Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following are balances of a partnership between Shoe and Lace as at 2021 December 31: DR $ Capital on 2021 January 01: Shoe

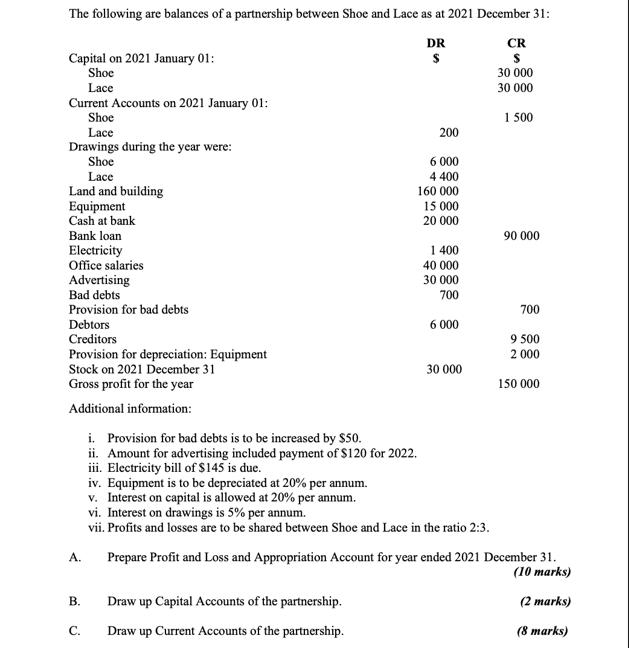

The following are balances of a partnership between Shoe and Lace as at 2021 December 31: DR $ Capital on 2021 January 01: Shoe Lace Current Accounts on 2021 January 01: Shoe Lace Drawings during the year were: Shoe Lace Land and building Equipment Cash at bank Bank loan Electricity Office salaries Advertising Bad debts Provision for bad debts Debtors Creditors Provision for depreciation: Equipment Stock on 2021 December 31 Gross profit for the year Additional information: A. B. C. i. Provision for bad debts is to be increased by $50. ii. Amount for advertising included payment of $120 for 2022. iii. Electricity bill of $145 is due. iv. Equipment is to be depreciated at 20% per annum. v. Interest on capital is allowed at 20% per annum. 200 6 000 4 400 160 000 Draw up Capital Accounts of the partnership. Draw up Current Accounts of the partnership. 15 000 20 000 1400 40 000 30 000 700 6 000 30 000 vi. Interest on drawings is 5% per annum. vii. Profits and losses are to be shared between Shoe and Lace in the ratio 2:3. CR S 30 000 30 000 1 500 90 000 700 9 500 2 000 150 000 Prepare Profit and Loss and Appropriation Account for year ended 2021 December 31. (10 marks) (2 marks) (8 marks)

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started