Answered step by step

Verified Expert Solution

Question

1 Approved Answer

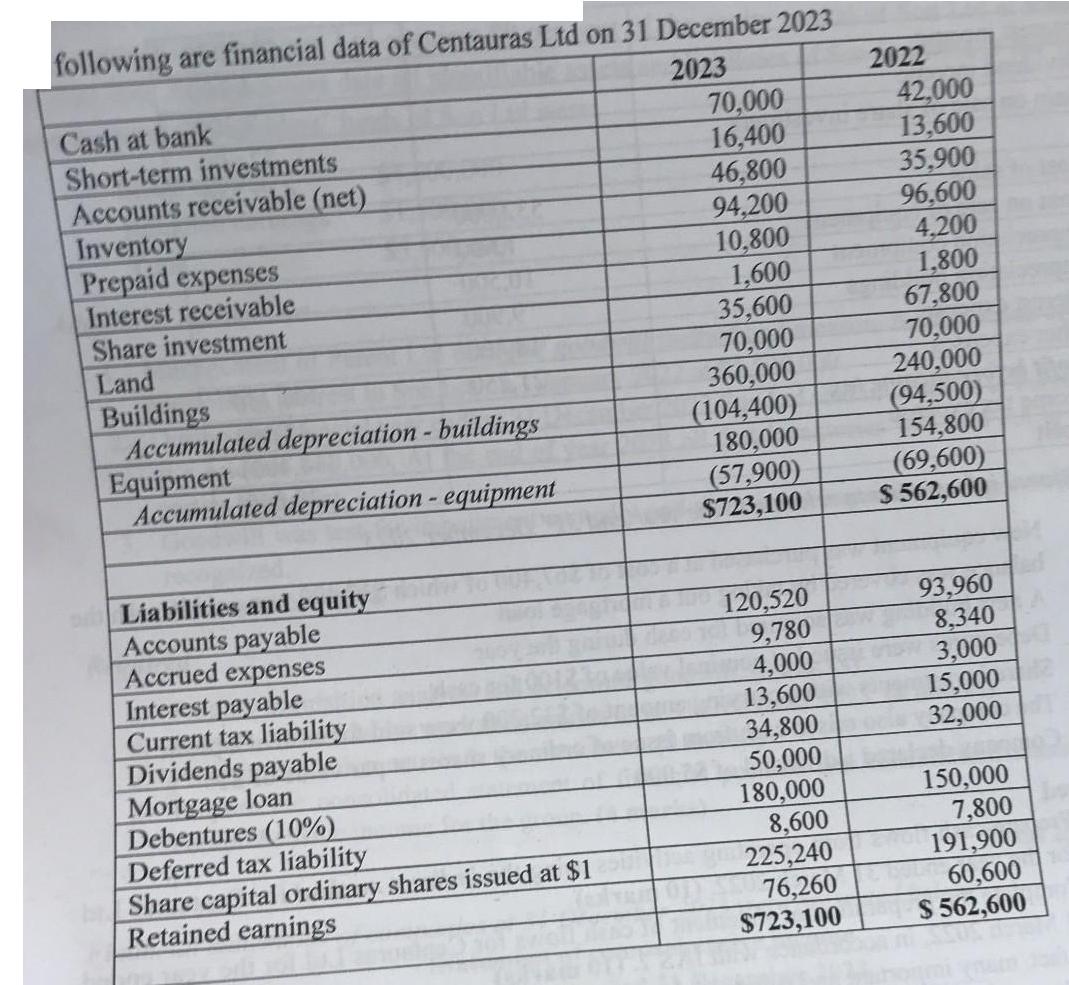

following are financial data of Centauras Ltd on 31 December 2023 2023 Cash at bank Short-term investments Accounts receivable (net) Inventory Prepaid expenses Interest

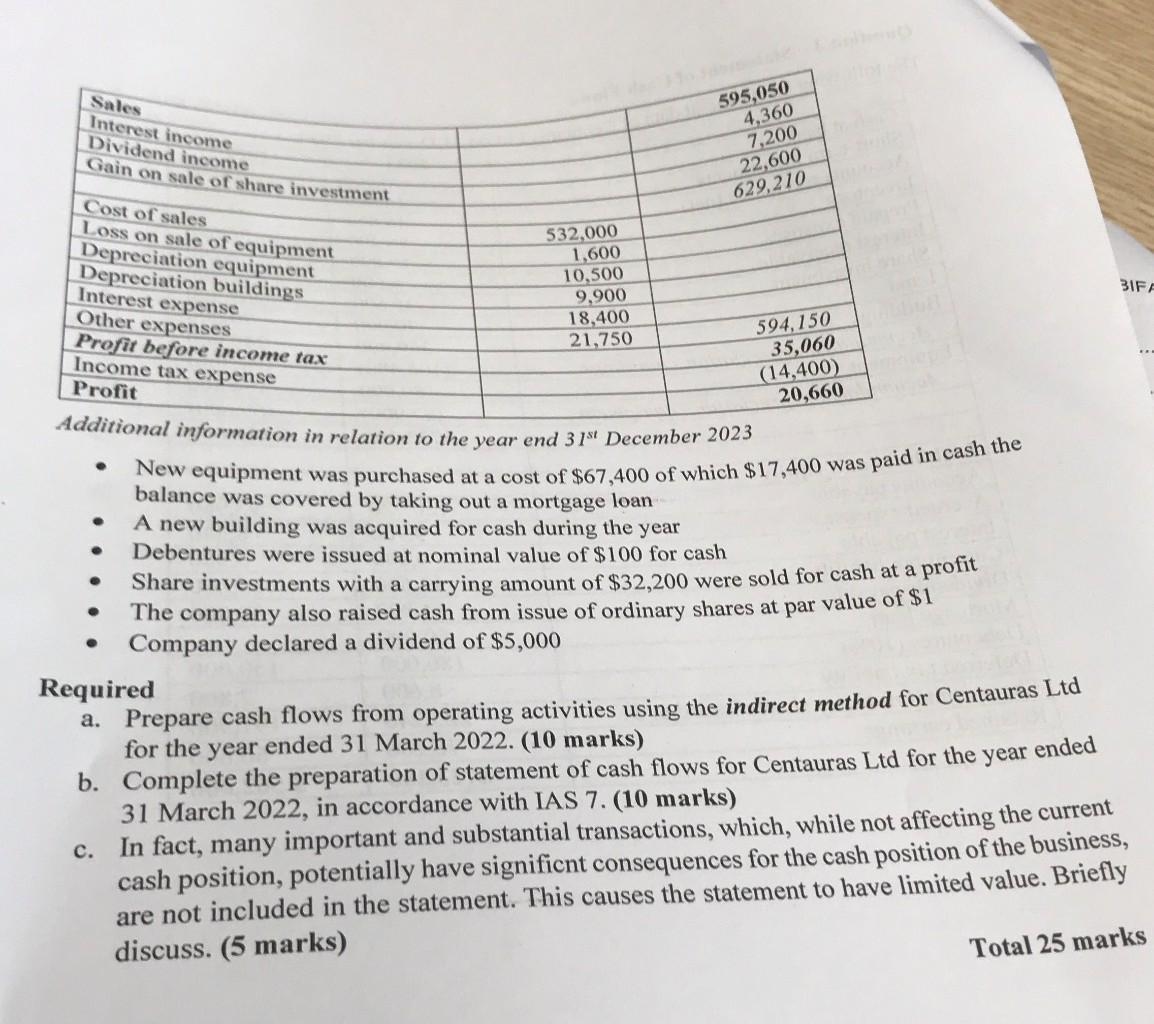

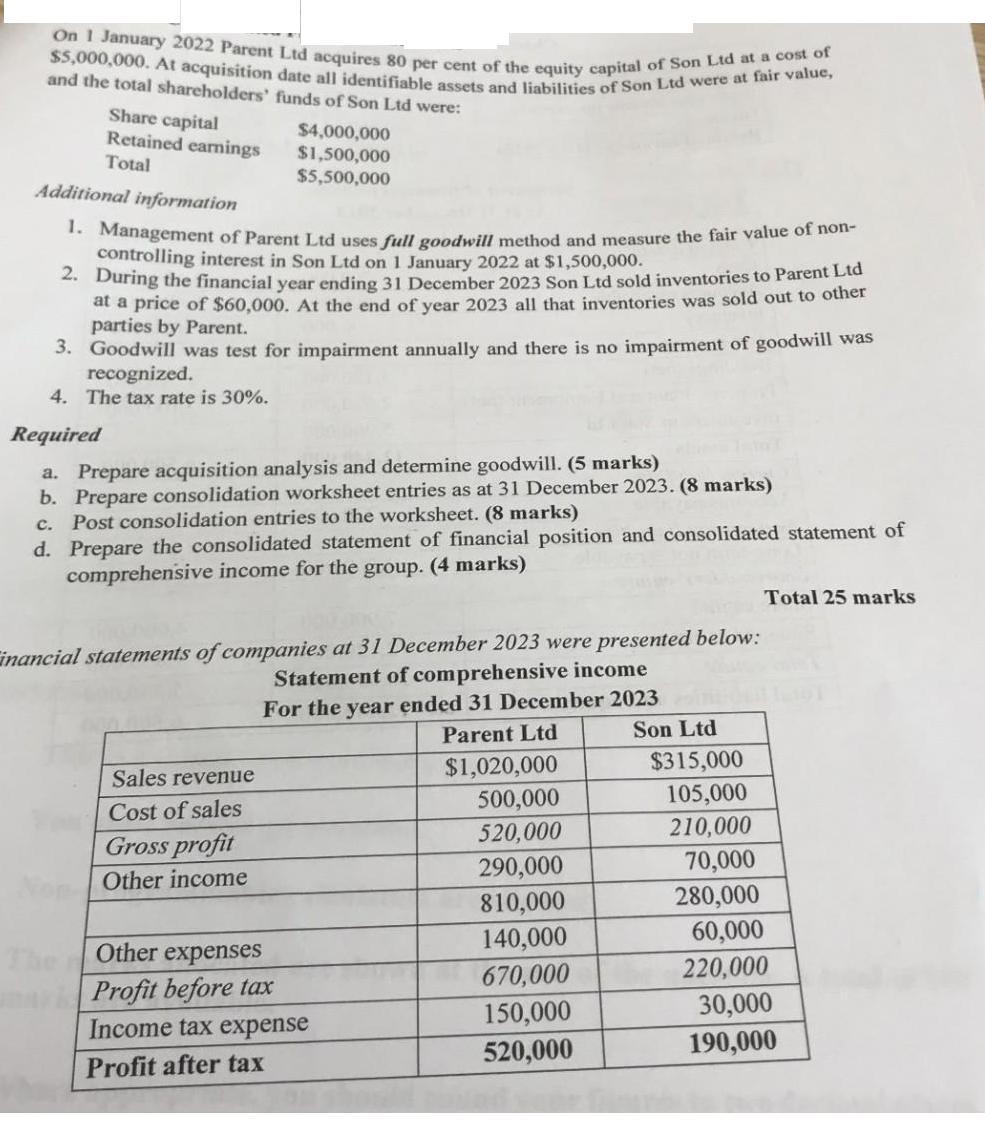

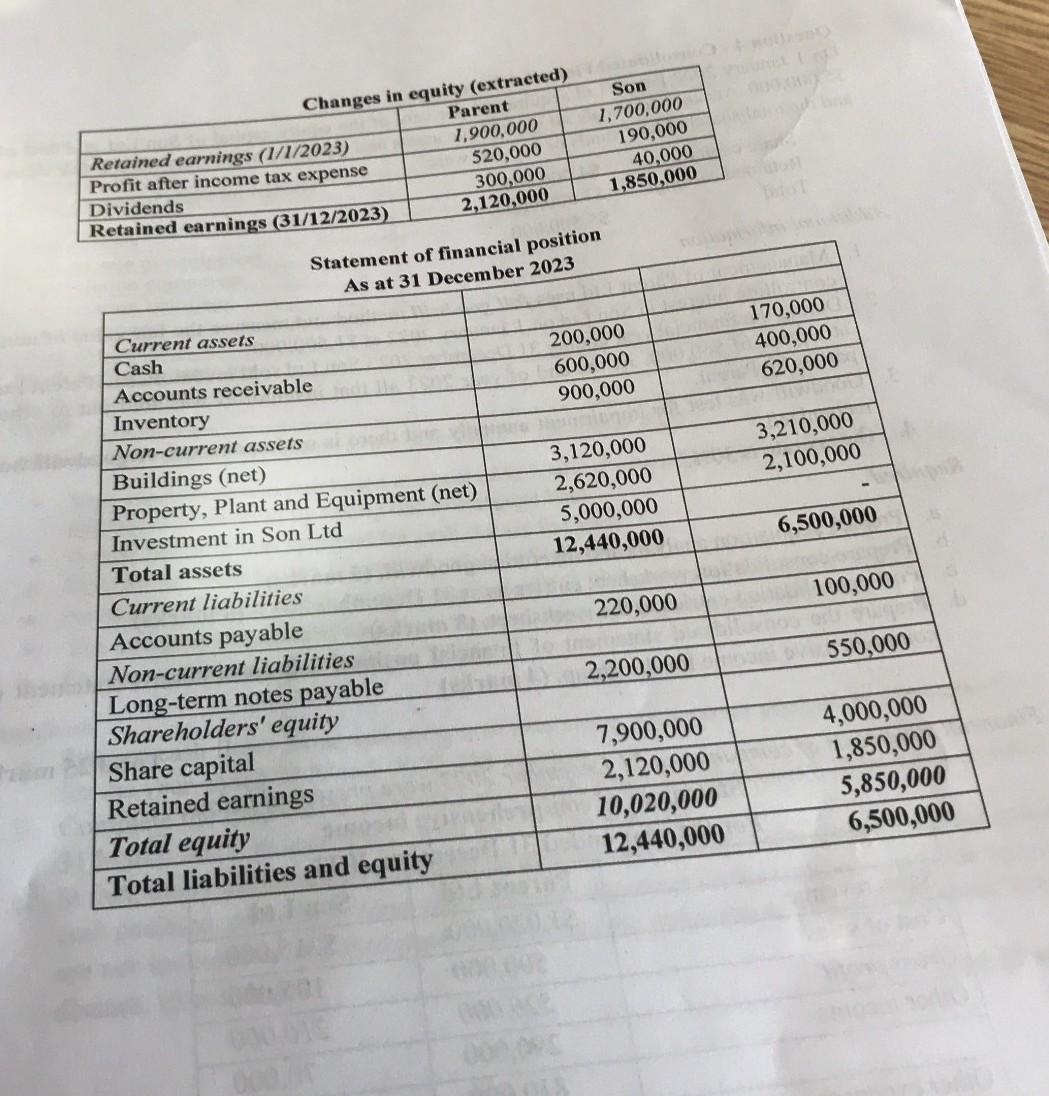

following are financial data of Centauras Ltd on 31 December 2023 2023 Cash at bank Short-term investments Accounts receivable (net) Inventory Prepaid expenses Interest receivable Share investment Land Buildings Accumulated depreciation - buildings Equipment Accumulated depreciation - equipment Liabilities and equity Accounts payable Accrued expenses Interest payable Current tax liability Dividends payable Mortgage loan Debentures (10%) Deferred tax liability Share capital ordinary shares issued at $1 Retained earnings 601 70,000 16,400 46,800 94,200 10,800 1,600 35,600 70,000 360,000 (104,400) 180,000 (57,900) $723,100 120,520 9,780 4,000 13,600 34,800 50,000 180,000 8,600 225,240 76,260 $723,100 2022 42,000 13,600 35,900 96,600 4,200 1.800 67,800 70,000 240,000 (94,500) 154,800 (69,600) $ 562,600 93,960 8.340 3,000 15,000 32,000 150,000 7,800 191,900 60,600 $ 562,600 575 Sales Interest income Dividend income Gain on sale of share investment Cost of sales Loss on sale of equipment Depreciation equipment Depreciation buildings Interest expense Other expenses Profit before income tax Income tax expense Profit Additional information in relation to the year end 31st December 2023 532,000 1,600 10,500 C. 595,050 4,360 7,200 22,600 629,210 9,900 18,400 21,750 594,150 35,060 (14,400) 20,660 New equipment was purchased at a cost of $67,400 of which $17,400 was paid in cash the balance was covered by taking out a mortgage loan A new building was acquired for cash during the year Debentures were issued at nominal value of $100 for cash Share investments with a carrying amount of $32,200 were sold for cash at a profit The company also raised cash from issue of ordinary shares at par value of $1 Company declared a dividend of $5,000 31FF Required a. Prepare cash flows from operating activities using the indirect method for Centauras Ltd for the year ended 31 March 2022. (10 marks) b. Complete the preparation of statement of cash flows for Centauras Ltd for the year ended 31 March 2022, in accordance with IAS 7. (10 marks) In fact, many important and substantial transactions, which, while not affecting the current cash position, potentially have significnt consequences for the cash position of the business, are not included in the statement. This causes the statement to have limited value. Briefly discuss. (5 marks) *** Total 25 marks On 1 January 2022 Parent Ltd acquires 80 per cent of the equity capital of Son Ltd at a cost of $5,000,000. At acquisition date all identifiable assets and liabilities of Son Ltd were at fair value, and the total shareholders' funds of Son Ltd were: Share capital Retained earnings Total Additional information 1. Management of Parent Ltd uses full goodwill method and measure the fair value of non- controlling interest in Son Ltd on 1 January 2022 at $1,500,000. 2. During the financial year ending 31 December 2023 Son Ltd sold inventories to Parent Ltd at a price of $60,000. At the end of year 2023 all that inventories was sold out to other parties by Parent. $4,000,000 $1,500,000 $5,500,000 3. Goodwill was test for impairment annually and there is no impairment of goodwill was recognized. 4. The tax rate is 30%. Required a. Prepare acquisition analysis and determine goodwill. (5 marks) b. Prepare consolidation worksheet entries as at 31 December 2023. (8 marks) c. Post consolidation entries to the worksheet. (8 marks) d. Prepare the consolidated statement of financial position and consolidated statement of comprehensive income for the group. (4 marks) inancial statements of companies at 31 December 2023 were presented below: Statement of comprehensive income For the year ended 31 December 2023 Parent Ltd Sales revenue Cost of sales Gross profit Other income Other expenses Profit before tax Income tax expense Profit after tax $1,020,000 500,000 520,000 290,000 810,000 140,000 670,000 150,000 520,000 Son Ltd $315,000 105,000 210,000 Total 25 marks 70,000 280,000 60,000 220,000 30,000 190,000 Retained earnings (1/1/2023) Profit after income tax expense Dividends Retained earnings (31/12/2023) Current assets Cash Changes in equity (extracted) Accounts receivable Inventory Non-current assets Statement of financial position As at 31 December 2023 Buildings (net) Property, Plant and Equipment (net) Investment in Son Ltd Total assets Current liabilities Accounts payable Non-current liabilities Long-term notes payable Shareholders' equity Share capital Retained earnings 0007 Parent 1,900,000 520,000 300,000 2,120,000 Total equity Total liabilities and equity Son 1,700,000 190,000 40,000 1,850,000 200,000 600,000 900,000 3,120,000 2,620,000 5,000,000 12,440,000 220,000 10-57 2,200,000 7,900,000 2,120,000 10,020,000 12,440,000 170,000 400,000 620,000 3,210,000 2,100,000 6,500,000 100,000 550,000 4,000,000 1,850,000 5,850,000 6,500,000

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Prepare cash flows from operating activities using the indirect method for Centauras Ltd for the year ended 31 December 2023 To calculate the cash flows from operating activities using the indirect ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started