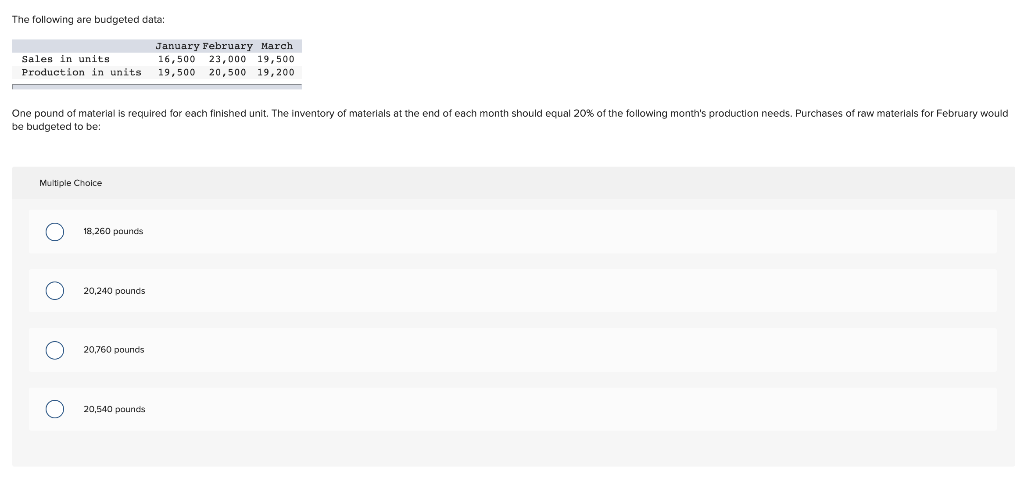

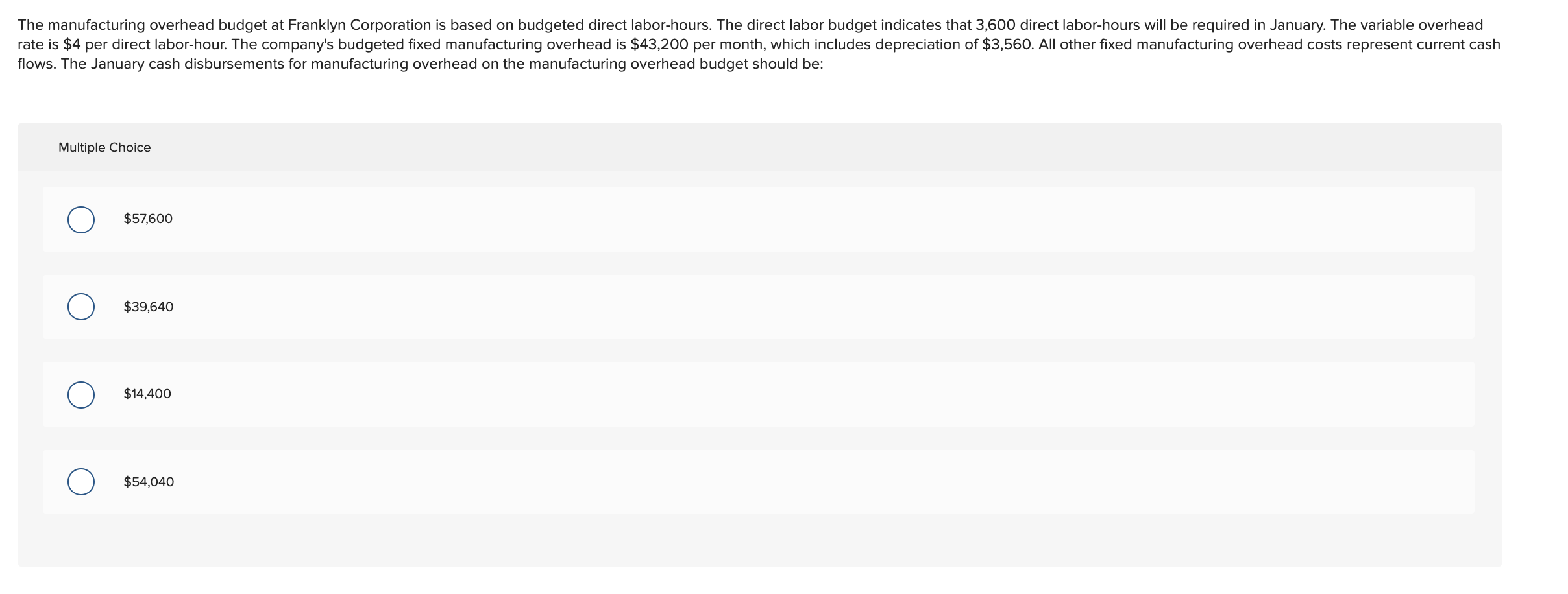

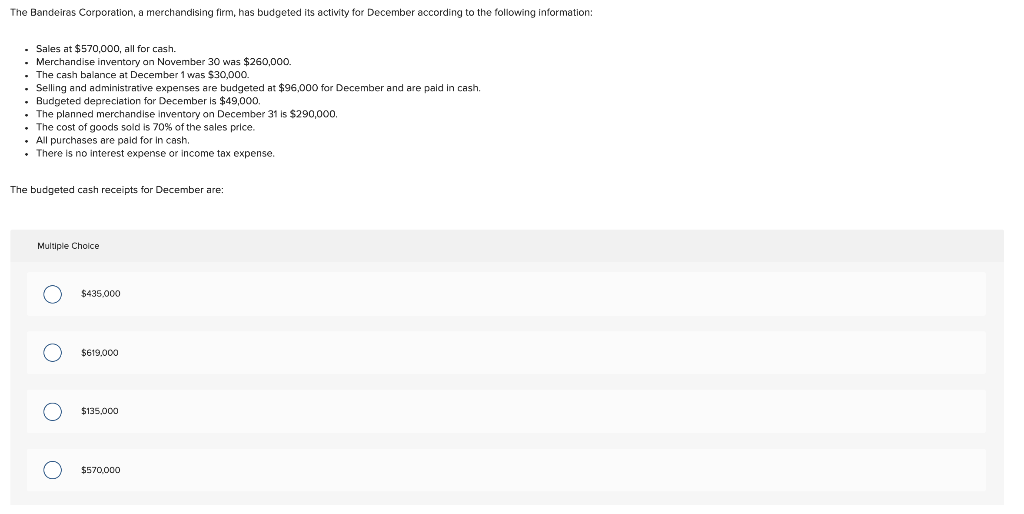

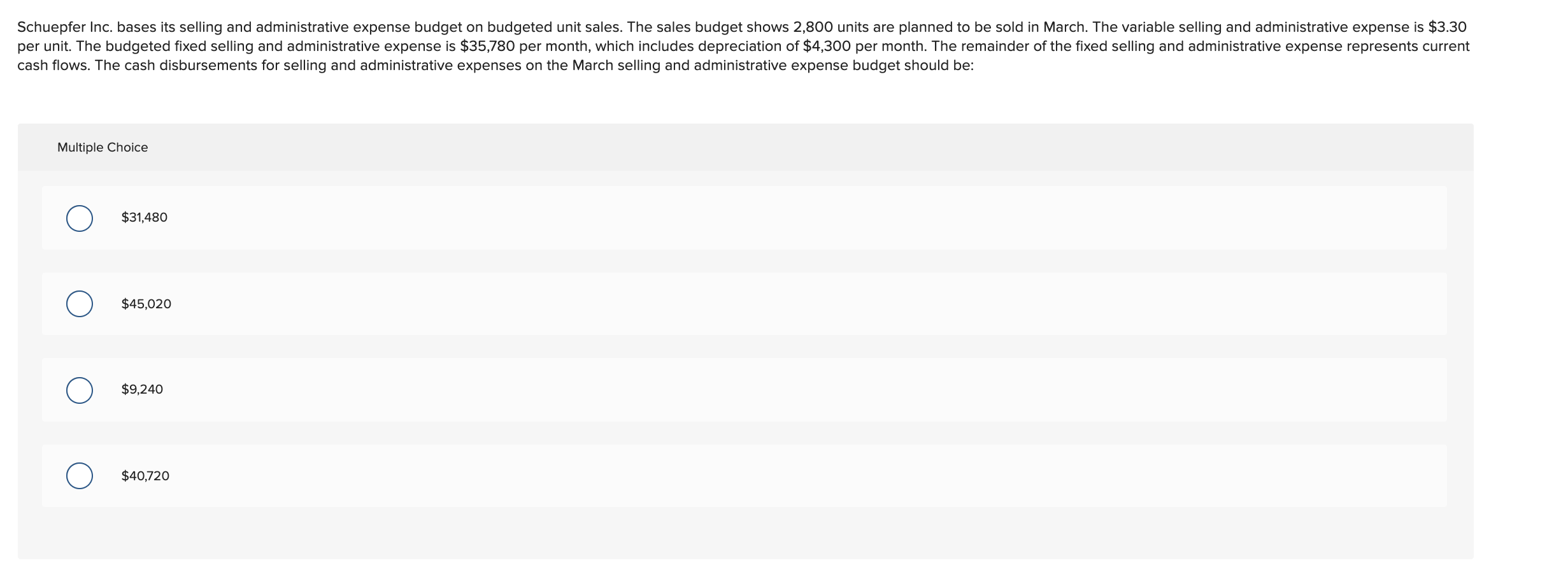

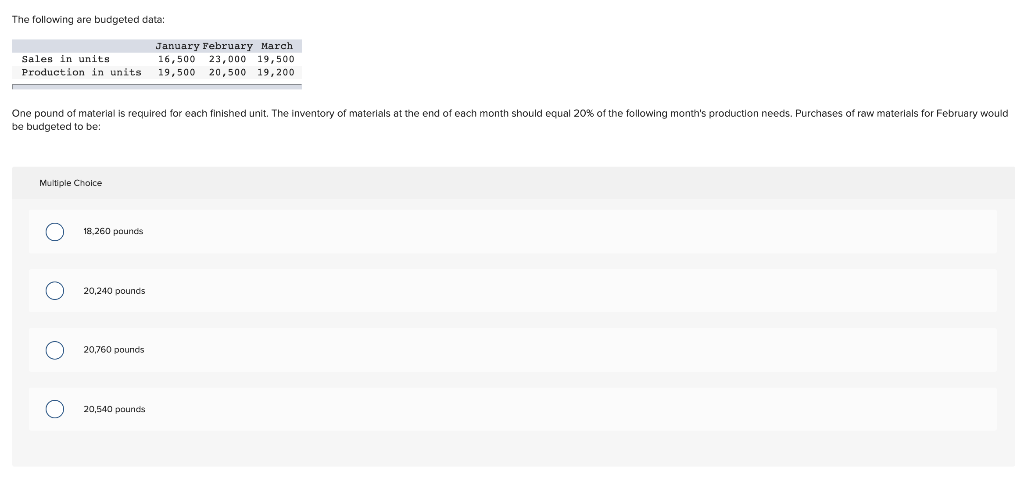

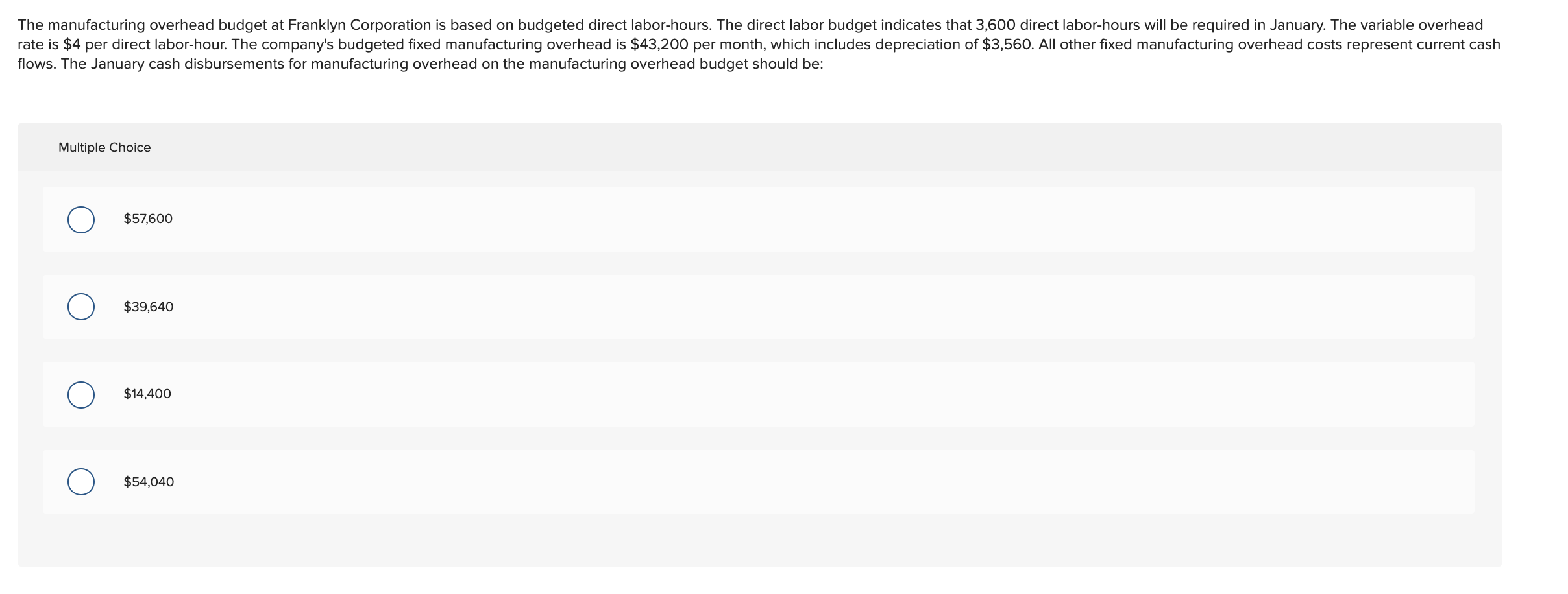

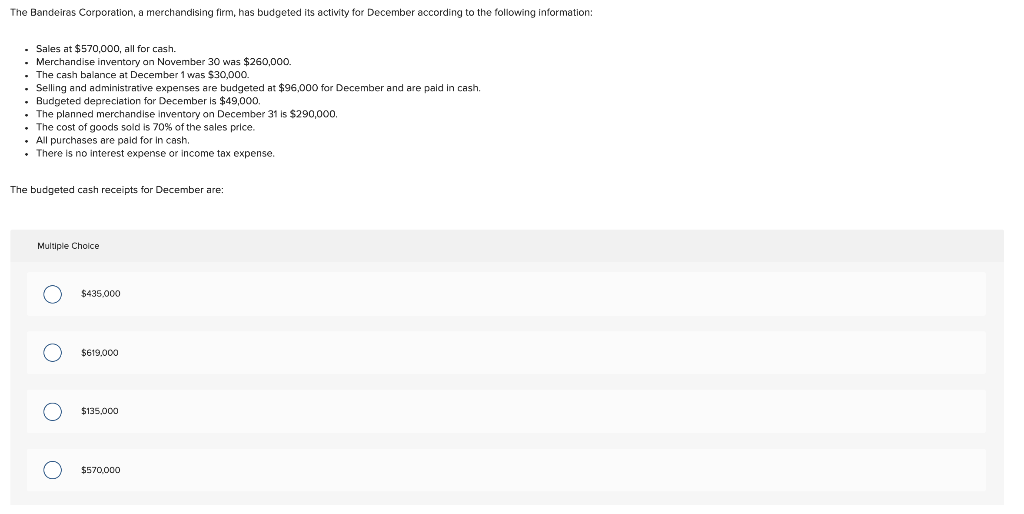

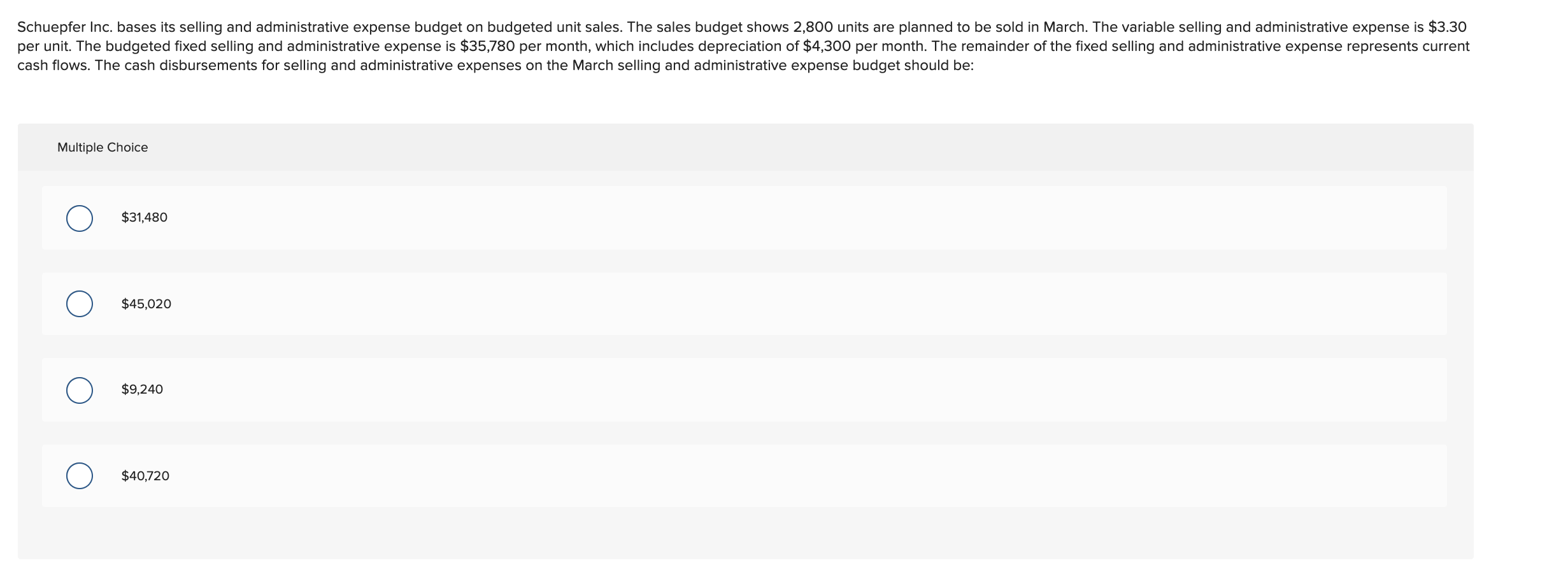

The following are budgeted data: Sales in units Production in units January February March 16,500 23,000 19,500 19,500 20,500 19,200 One pound of material is required for each finished unit. The inventory of materials at the end of each month should equal 20% of the following month's production needs. Purchases of raw materials for February would be budgeted to be: Multiple Choice 18,260 pounds 20,240 pounds oooo 20,760 pounds 20,540 pounds The manufacturing overhead budget at Franklyn Corporation is based on budgeted direct labor-hours. The direct labor budget indicates that 3,600 direct labor-hours will be required in January. The variable overhead rate is $4 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $43,200 per month, which includes depreciation of $3,560. All other fixed manufacturing overhead costs represent current cash flows. The January cash disbursements for manufacturing overhead on the manufacturing overhead budget should be: Multiple Choice 0 $57,600 0 $39,640 0 $14,400 0 $54,040 The Bandeiras Corporation, a merchandising firm, has budgeted its activity for December according to the following information: - Sales at $570,000, all for cash. Merchandise inventory on November 30 was $260,000. The cash balance at December 1 was $30,000. Selling and administrative expenses are budgeted at $96,000 for December and are paid in cash Budgeted depreciation for December is $49,000. The planned merchandise inventory on December 31 is $290,000 The cost of goods sold is 70% of the sales price. All purchases are paid for in cash. There is no interest expense or income tax expense. The budgeted cash receipts for December are: Multiple Choice $435.000 $619.000 oooo $135.000 O $570,000 Schuepfer Inc. bases its selling and administrative expense budget on budgeted unit sales. The sales budget shows 2,800 units are planned to be sold in March. The variable selling and administrative expense is $3.30 per unit. The budgeted fixed selling and administrative expense is $35,780 per month, which includes depreciation of $4,300 per month. The remainder of the fixed selling and administrative expense represents current cash flows. The cash disbursements for selling and administrative expenses on the March selling and administrative expense budget should be: Multiple Choice 0 $31,480 0 $45,020 0 $9,240 0 $40,720