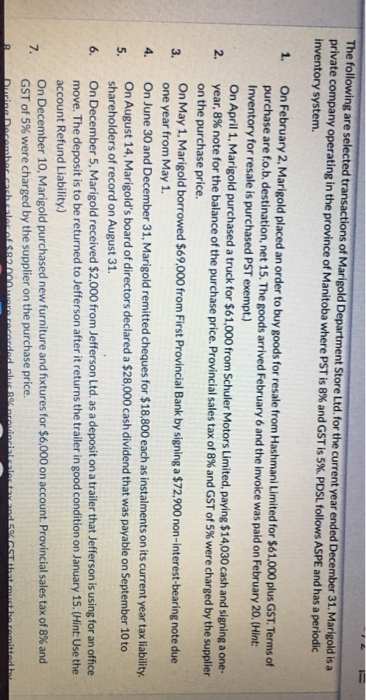

The following are selected transactions of Marigold Department Store Ltd. for the current year ended December 31, Marigold is a private company operating in the province of Manitoba where PST is 8% and GST is 5%. PDSL follows ASPE and has a periodic inventory system. 1. 2. 3. 4. On February 2, Marigold placed an order to buy goods for resale from Hashmani Limited for $61,000 plus GST. Terms of purchase are fo.b.destination, net 15. The goods arrived February 6 and the invoice was paid on February 20. (Hint: Inventory for resale is purchased PST exempt.) On April 1, Marigold purchased a truck for $61,000 from Schuler Motors Limited, paying $14,030 cash and signing a one- year, 8% note for the balance of the purchase price. Provincial sales tax of 8% and GST of 5% were charged by the supplier on the purchase price. On May 1, Marigold borrowed $69,000 from First Provincial Bank by signing a $72,900 non-interest-bearing note due one year from May 1. On June 30 and December 31, Marigold remitted cheques for $18,800 each as instalments on its current year tax liability, On August 14, Marigold's board of directors declared a $28,000 cash dividend that was payable on September 10 to shareholders of record on August 31. On December 5, Marigold received $2,000 from Jefferson Ltd, as a deposit on a trailer that Jefferson is using for an office move. The deposit is to be returned to Jefferson after it returns the trailer in good condition on January 15. (Hint: Use the account Refund Liability.) On December 10, Marigold purchased new furniture and fixtures for $6,000 on account. Provincial sales tax of 8% and GST of 5% were charged by the supplier on the purchase price. During December.cache.of.D.C.Wecorded allevando escobremittel 5. 6. 7. The following are selected transactions of Marigold Department Store Ltd. for the current year ended December 31, Marigold is a private company operating in the province of Manitoba where PST is 8% and GST is 5%. PDSL follows ASPE and has a periodic inventory system. 1. 2. 3. 4. On February 2, Marigold placed an order to buy goods for resale from Hashmani Limited for $61,000 plus GST. Terms of purchase are fo.b.destination, net 15. The goods arrived February 6 and the invoice was paid on February 20. (Hint: Inventory for resale is purchased PST exempt.) On April 1, Marigold purchased a truck for $61,000 from Schuler Motors Limited, paying $14,030 cash and signing a one- year, 8% note for the balance of the purchase price. Provincial sales tax of 8% and GST of 5% were charged by the supplier on the purchase price. On May 1, Marigold borrowed $69,000 from First Provincial Bank by signing a $72,900 non-interest-bearing note due one year from May 1. On June 30 and December 31, Marigold remitted cheques for $18,800 each as instalments on its current year tax liability, On August 14, Marigold's board of directors declared a $28,000 cash dividend that was payable on September 10 to shareholders of record on August 31. On December 5, Marigold received $2,000 from Jefferson Ltd, as a deposit on a trailer that Jefferson is using for an office move. The deposit is to be returned to Jefferson after it returns the trailer in good condition on January 15. (Hint: Use the account Refund Liability.) On December 10, Marigold purchased new furniture and fixtures for $6,000 on account. Provincial sales tax of 8% and GST of 5% were charged by the supplier on the purchase price. During December.cache.of.D.C.Wecorded allevando escobremittel 5. 6. 7