Answered step by step

Verified Expert Solution

Question

1 Approved Answer

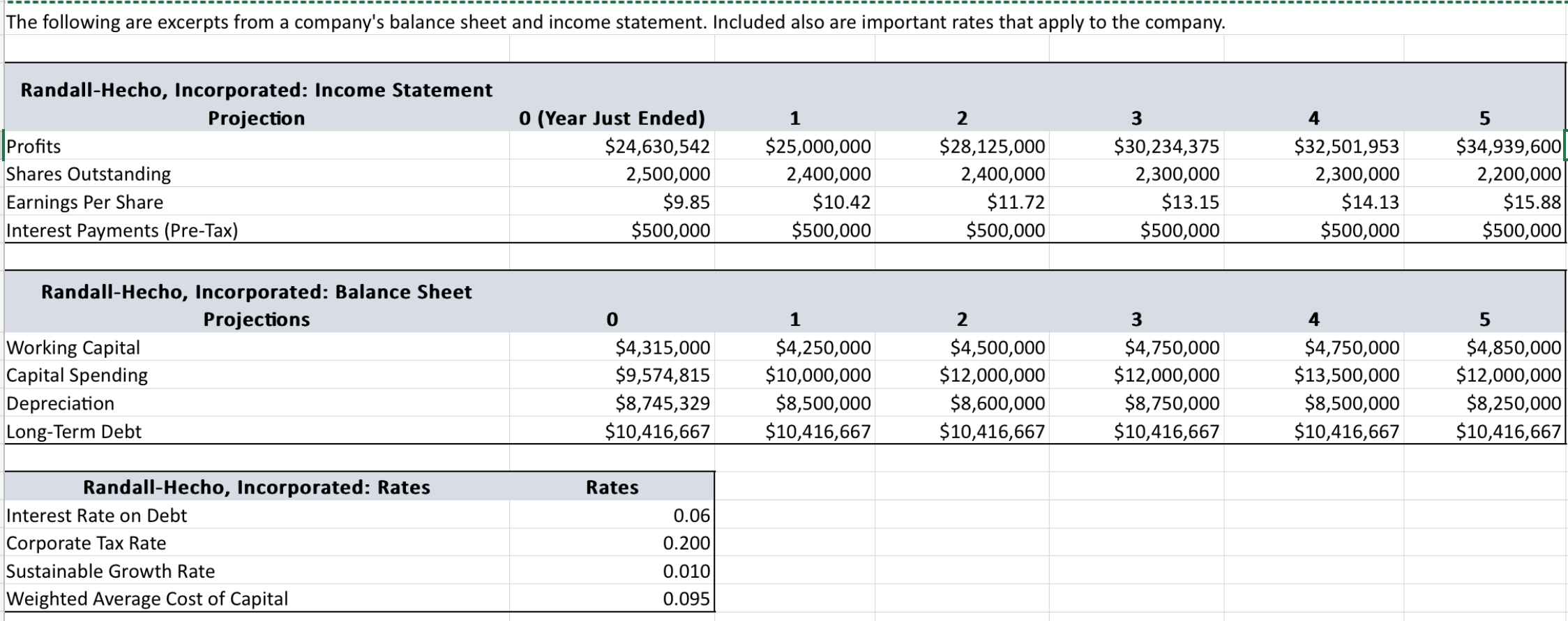

The following are excerpts from a company's balance sheet and income statement. Included also are important rates that apply to the company. Randall-Hecho, Incorporated:

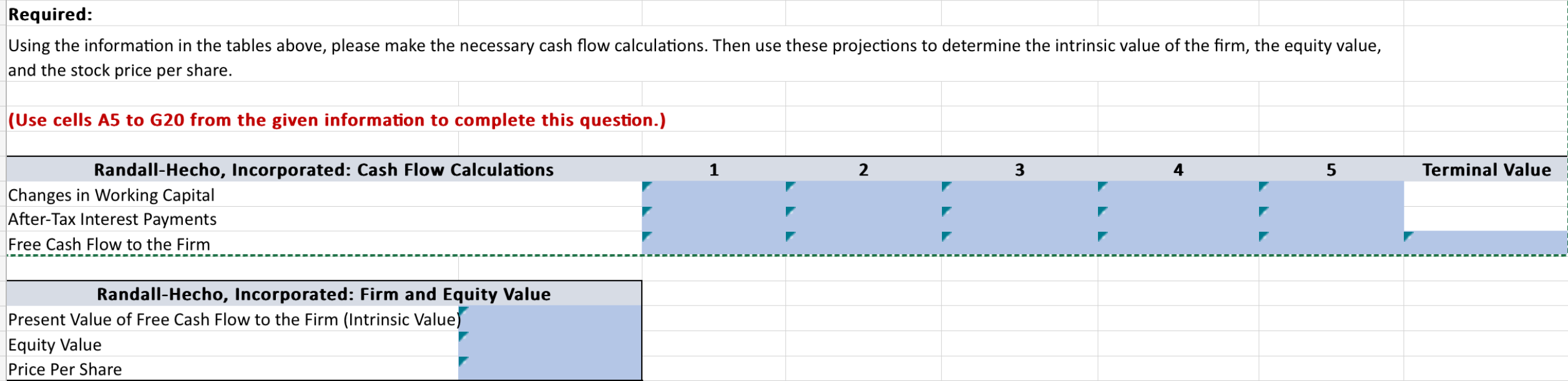

The following are excerpts from a company's balance sheet and income statement. Included also are important rates that apply to the company. Randall-Hecho, Incorporated: Income Statement Projection Profits Shares Outstanding Earnings Per Share Interest Payments (Pre-Tax) Randall-Hecho, Incorporated: Balance Sheet Projections Working Capital Capital Spending Depreciation Long-Term Debt Randall-Hecho, Incorporated: Rates Interest Rate on Debt Corporate Tax Rate Sustainable Growth Rate Weighted Average Cost of Capital 0 (Year Just Ended) $24,630,542 2,500,000 $9.85 $500,000 0 $4,315,000 $9,574,815 $8,745,329 $10,416,667 Rates 0.06 0.200 0.010 0.095 1 $25,000,000 2,400,000 $10.42 $500,000 1 $4,250,000 $10,000,000 $8,500,000 $10,416,667 2 $28,125,000 2,400,000 $11.72 $500,000 2 $4,500,000 $12,000,000 $8,600,000 $10,416,667 $30,234,375 2,300,000 $13.15 $500,000 3 $4,750,000 $12,000,000 $8,750,000 $10,416,667 4 $32,501,953 2,300,000 $14.13 $500,000 4 $4,750,000 $13,500,000 $8,500,000 $10,416,667 5 $34,939,600 2,200,000 $15.88 $500,000 5 $4,850,000 $12,000,000 $8,250,000 $10,416,667 Required: Using the information in the tables above, please make the necessary cash flow calculations. Then use these projections to determine the intrinsic value of the firm, the equity value, and the stock price per share. (Use cells A5 to G20 from the given information to complete this question.) Randall-Hecho, Incorporated: Cash Flow Calculations Changes in Working Capital After-Tax Interest Payments Free Cash Flow to the Firm Randall-Hecho, Incorporated: Firm and Equity Value Present Value of Free Cash Flow to the Firm (Intrinsic Value) Equity Value Price Per Share 1 2 3 4 5 Terminal Value

Step by Step Solution

★★★★★

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the cash flow projections we need to determine the free cash flow to the firm for each year The free cash flow to the firm is calculated ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started