Answered step by step

Verified Expert Solution

Question

1 Approved Answer

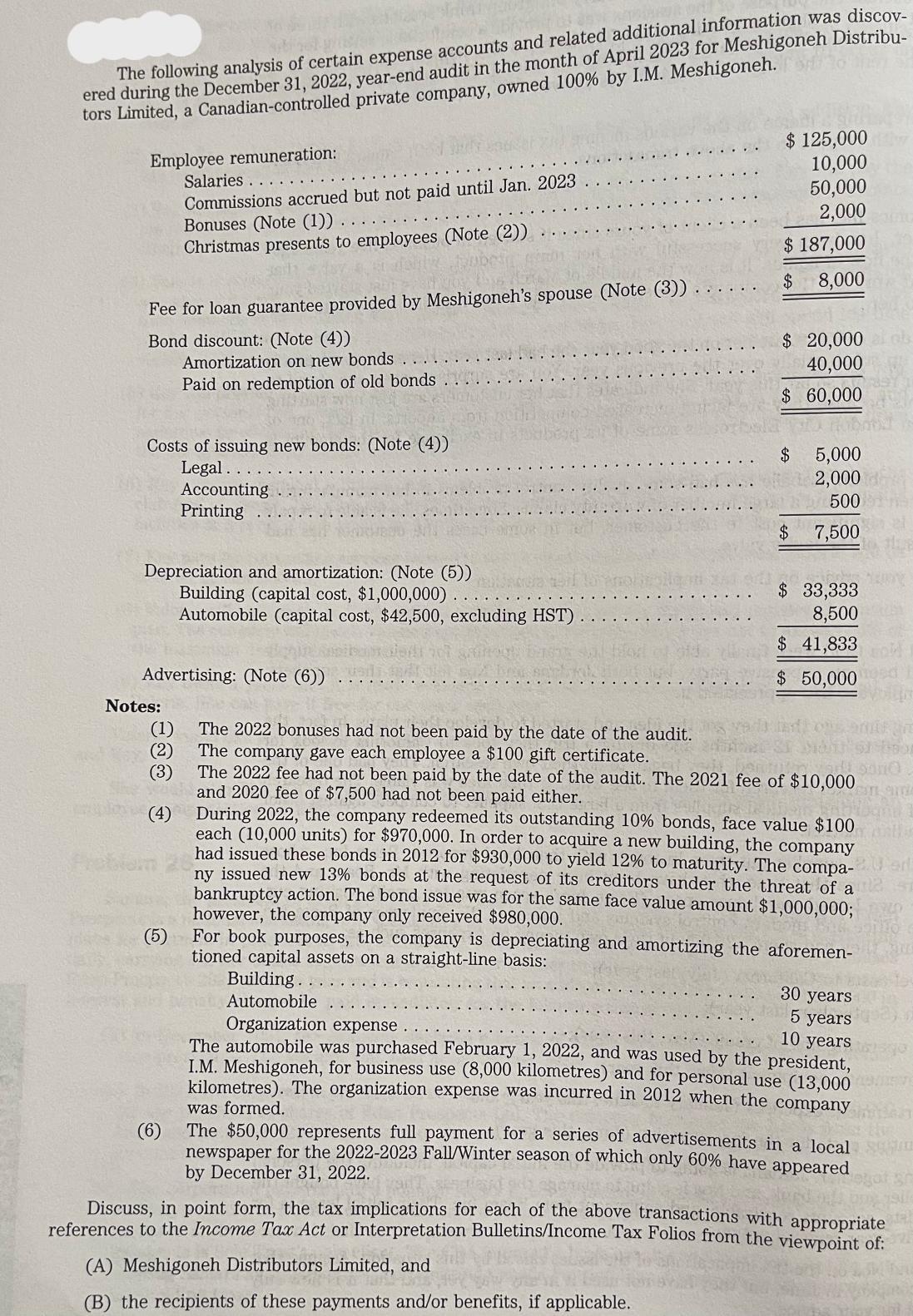

The following analysis of certain expense accounts and related additional information was discov- ered during the December 31, 2022, year-end audit in the month

The following analysis of certain expense accounts and related additional information was discov- ered during the December 31, 2022, year-end audit in the month of April 2023 for Meshigoneh Distribu- tors Limited, a Canadian-controlled private company, owned 100% by I.M. Meshigoneh. Employee remuneration: Salaries Commissions accrued but not paid until Jan. 2023 Bonuses (Note (1)) Christmas presents to employees (Note (2)) Fee for loan guarantee provided by Meshigoneh's spouse (Note (3)). Bond discount: (Note (4)) Amortization on new bonds Paid on redemption of old bonds Costs of issuing new bonds: (Note (4)) Legal.. Accounting Printing $ 125,000 10,000 50,000 2,000 u $ 187,000 $ 8,000 $ 20,000 40,000 $ 60,000 $ 5,000 2,000 500 $ 7,500 $ 33,333 8,500 Depreciation and amortization: (Note (5)) Building (capital cost, $1,000,000) Automobile (capital cost, $42,500, excluding HST) Advertising: (Note (6)) Notes: Problem (1) The 2022 bonuses had not been paid by the date of the audit. (2) The company gave each employee a $100 gift certificate. (3) (4) (5) (6) $ 41,833 $ 50,000 The 2022 fee had not been paid by the date of the audit. The 2021 fee of $10,000 and 2020 fee of $7,500 had not been paid either. During 2022, the company redeemed its outstanding 10% bonds, face value $100 each (10,000 units) for $970,000. In order to acquire a new building, the company had issued these bonds in 2012 for $930,000 to yield 12% to maturity. The compa- ny issued new 13% bonds at the request of its creditors under the threat of a bankruptcy action. The bond issue was for the same face value amount $1,000,000; however, the company only received $980,000. For book purposes, the company is depreciating and amortizing the aforemen- tioned capital assets on a straight-line basis: Building.. Automobile Organization expense 30 years 5 years 10 years The automobile was purchased February 1, 2022, and was used by the president, I.M. Meshigoneh, for business use (8,000 kilometres) and for personal use (13,000 kilometres). The organization expense was incurred in 2012 when the company was formed. The $50,000 represents full payment for a series of advertisements in a local newspaper for the 2022-2023 Fall/Winter season of which only 60% have appeared by December 31, 2022. Discuss, in point form, the tax implications for each of the above transactions with appropriate references to the Income Tax Act or Interpretation Bulletins/Income Tax Folios from the viewpoint of: (A) Meshigoneh Distributors Limited, and (B) the recipients of these payments and/or benefits, if applicable.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started