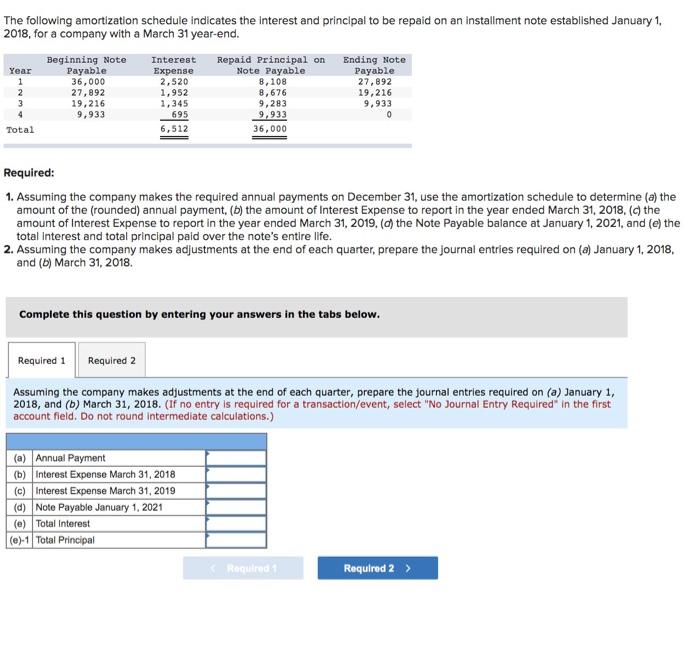

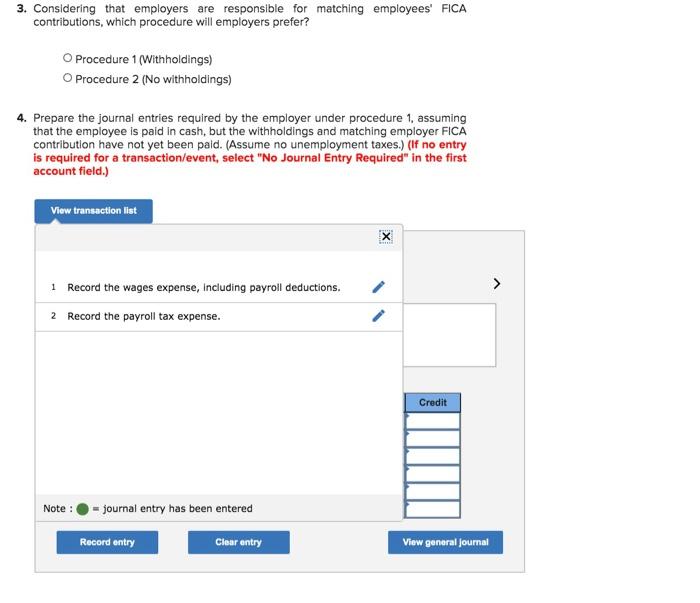

The following amortization schedule indicates the interest and principal to be repaid on an installment note established January 1, 2018, for a company with a March 31 year-end. Beginning Note Interest Repaid Principal on Ending Note Year Payable Expense Note Payable Payable 1 36,000 2,520 8,108 27,892 2 27,892 1,952 8,676 19,216 3 19,216 1,345 9,283 9,933 4 9.933 695 9,933 0 Total 6,512 36,000 Required: 1. Assuming the company makes the required annual payments on December 31, use the amortization schedule to determine (a) the amount of the rounded) annual payment, (b) the amount of Interest Expense to report in the year ended March 31, 2018. (c) the amount of Interest Expense to report in the year ended March 31, 2019. (g) the Note Payable balance at January 1, 2021, and (c) the total interest and total principal paid over the note's entire life. 2. Assuming the company makes adjustments at the end of each quarter, prepare the journal entries required on (a) January 1, 2018. and (6) March 31, 2018 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assuming the company makes adjustments at the end of each quarter, prepare the journal entries required on (a) January 1, 2018, and (b) March 31, 2018. (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field. Do not round intermediate calculations.) (a) Annual Payment (b) Interest Expense March 31, 2018 (c) Interest Expense March 31, 2019 (d) Note Payable January 1, 2021 (e) Total Interest (e)-1 Total Principal Required 1 Required 2 > 3. Considering that employers are responsible for matching employees' FICA contributions, which procedure will employers prefer? O Procedure 1 (Withholdings) Procedure 2 (No withholdings) 4. Prepare the journal entries required by the employer under procedure 1, assuming that the employee is paid in cash, but the withholdings and matching employer FICA contribution have not yet been paid. (Assume no unemployment taxes.) (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list 1 Record the wages expense, including payroll deductions. > 2 Record the payroll tax expense. Credit Note : - journal entry has been entered Record entry Clear entry View general Journal