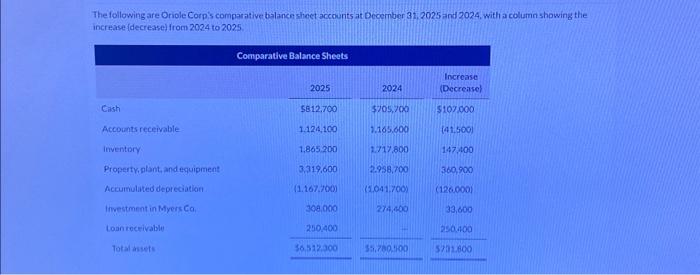

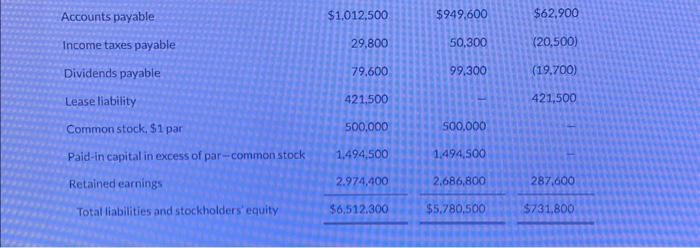

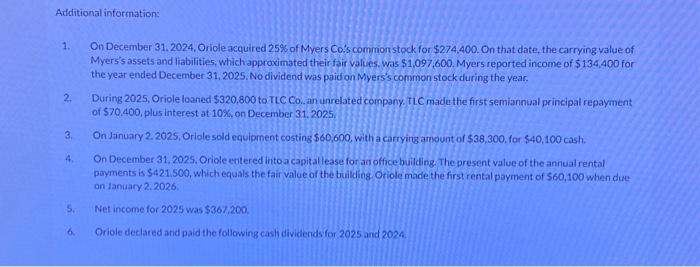

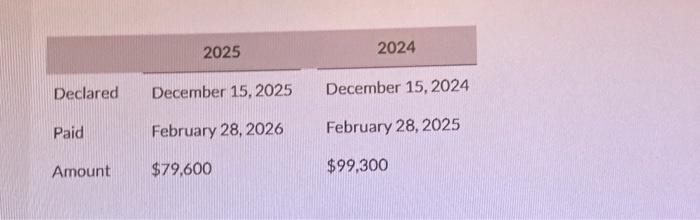

The following are Oriole Corp's comparative balancesheet accounts at December 31,2025 and 2024 , with a column showing the increase (decrease) from 2024 to 2025 \begin{tabular}{|c|c|c|c|} \hline Accounts payable & $1,012,500 & $949,600 & $62,900 \\ \hline Income taxes payable & 29,800 & 50,300 & (20,500) \\ \hline Dividends payable & 79.600 & 99,300 & (19,700) \\ \hline Lease liability & 421,500 & 7 & 421,500 \\ \hline Common stock, \$1 par & 500,000 & 500,000 & \\ \hline Paid-in capital in excess of par-common stock & 1.49,4,500 & 1.494,500 & \\ \hline Retained earnings & 2.974,400 & 2.686,800 & 287,600 \\ \hline Total liabilities and stockholders equity & $6,512.300 & $5.780,500 & $731,800 \\ \hline \end{tabular} 1. On December 31.2024 , Oricle acquired 25% of Myers Co's common stock for $274,400. On that date, the carrying value of Myers's assets and liabilities, which approximated their fair values. was $1,097,600. Myers reported income of $134,400 for the year ended December 31, 2025. No dividend was paid on Myers's common stock during the year. 2. During 2025, Oriole loaned $320,800 to TLC Co. an unrelated company TLC made the first semiannual principal repayment of $70,400, plus interest at 10%, on December 31.2025 . 3. On January 2.2025 , Oriole sold equipment costing $60,600, with a carryirg amount of $38,300, for $40,100 cash. 4. On December 31.2025, Oriole entered into a capital lease for an office building the present value of the annual rental payments is $421.500, which equals the fair value of the building Otiole made the first rental payment of $60,100 when due: on danuary 2.2026. 5. Net income for 2025 was $367,200. 6. Oriole declared and paid the following cash dividends for 2025 and 2024. \begin{tabular}{llll} & \multicolumn{1}{c}{2025} & & 2024 \\ \cline { 2 - 2 } Declared & December 15,2025 & & December 15, 2024 \\ Paid & February 28,2026 & & February 28, 2025 \\ Amount & $79,600 & $99,300 \end{tabular} that decreose cosh flow with either asign es 15,000 or in paren thesis es. (15,000) ) ORTOLE CORP. Statement of Cash Flows $ Adjustments to reconcile net income to