Answered step by step

Verified Expert Solution

Question

1 Approved Answer

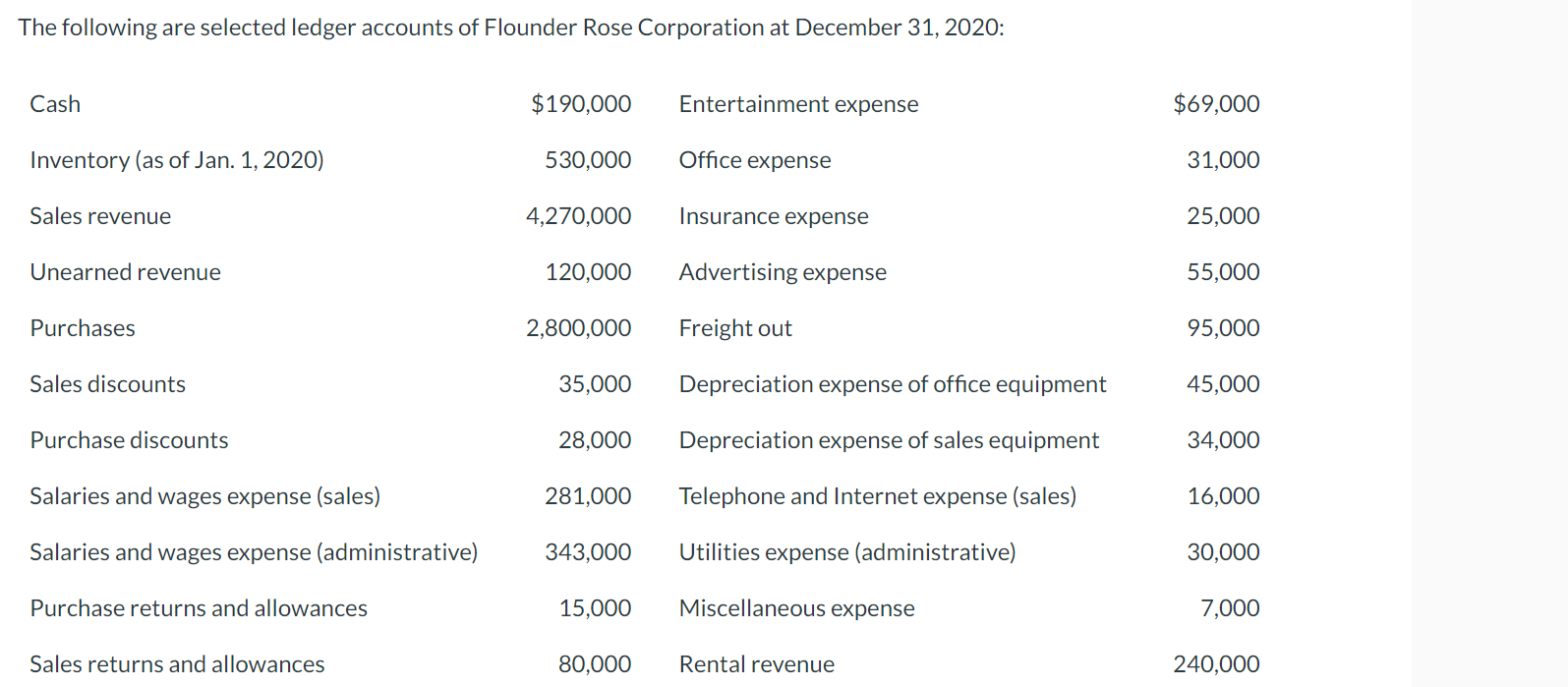

The following are selected ledger accounts of Flounder Rose Corporation at December 31, 2020: Cash $190,000 Entertainment expense $69,000 Inventory (as of Jan. 1,

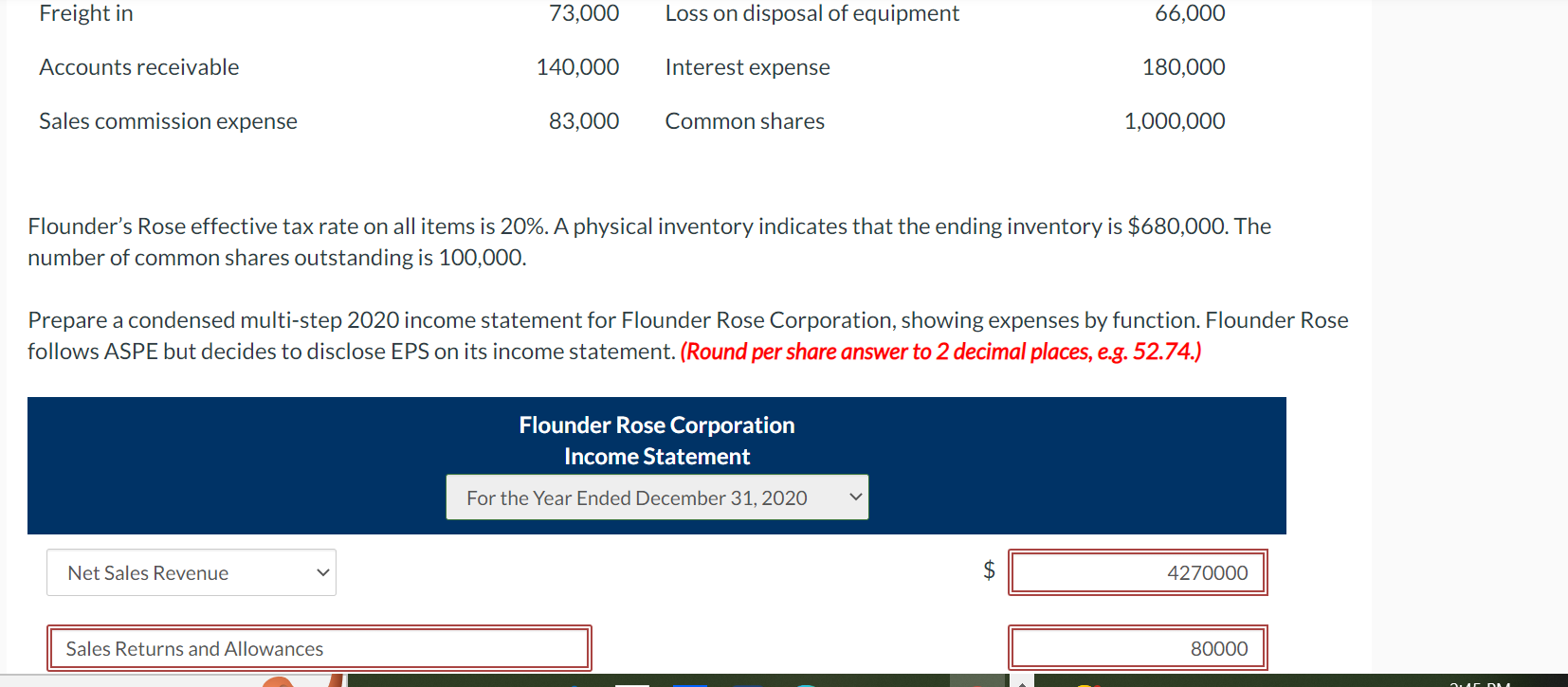

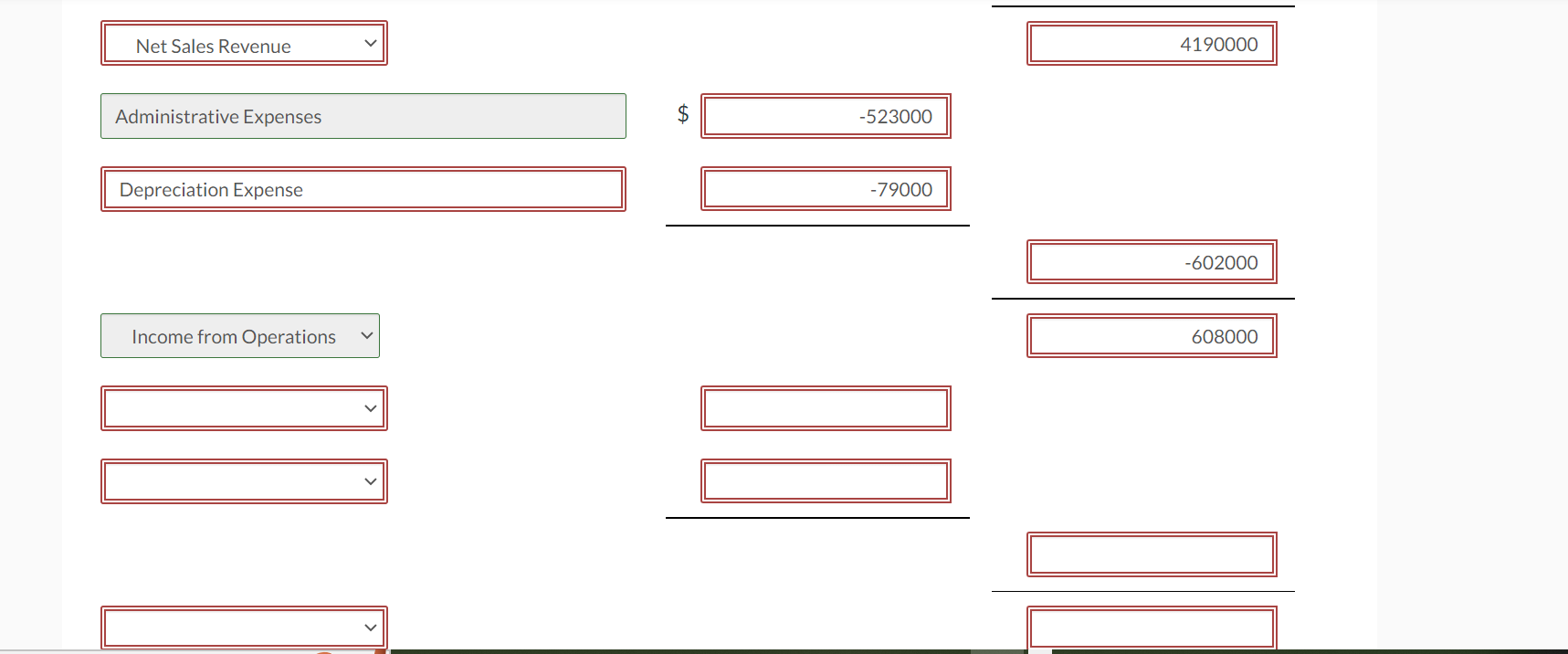

The following are selected ledger accounts of Flounder Rose Corporation at December 31, 2020: Cash $190,000 Entertainment expense $69,000 Inventory (as of Jan. 1, 2020) 530,000 Office expense 31,000 Sales revenue 4,270,000 Insurance expense 25,000 Unearned revenue 120,000 Advertising expense 55,000 Purchases Sales discounts 2,800,000 Freight out 95,000 35,000 Depreciation expense of office equipment 45.000 Purchase discounts 28,000 Depreciation expense of sales equipment 34,000 Salaries and wages expense (sales) 281,000 Telephone and Internet expense (sales) 16,000 Salaries and wages expense (administrative) 343,000 Utilities expense (administrative) 30,000 Purchase returns and allowances 15,000 Miscellaneous expense 7,000 Sales returns and allowances 80,000 Rental revenue 240,000 Freight in Accounts receivable Sales commission expense 73,000 Loss on disposal of equipment 66,000 140,000 Interest expense 180,000 83,000 Common shares 1,000,000 Flounder's Rose effective tax rate on all items is 20%. A physical inventory indicates that the ending inventory is $680,000. The number of common shares outstanding is 100,000. Prepare a condensed multi-step 2020 income statement for Flounder Rose Corporation, showing expenses by function. Flounder Rose follows ASPE but decides to disclose EPS on its income statement. (Round per share answer to 2 decimal places, e.g. 52.74.) Flounder Rose Corporation Income Statement For the Year Ended December 31, 2020 Net Sales Revenue Sales Returns and Allowances +A $ 4270000 80000 QUE DU Net Sales Revenue Administrative Expenses $ Depreciation Expense Income from Operations -523000 -79000 4190000 -602000 608000 eTextbook and Media $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started