |||||||||||||

| Net income | $228,960 | ||||||||||||

| Adjustments to reconcile net income to net cash | |||||||||||||

| flow from operating activities: | |||||||||||||

| Depreciation | 20,880 | ||||||||||||

| Loss on inventory write down and fixed assets | Loss on sale of investments | 14,400 | |||||||||||

| Changes in current operating assets and liabilities: | |||||||||||||

| Increase in accounts receivable | (26,880) | ||||||||||||

| Increase in inventories | (12,240) | ||||||||||||

| Increase in accounts payable | 16,320 | ||||||||||||

| Increase in accrued expenses payable | 5,280 | ||||||||||||

| Net cash flow from operating activities | $246,720 | ||||||||||||

| Cash flows from investing activities: | |||||||||||||

| Cash received from sale of investments | $129,600 | ||||||||||||

| Less cash paid for purchase of land | (417,600) | ||||||||||||

| Less cash paid for purchase of equipment | (113,760) | ||||||||||||

| Net cash flow used for investing activities | (401,760) | ||||||||||||

| Cash flows from financing activities: | |||||||||||||

| Cash received from sale of common stock | $324,000 | ||||||||||||

| Less cash paid for dividends | (136,800) | ||||||||||||

| Net cash flow provided by financing activities | 187,200 | ||||||||||||

| Increase in cash | $32,160 | ||||||||||||

| Cash at the beginning of the year | 67,680 | ||||||||||||

| Cash at the end of the year | $99,840 | ||||||||||||

| Balance, | Transactions | Balance, | |||||||||||||

| Dec. 31, 2012 | Debit | Credit | Dec. 31, 2013 | ||||||||||||

| Cash | 67,680 | O | 32,160 | 99,840 | |||||||||||

| Accounts receivable (net) | 265,680 | n | 26,880 | 292,560 | |||||||||||

| Inventories | 409,200 | 12,240 | 421,440 | ||||||||||||

| Investments | 144,000 | 144,000 | - | ||||||||||||

| Land | - | 417,600 | 417,600 | ||||||||||||

| Equipment | 505,440 | 113,760 | 619,200 | ||||||||||||

| Accum. depr. - equipment | (119,040) | 20,880 | (139,920) | ||||||||||||

| Accounts payable | (274,080) | 16,320 | (290,400) | ||||||||||||

| Accrued expenses payable | (37,920) | 5,280 | (43,200) | ||||||||||||

| Dividends payable | (28,800) | 7,200 | (36,000) | ||||||||||||

| Common stock, $1 par | (144,000) | 18,000 | (162,000) | ||||||||||||

| Paid-in capital in excess of par | (288,000) | 306,000 | (594,000) | ||||||||||||

| Retained earnings | (500,160) | 84,960 | (585,120) | ||||||||||||

| Totals | - | 602,640 | 602,640 | - | |||||||||||

| Please help on this (below i'm stuck here) Operating activities: | |||||||||||||||

| Net income | 84,960 | ||||||||||||||

| Depreciation | 20,880 | ||||||||||||||

| Loss on sale of investments | 14,440 | ||||||||||||||

| Increase in accounts receivable | 26,880 | ||||||||||||||

| Increase in inventories | 12,240 | ||||||||||||||

| Increase in accounts payable | 16,320 | ||||||||||||||

| Increase in accrued expenses payable | 5,280 | ||||||||||||||

| Investing activities: | |||||||||||||||

| Purchase of equipment | 113,760 | ||||||||||||||

| Purchase of land | 417,600 | ||||||||||||||

| Sale of investments | 129,000 | ||||||||||||||

| Financing activities: | |||||||||||||||

| Declaration of cash dividends | 144,000 | ||||||||||||||

| Sale of common stock | 18,000 | ||||||||||||||

| Increase in dividends payable | 7,200 | ||||||||||||||

| Net increase in cash | 31,160 | ||||||||||||||

| Totals | |||||||||||||||

The following additional information was taken from the records of Juras equipment: a. Equipment and land were acquired for cash. There were no disposals of equipment during the year. The investments were sold for $129,600 cash. The common stock was issued for cash. There was a $228,960 credit to Retained Earnings for net income. There was a $144,000 debit to Retained Earnings for cash dividends declared.Instructions: Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities.MyAnswer:Cash flows from operating activities: Net income $228,960 Adjustments to reconcile net income to net cashflow from operating activities:Depreciation 20,880 Loss on inventory write down and fixed assets Loss on sale of investments 14,400 Changes in current operating assets and liabilities: Increase in accounts receivable (26,880) Increase in inventories (12,240) Increase in accounts payable 16,320 Increase in accrued expenses payable 5,280 Net cash flow from operating activities$246,720 Cash flows from investing activities: Cash received from sale of investments $129,600 Less cash paid for purchase of land (417,600) Less cash paid for purchase of equipment (113,760) Net cash flow used for investing activities(401,760) Cash flows from financing activities: Cash received from sale of common stock $324,000 Less cash paid for dividends (136,800) Net cash flow provided by financing activities187,200 Increase in cash $32,160 Cash at the beginning of the year 67,680 Cash at the end of the year $99,840Balance, Transactions Balance, Dec. 31, 2012Debit CreditDec. 31, 2013 Cash 67,680 O 32,16099,840 Accounts receivable (net) 265,680 n 26,880292,560 Inventories 409,200 12,240421,440 Investments 144,000144,000 - Land - 417,600417,600 Equipment 505,440 113,760619,200 Accum. depr. - equipment (119,040)20,880 (139,920) Accounts payable (274,080)16,320 (290,400) Accrued expenses payable (37,920)5,280 (43,200) Dividends payable (28,800)7,200 (36,000) Common stock, $1 par (144,000)18,000 (162,000) Paid-in capital in excess of par (288,000)306,000 (594,000) Retained earnings (500,160)84,960 (585,120) Totals - 602,640 602,640 -Please help on this (below i'm stuck here) Operating activities: Net income84,960Depreciation20,880Loss on sale of investments14,440Increase in accounts receivable 26,880 Increase in inventories 12,240 Increase in accounts payable16,320Increase in accrued expenses payable5,280 Investing activities: Purchase of equipment 113,760 Purchase of land 417,600 Sale of investments129,000 Financing activities: Declaration of cash dividends144,000Sale of common stock18,000Increase in dividends payable7,200 Net increase in cash 31,160 Totals The following additional information was taken from the records of Juras equipment: a. Equipment and land were acquired for cash. There were no disposals of equipment during the year. The investments were sold for $129,600 cash. The common stock was issued for cash. There was a $228,960 credit to Retained Earnings for net income. There was a $144,000 debit to Retained Earnings for cash dividends declared.Instructions: Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities.MyAnswer:Cash flows from operating activities: Net income $228,960 Adjustments to reconcile net income to net cashflow from operating activities:Depreciation 20,880 Loss on inventory write down and fixed assets Loss on sale of investments 14,400 Changes in current operating assets and liabilities: Increase in accounts receivable (26,880) Increase in inventories (12,240) Increase in accounts payable 16,320 Increase in accrued expenses payable 5,280 Net cash flow from operating activities$246,720 Cash flows from investing activities: Cash received from sale of investments $129,600 Less cash paid for purchase of land (417,600) Less cash paid for purchase of equipment (113,760) Net cash flow used for investing activities(401,760) Cash flows from financing activities: Cash received from sale of common stock $324,000 Less cash paid for dividends (136,800) Net cash flow provided by financing activities187,200 Increase in cash $32,160 Cash at the beginning of the year 67,680 Cash at the end of the year $99,840Balance, Transactions Balance, Dec. 31, 2012Debit CreditDec. 31, 2013 Cash 67,680 O 32,16099,840 Accounts receivable (net) 265,680 n 26,880292,560 Inventories 409,200 12,240421,440 Investments 144,000144,000 - Land - 417,600417,600 Equipment 505,440 113,760619,200 Accum. depr. - equipment (119,040)20,880 (139,920) Accounts payable (274,080)16,320 (290,400) Accrued expenses payable (37,920)5,280 (43,200) Dividends payable (28,800)7,200 (36,000) Common stock, $1 par (144,000)18,000 (162,000) Paid-in capital in excess of par (288,000)306,000 (594,000) Retained earnings (500,160)84,960 (585,120) Totals - 602,640 602,640 -Please help on this (below i'm stuck here) Operating activities: Net income84,960Depreciation20,880Loss on sale of investments14,440Increase in accounts receivable 26,880 Increase in inventories 12,240 Increase in accounts payable16,320Increase in accrued expenses payable5,280 Investing activities: Purchase of equipment 113,760 Purchase of land 417,600 Sale of investments129,000 Financing activities: Declaration of cash dividends144,000Sale of common stock18,000Increase in dividends payable7,200 Net increase in cash 31,160 Totals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started