Answered step by step

Verified Expert Solution

Question

1 Approved Answer

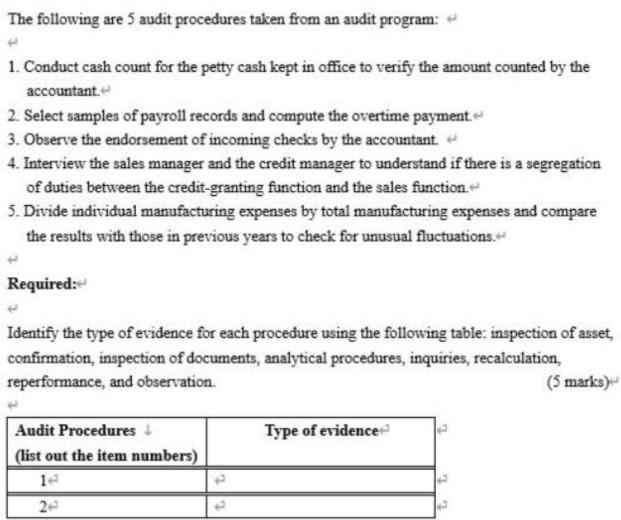

The following are 5 audit procedures taken from an audit program: 1. Conduct cash count for the petty cash kept in office to verify

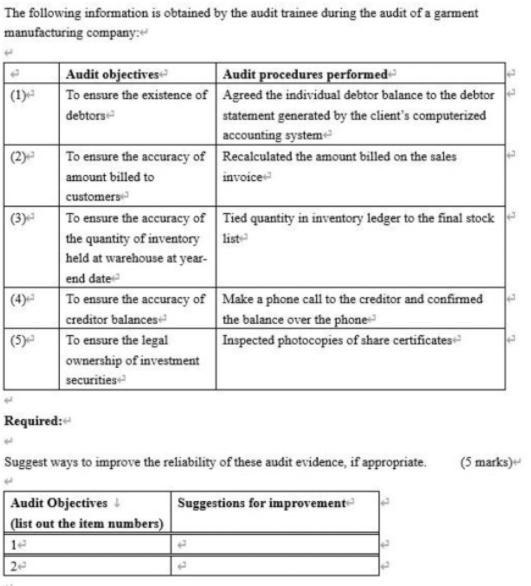

The following are 5 audit procedures taken from an audit program: 1. Conduct cash count for the petty cash kept in office to verify the amount counted by the accountant. 2. Select samples of payroll records and compute the overtime payment. 3. Observe the endorsement of incoming checks by the accountant. 4. Interview the sales manager and the credit manager to understand if there is a segregation of duties between the credit-granting function and the sales function. 5. Divide individual manufacturing expenses by total manufacturing expenses and compare the results with those in previous years to check for unusual fluctuations. Required: Identify the type of evidence for each procedure using the following table: inspection of asset, confimation, inspection of documents, analytical procedures, inquiries, recalculation, reperformance, and observation. (5 marks) Audit Procedures Type of evidence (list out the item numbers) 1 2 The following information is obtained by the audit trainee during the audit of a garment manufacturing company: Audit objectives To ensure the existence of Agreed the individual debtor balance to the debtor debtors Audit procedures performed (1) statement generated by the client's computerized accounting system To ensure the accuracy of Recalculated the amount billed on the sales amount billed to (2)- invoice customers To ensure the accuracy of Tied quantity in inventory ledger to the final stock the quantity of inventory list held at warehouse at year- end date To ensure the accuracy of Make a phone call to the creditor and confirmed creditor balances (3) (4) the balance over the phone Inspected photocopies of share certificates (5) To ensure the legal ownership of investment securities Required: Suggest ways to improve the reliability of these audit evidence, if appropriate. (5 marks) Audit Objectives 4 Suggestions for improvement (list out the item numbers) 1+ 2

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Audit Procedures Petty Cash Count 1 Inspection of asset 2 Confirmation 3 Inspection of Documents 4 A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started