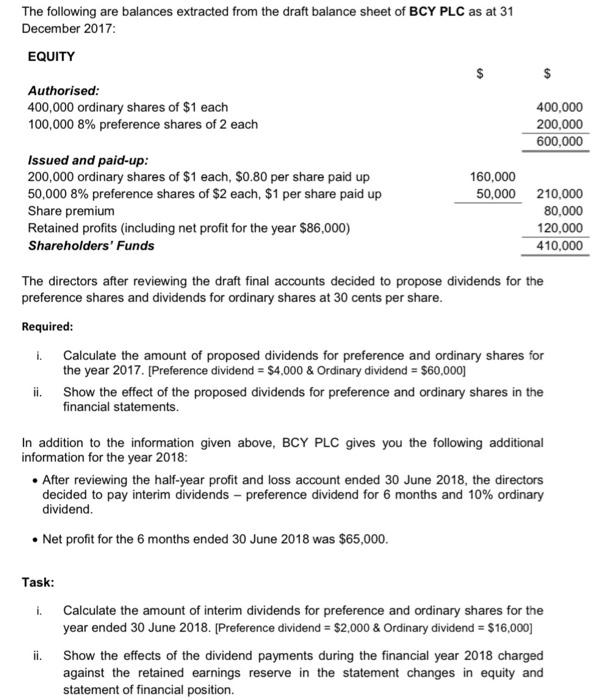

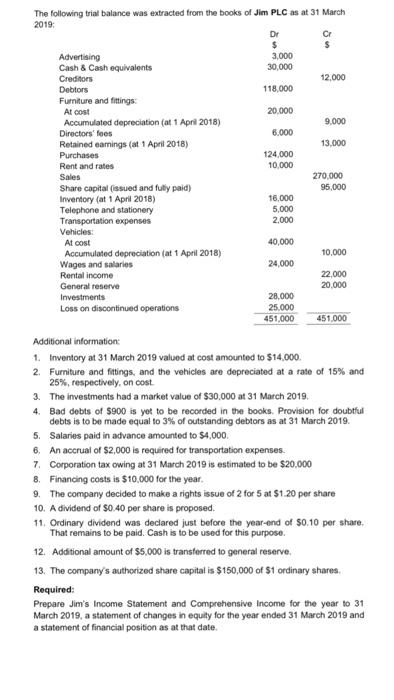

The following are balances extracted from the draft balance sheet of BCY PLC as at 31 December 2017: The directors after reviewing the draft final accounts decided to propose dividends for the preference shares and dividends for ordinary shares at 30 cents per share. Required: i. Calculate the amount of proposed dividends for preference and ordinary shares for the year 2017. [Preference dividend =$4,000& Ordinary dividend =$60,000 ] ii. Show the effect of the proposed dividends for preference and ordinary shares in the financial statements. In addition to the information given above, BCY PLC gives you the following additional information for the year 2018: - After reviewing the half-year profit and loss account ended 30 June 2018, the directors decided to pay interim dividends - preference dividend for 6 months and 10% ordinary dividend. - Net profit for the 6 months ended 30 June 2018 was $65,000. Task: i. Calculate the amount of interim dividends for preference and ordinary shares for the year ended 30 June 2018. [Preference dividend =$2,000& Ordinary dividend =$16,000 ] ii. Show the effects of the dividend payments during the financial year 2018 charged against the retained earnings reserve in the statement changes in equity and statement of financial position. The following trial balance was extracted trom the books of Jim PLC as at 31 March 2019 : Additional information: 1. Inventory at 31 March 2019 valued at cost amounted to $14,000. 2. Furniture and fitings, and the vehicles are depreciated at a rate of 15% and 25%, respectively, on cost. 3. The investments had a market value of $30,000 at 31 March 2019. 4. Bad debts of $900 is yet to be recorded in the books. Provision for doubtful debts is to be made equal to 3% of outstanding debtors as at 31 March 2019. 5. Salaries paid in advance amounted to $4,000. 6. An accrual of $2,000 is required for transportation expenses. 7. Corporation tax owing at 31 March 2019 is estimated to be $20.000 8. Financing costs is $10,000 for the year. 9. The company decided to make a rights issue of 2 for 5 at $1.20 per share 10. A dividend of $0.40 per share is proposed. 11. Ordinary dividend was declared just before the year-end of $0.10 per share. That remains to be paid. Cash is to be used for this purpose. 12. Additional amount of $5,000 is transferred to general reserve. 13. The company's authorized share capital is $150,000 of $1 ordinary shares. Required: Prepare Jim's Income Statement and Comprehensive Income for the year to 31 March 2019, a statement of changes in equity for the year ended 31 March 2019 and a statement of financial posibion as at that date