Question

The following are extracts from the draft financial accounts of Deepwater Bhd for the year ended 31 December 2021. Additional information: i) Bad debts of

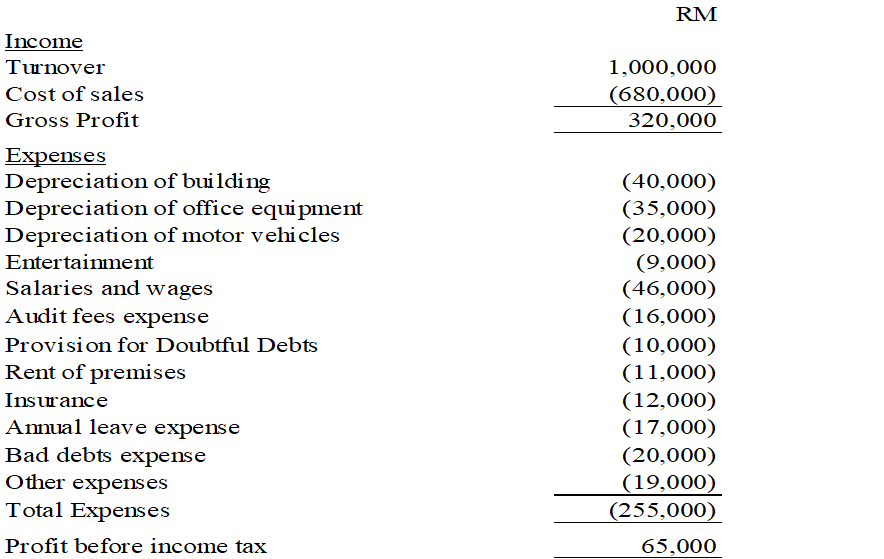

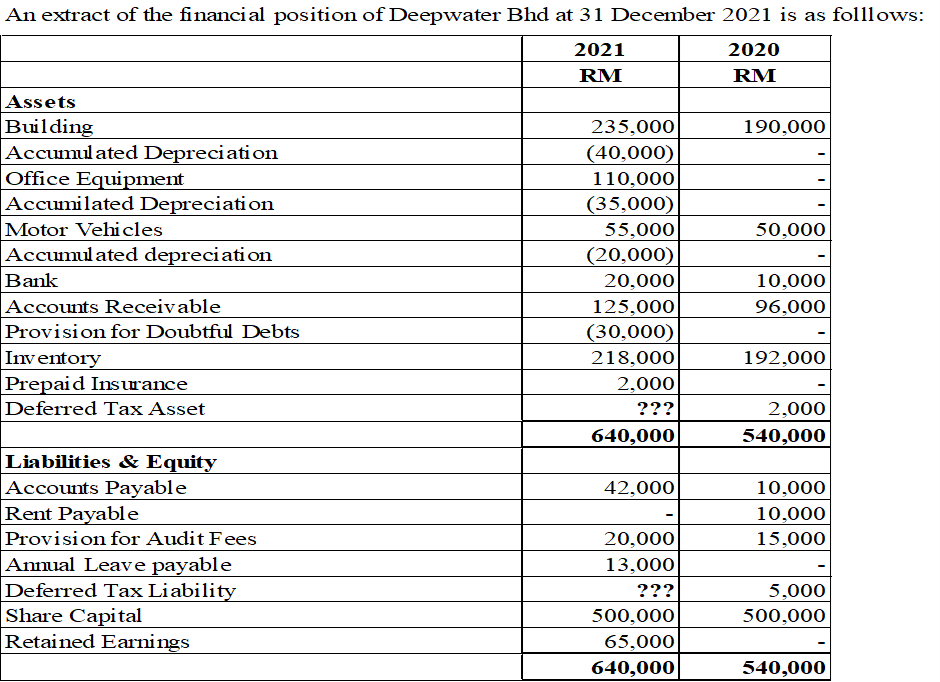

The following are extracts from the draft financial accounts of Deepwater Bhd for the year

ended 31 December 2021.

Additional information:

i) Bad debts of RM20,000 were written off during the year.

ii) The depreciation for tax purposes for the current year and tax base of the office equipment and motor vehicles at 31 December 2021 were as follows: Office Equipment Motor Vehicles

Tax Depreciation (RM) 27,500 16,500

Tax Base (RM) 50,000 30,000

The company's buildings do not qualify for capital allowance.

iii) Entertainment expenses are not allowable as a tax deduction.

iv) The companys corporate tax rate is 24%.

v) Deepwater Bed accounts for deferred tax using the full provision (Liability method).

Required:

a) Calculate the income tax liability for Deepwater Bhd as at 31 December 2021 and prepare the journal entry to record the income tax payable. (12 marks)

b) Prepare the deferred tax worksheet at 31 December 2021 to determine deferred tax entries for the year. (15 marks)

c) Record the journal entry for Deferred Tax Asset and Deferred Tax Liability for the current financial year. (3 marks)

\begin{tabular}{lr} Income & RM \\ Turnover & 1,000,000 \\ Cost of sales & (680,000) \\ Gross Profit & 320,000 \\ \hline Expenses & \\ Depreciation of building & (40,000) \\ Depreciation of office equipment & (35,000) \\ Depreciation of motor vehicles & (20,000) \\ Entertainment & (9,000) \\ Salaries and wages & (46,000) \\ Audit fees expense & (16,000) \\ Provision for Doubtful Debts & (10,000) \\ Rent of premises & (11,000) \\ Insurance & (12,000) \\ Annual leave expense & (17,000) \\ Bad debts expense & (20,000) \\ Other expenses & (19,000) \\ Total Expenses & (255,000) \\ Profit before income tax & 65,000 \\ \cline { 2 - 3 } \end{tabular} An extract of the financial position of Deepwater Bhd at 31 December 2021 is as folllows: \begin{tabular}{lr} Income & RM \\ Turnover & 1,000,000 \\ Cost of sales & (680,000) \\ Gross Profit & 320,000 \\ \hline Expenses & \\ Depreciation of building & (40,000) \\ Depreciation of office equipment & (35,000) \\ Depreciation of motor vehicles & (20,000) \\ Entertainment & (9,000) \\ Salaries and wages & (46,000) \\ Audit fees expense & (16,000) \\ Provision for Doubtful Debts & (10,000) \\ Rent of premises & (11,000) \\ Insurance & (12,000) \\ Annual leave expense & (17,000) \\ Bad debts expense & (20,000) \\ Other expenses & (19,000) \\ Total Expenses & (255,000) \\ Profit before income tax & 65,000 \\ \cline { 2 - 3 } \end{tabular} An extract of the financial position of Deepwater Bhd at 31 December 2021 is as folllowsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started