Question

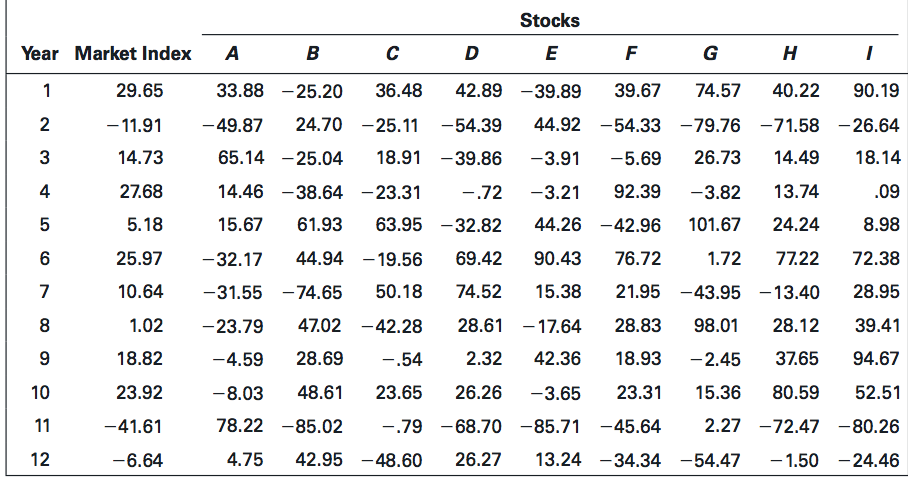

The following annual excess rates of return (%) were obtained for nine individual stocks and a market index: Perform the first-pass regressions and tabulate the

The following annual excess rates of return (%) were obtained for nine individual stocks and a market index:

-

Perform the first-pass regressions and tabulate the summary statistics.

-

Specify the hypotheses for a test of the second-pass regression for the SML.

-

Perform the second-pass SML regression by regressing the average excess return of each portfolio on its beta.

-

Summarize your test results and compare them to the reported results in the text.

-

Group the nine stocks into three portfolios, maximizing the dispersion of the betas of the three

resultant portfolios. Repeat the test and explain any changes in the results.

-

Explain Rolls critique as it applies to the tests performed in problems 3 to 7.

-

Plot the capital market line (CML), the nine stocks, and the three portfolios on a graph of average returns versus standard deviation. Compare the mean-variance efficiency of the three portfolios and the market index. Does the comparison support the CAPM?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started