Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following are extracts of financial statements from the Laptop Ltd group of companies for the year ended 31 December 2021. LAPTOP LTD GROUP: EXTRACTS

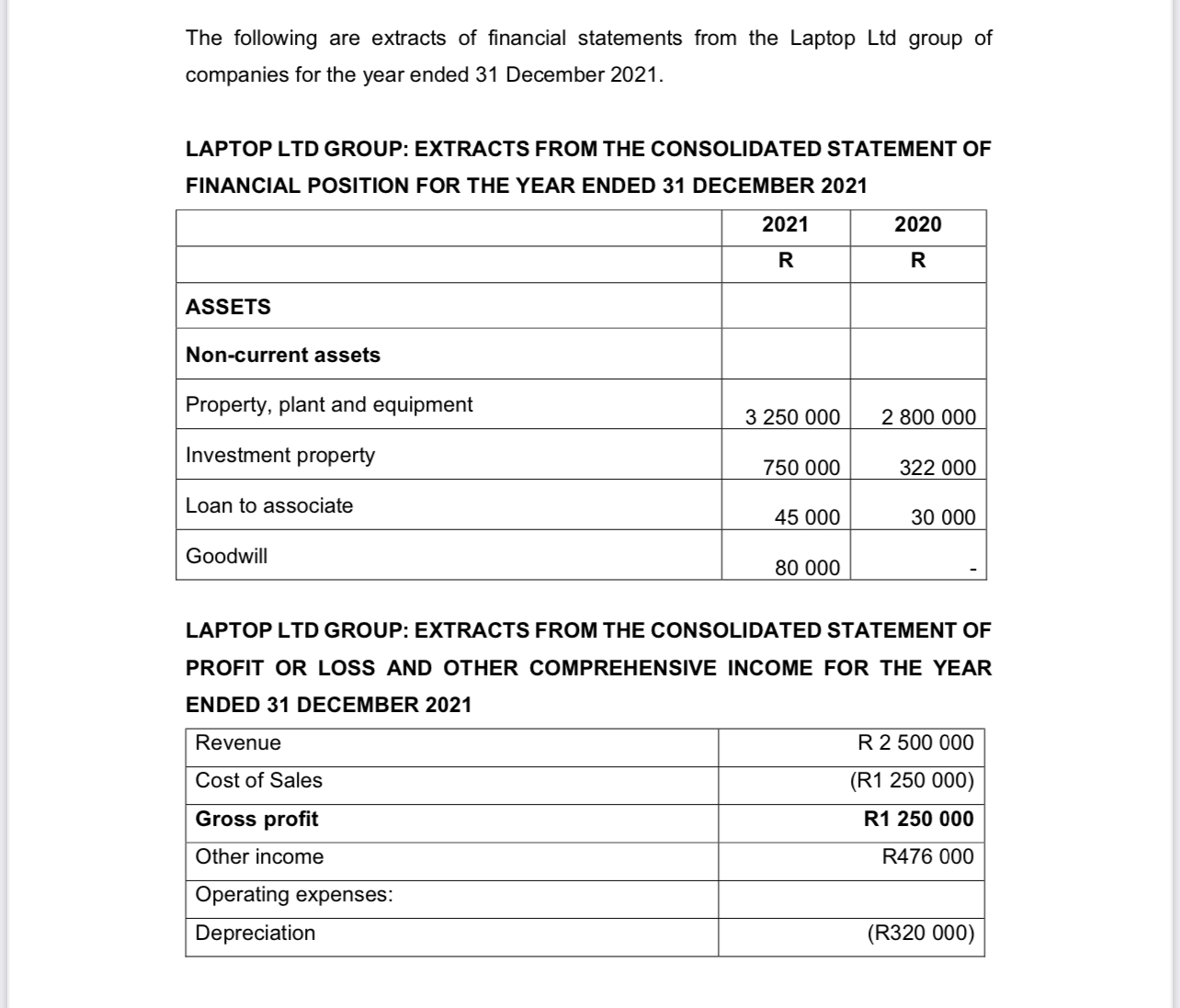

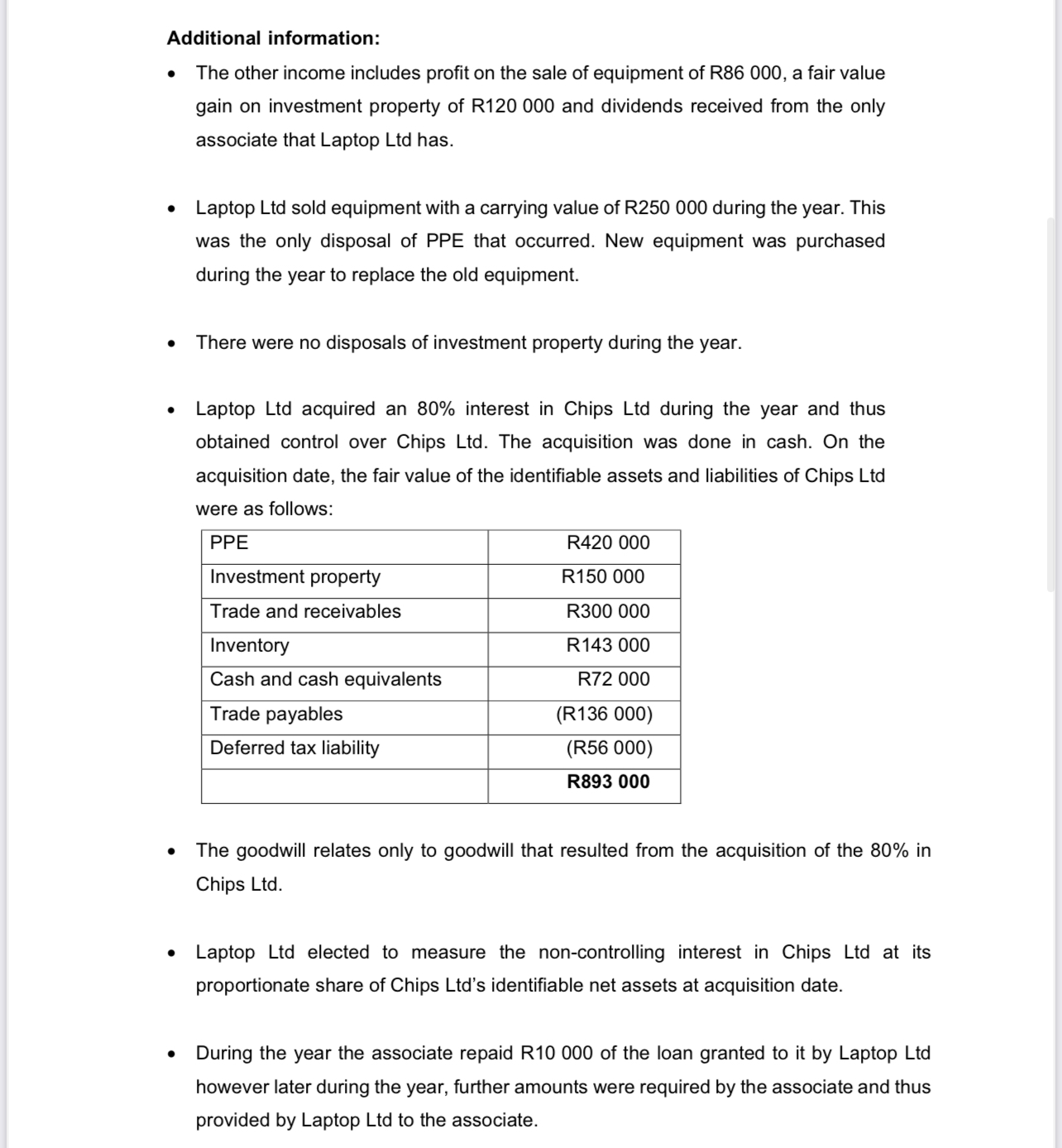

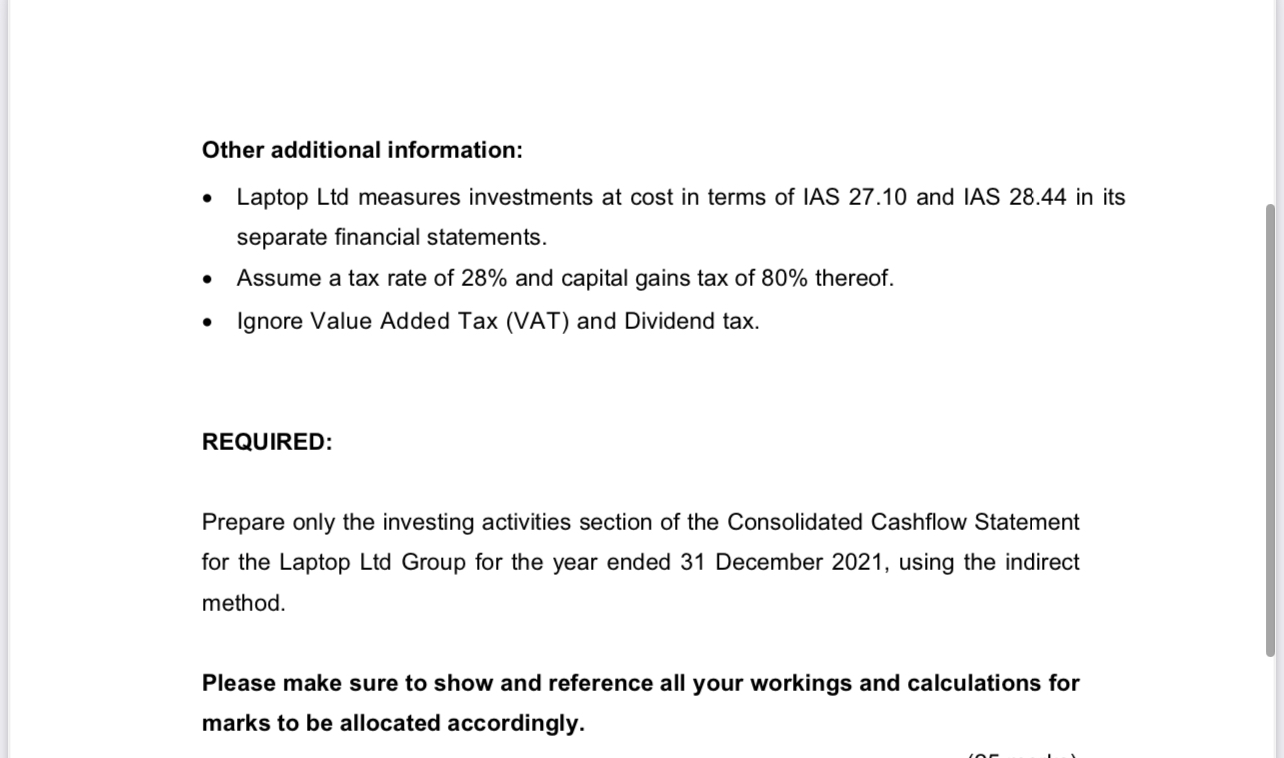

The following are extracts of financial statements from the Laptop Ltd group of companies for the year ended 31 December 2021. LAPTOP LTD GROUP: EXTRACTS FROM THE CONSOLIDATED STATEMENT OF FINANCIAL POSITION FOR THE YEAR ENDED 31 DECEMBER 2021 LAPTOP LTD GROUP: EXTRACTS FROM THE CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2021 Additional information: - The other income includes profit on the sale of equipment of R86 000, a fair value gain on investment property of R120000 and dividends received from the only associate that Laptop Ltd has. - Laptop Ltd sold equipment with a carrying value of R250 000 during the year. This was the only disposal of PPE that occurred. New equipment was purchased during the year to replace the old equipment. - There were no disposals of investment property during the year. - Laptop Ltd acquired an 80% interest in Chips Ltd during the year and thus obtained control over Chips Ltd. The acquisition was done in cash. On the acquisition date, the fair value of the identifiable assets and liabilities of Chips Ltd were as follows: - The goodwill relates only to goodwill that resulted from the acquisition of the 80% in Chips Ltd. - Laptop Ltd elected to measure the non-controlling interest in Chips Ltd at its proportionate share of Chips Ltd's identifiable net assets at acquisition date. - During the year the associate repaid R10 000 of the loan granted to it by Laptop Ltd however later during the year, further amounts were required by the associate and thus provided by Laptop Ltd to the associate. Other additional information: - Laptop Ltd measures investments at cost in terms of IAS 27.10 and IAS 28.44 in its separate financial statements. - Assume a tax rate of 28% and capital gains tax of 80% thereof. - Ignore Value Added Tax (VAT) and Dividend tax. REQUIRED: Prepare only the investing activities section of the Consolidated Cashflow Statement for the Laptop Ltd Group for the year ended 31 December 2021, using the indirect method. Please make sure to show and reference all your workings and calculations for marks to be allocated accordingly

The following are extracts of financial statements from the Laptop Ltd group of companies for the year ended 31 December 2021. LAPTOP LTD GROUP: EXTRACTS FROM THE CONSOLIDATED STATEMENT OF FINANCIAL POSITION FOR THE YEAR ENDED 31 DECEMBER 2021 LAPTOP LTD GROUP: EXTRACTS FROM THE CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2021 Additional information: - The other income includes profit on the sale of equipment of R86 000, a fair value gain on investment property of R120000 and dividends received from the only associate that Laptop Ltd has. - Laptop Ltd sold equipment with a carrying value of R250 000 during the year. This was the only disposal of PPE that occurred. New equipment was purchased during the year to replace the old equipment. - There were no disposals of investment property during the year. - Laptop Ltd acquired an 80% interest in Chips Ltd during the year and thus obtained control over Chips Ltd. The acquisition was done in cash. On the acquisition date, the fair value of the identifiable assets and liabilities of Chips Ltd were as follows: - The goodwill relates only to goodwill that resulted from the acquisition of the 80% in Chips Ltd. - Laptop Ltd elected to measure the non-controlling interest in Chips Ltd at its proportionate share of Chips Ltd's identifiable net assets at acquisition date. - During the year the associate repaid R10 000 of the loan granted to it by Laptop Ltd however later during the year, further amounts were required by the associate and thus provided by Laptop Ltd to the associate. Other additional information: - Laptop Ltd measures investments at cost in terms of IAS 27.10 and IAS 28.44 in its separate financial statements. - Assume a tax rate of 28% and capital gains tax of 80% thereof. - Ignore Value Added Tax (VAT) and Dividend tax. REQUIRED: Prepare only the investing activities section of the Consolidated Cashflow Statement for the Laptop Ltd Group for the year ended 31 December 2021, using the indirect method. Please make sure to show and reference all your workings and calculations for marks to be allocated accordingly Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started