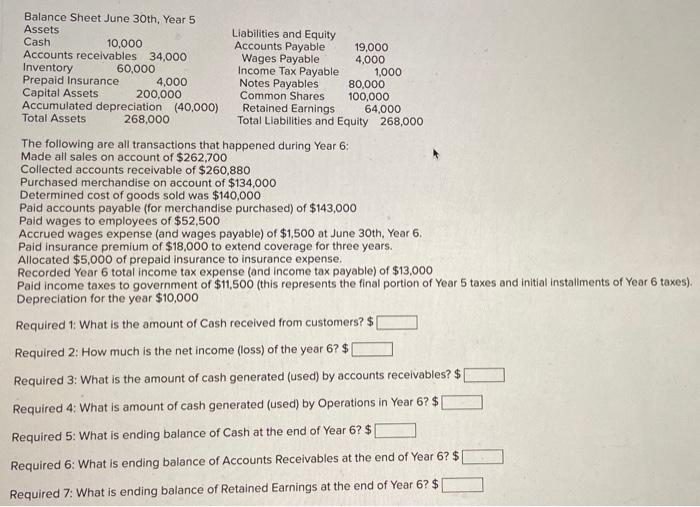

The following are all transactions that happened during Year 6 : Made all sales on account of $262,700 Collected accounts receivable of $260,880 Purchased merchandise on account of $134,000 Determined cost of goods sold was $140,000 Paid accounts payable (for merchandise purchased) of $143,000 Paid wages to employees of $52,500 Accrued wages expense (and wages payable) of $1,500 at June 30th, Year 6 . Paid insurance premium of $18,000 to extend coverage for three years. Allocated $5,000 of prepaid insurance to insurance expense. Recorded Year 6 total income tax expense (and income tax payable) of $13,000 Paid income taxes to government of $11,500 (this represents the final portion of Year 5 taxes and initial installments of Year 6 taxes). Depreciation for the year $10,000 Required 1: What is the amount of Cash received from customers? $ Required 2: How much is the net income (loss) of the year 6?$ Required 3: What is the amount of cash generated (used) by accounts receivables? \$ Required 4: What is amount of cash generated (used) by Operations in Year 6? \$ Required 5: What is ending balance of Cash at the end of Year 6?$ Required 6: What is ending balance of Accounts Receivables at the end of Year 6?$ Required 7: What is ending balance of Retained Earnings at the end of Year 6?$ The following are all transactions that happened during Year 6 : Made all sales on account of $262,700 Collected accounts receivable of $260,880 Purchased merchandise on account of $134,000 Determined cost of goods sold was $140,000 Paid accounts payable (for merchandise purchased) of $143,000 Paid wages to employees of $52,500 Accrued wages expense (and wages payable) of $1,500 at June 30th, Year 6 . Paid insurance premium of $18,000 to extend coverage for three years. Allocated $5,000 of prepaid insurance to insurance expense. Recorded Year 6 total income tax expense (and income tax payable) of $13,000 Paid income taxes to government of $11,500 (this represents the final portion of Year 5 taxes and initial installments of Year 6 taxes). Depreciation for the year $10,000 Required 1: What is the amount of Cash received from customers? $ Required 2: How much is the net income (loss) of the year 6?$ Required 3: What is the amount of cash generated (used) by accounts receivables? \$ Required 4: What is amount of cash generated (used) by Operations in Year 6? \$ Required 5: What is ending balance of Cash at the end of Year 6?$ Required 6: What is ending balance of Accounts Receivables at the end of Year 6?$ Required 7: What is ending balance of Retained Earnings at the end of Year 6?$