Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following are the 202 transactions of the Midwest Heart Assoclation, which has the following funds and fund balances on January 1, 202: 1. Had

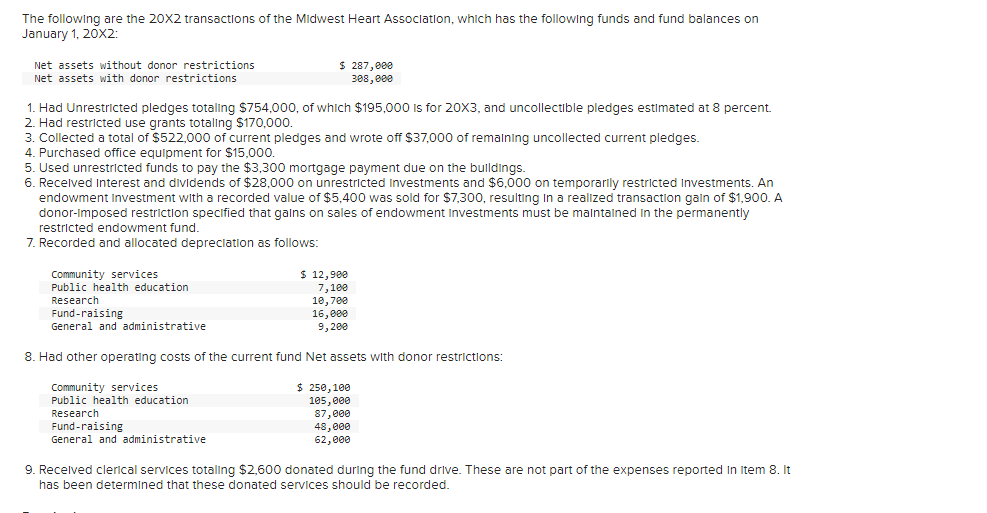

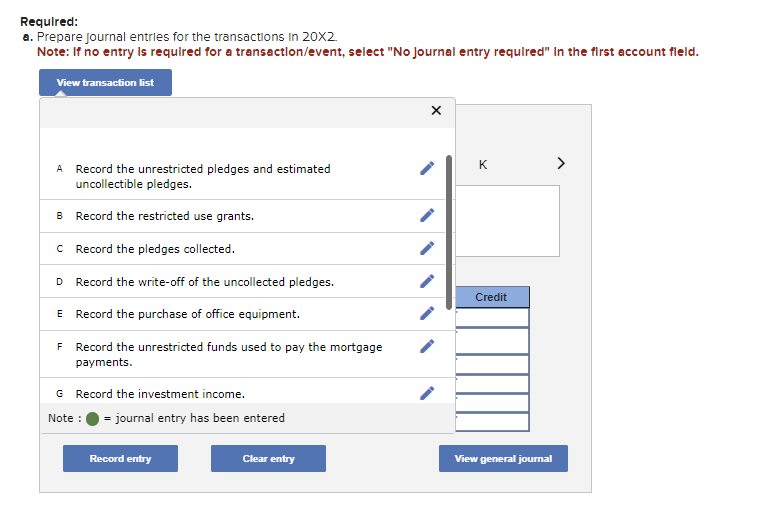

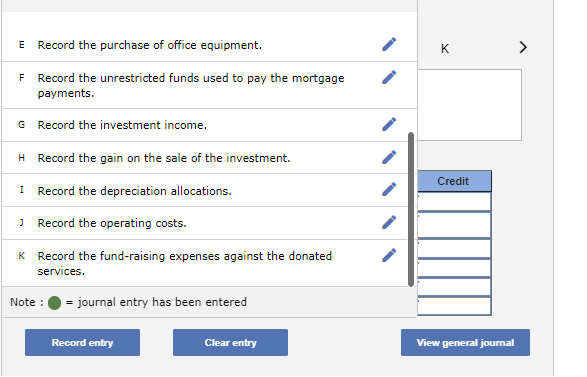

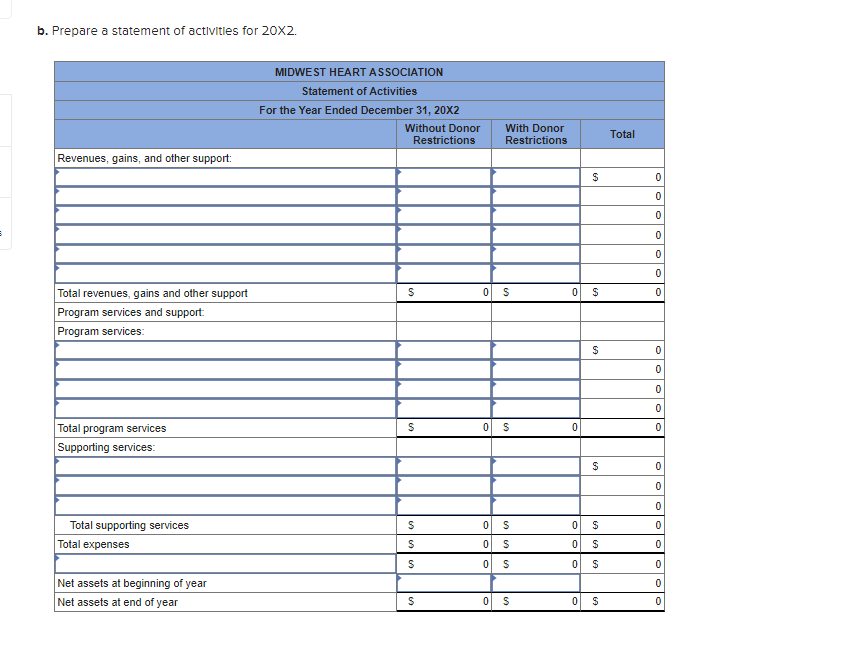

The following are the 202 transactions of the Midwest Heart Assoclation, which has the following funds and fund balances on January 1, 202: 1. Had Unrestricted pledges totaling $754,000, of which $195,000 is for 20X3, and uncollectible pledges estimated at 8 percent. 2. Had restrlcted use grants totaling $170,000. 3. Collected a total of $522,000 of current pledges and wrote off $37,000 of remalning uncollected current pledges. 4. Purchased office equipment for $15,000. 5 . Used unrestrlcted funds to pay the $3,300 mortgage payment due on the bulldings. 6. Recelved Interest and dividends of $28,000 on unrestricted Investments and $6,000 on temporarlly restrlcted Investments. An endowment Investment with a recorded value of $5,400 was sold for $7,300, resulting In a realized transaction galn of $1,900. A donor-Imposed restriction specified that galns on sales of endowment Investments must be maintained in the permanently restricted endowment fund. 7. Recorded and allocated depreclation as follows: 8. Had other operating costs of the current fund Net assets with donor restrictions: 9. Recelved clerical services totaling $2,600 donated during the fund drlve. These are not part of the expenses reported In Item 8 . It has been determined that these donated services should be recorded. Requlred: a. Prepare journal entrles for the transactions in 202. Note: If no entry is required for a transaction/event, select "No journal entry requlred" In the first account fleld. b. Prepare a statement of activitles for 202

The following are the 202 transactions of the Midwest Heart Assoclation, which has the following funds and fund balances on January 1, 202: 1. Had Unrestricted pledges totaling $754,000, of which $195,000 is for 20X3, and uncollectible pledges estimated at 8 percent. 2. Had restrlcted use grants totaling $170,000. 3. Collected a total of $522,000 of current pledges and wrote off $37,000 of remalning uncollected current pledges. 4. Purchased office equipment for $15,000. 5 . Used unrestrlcted funds to pay the $3,300 mortgage payment due on the bulldings. 6. Recelved Interest and dividends of $28,000 on unrestricted Investments and $6,000 on temporarlly restrlcted Investments. An endowment Investment with a recorded value of $5,400 was sold for $7,300, resulting In a realized transaction galn of $1,900. A donor-Imposed restriction specified that galns on sales of endowment Investments must be maintained in the permanently restricted endowment fund. 7. Recorded and allocated depreclation as follows: 8. Had other operating costs of the current fund Net assets with donor restrictions: 9. Recelved clerical services totaling $2,600 donated during the fund drlve. These are not part of the expenses reported In Item 8 . It has been determined that these donated services should be recorded. Requlred: a. Prepare journal entrles for the transactions in 202. Note: If no entry is required for a transaction/event, select "No journal entry requlred" In the first account fleld. b. Prepare a statement of activitles for 202 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started