Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following amounts have been taken from the weekly payroll register for October 15, 20xx. Prepare the general journal entry to record the payroll

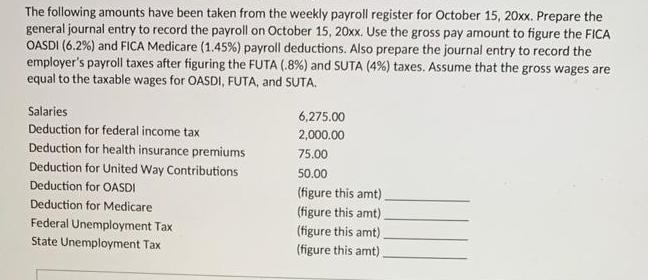

The following amounts have been taken from the weekly payroll register for October 15, 20xx. Prepare the general journal entry to record the payroll on October 15, 20xx. Use the gross pay amount to figure the FICA OASDI (6.2%) and FICA Medicare (1.45%) payroll deductions. Also prepare the journal entry to record the employer's payroll taxes after figuring the FUTA (.8%) and SUTA (4%) taxes. Assume that the gross wages are equal to the taxable wages for OASDI, FUTA, and SUTA. Salaries Deduction for federal income tax Deduction for health insurance premiums Deduction for United Way Contributions Deduction for OASDI Deduction for Medicare Federal Unemployment Tax State Unemployment Tax 6,275.00 2,000.00 75.00 50.00 (figure this amt) (figure this amt). (figure this amt). (figure this amt).

Step by Step Solution

★★★★★

3.27 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started