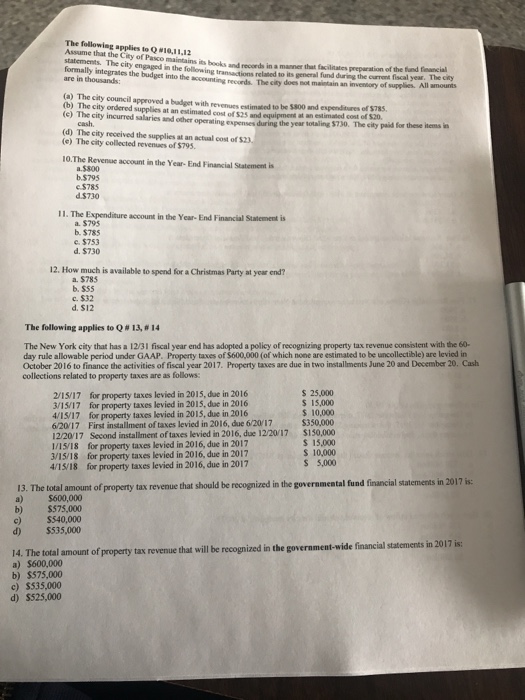

The following applies to Q #10,1 1,12 Assume that the City of Pasco aintains its books statements. The city engaged in the following transactions related to is formally integrates the budget into the accounting records. The city are in thousands and records in a manner that facilitates preparation of the fund feancial general fund during the ourrent fiscal year. The ciry does not maintain an inventory of supplies. All amounts (a) The city councilapproved a budget with revenues estimated to be $800 and expenditures of $785. b) The city ordered supplies at an estimated cost of $25 and equipment at an estlimated cost of s20. (e) The city incurred salaries and other operating espenses during the year totaling $730. The cilty paid for these lhems ia cash. (d) The city received the supplies at an actual cost of $23 (e) The city collected revenues of $795. 10.The Revenue account in the Year-End Financial Statement is a.5800 b.5795 $785 d $730 11. The Expenditure account in the Year- End Financial Statementis a. $795 b. $785 e$753 d. $730 12. How much is available to spend for a Christmas Party at year end? a. $783 b. $55 c. $32 d. $12 The following applies to Q # 13, # 14 The New York city that has a 12/31 fiscal year end has adopted a policy of recognizing property tax revenue consistent with the 60- day rule allowable period under GAAP. Property taxes of $600,000 (of which none are estimated to be uncollectible) are levied in October 2016 to finance the activities of fiscal year 2017. Property taxes are due in two installments June 20 and December 20. Cash collections related to property taxes are as follows s 25,000 s 15,000 $ 10,000 $350,000 2/15/17 for property taxes levied in 2015, due in 2016 3/15/17 for property taxes levied in 2015, due in 2016 4/15/17 for property taxes levied in 2015, due in 2016 6/20/17 First installment of taxes levied in 2016, due 6/20 17 12/20/17 Second installment of taxes levied in 2016, due 12/20/17 $150,000 1/15/18 for property taxes levied in 2016,due in 2017 3/15/18 for property taxes levied in 2016, due in 2017 4/15/18 for property taxes levied in 2016, due in 2017 S 15,000 S 10,000 S 5,000 13. The total amount of property tax revenue that should be recognized in the goveramental fund financial statements in 2017 is: a) b) $575,000 c) $540,000 d) $535,000 $600,000 14. The total amount of property tax revenue that will be recognized in the government-wide financial statements in a) $600,000 b) $575,000 c) $535,000 d) $525,000