Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following are the 20X2 transactions of the Midwest Heart Association, which has the following funds and fund balances on January 1, 20X2: Net assets

The following are the 20X2 transactions of the Midwest Heart Association, which has the following funds and fund balances on January 1, 20X2:

| Net assets without donor restrictions | $ | 283,000 | |

| Net assets with donor restrictions | 311,000 | ||

- Had Unrestricted pledges totaling $766,000, of which $195,000 is for 20X3 and uncollectible pledges estimated at 8 percent.

- Had restricted use grants totaling $200,000.

- Collected a total of $536,000 of current pledges and wrote off $35,000 of remaining uncollected current pledges.

- Purchased office equipment for $13,000.

- Used unrestricted funds to pay the $3,500 mortgage payment due on the buildings.

- Received interest and dividends of $28,600 on unrestricted investments and $5,500 on temporarily restricted investments. An endowment investment with a recorded value of $5,400 was sold for $7,100, resulting in a realized transaction gain of $1,700. A donor-imposed restriction specified that gains on sales of endowment investments must be maintained in the permanently restricted endowment fund.

- Recorded and allocated depreciation as follows:

| Community services | $ | 12,100 | |

| Public health education | 7,600 | ||

| Research | 10,100 | ||

| Fund-raising | 15,400 | ||

| General and administrative | 9,600 | ||

- Had other operating costs of the current fund Net assets with donor restrictions:

| Community services | $ | 251,000 | |

| Public health education | 104,500 | ||

| Research | 87,000 | ||

| Fund-raising | 47,000 | ||

| General and administrative | 69,000 | ||

- Received clerical services totaling $2,800 donated during the fund drive. These are not part of the expenses reported in item 8. It has been determined that these donated services should be recorded.

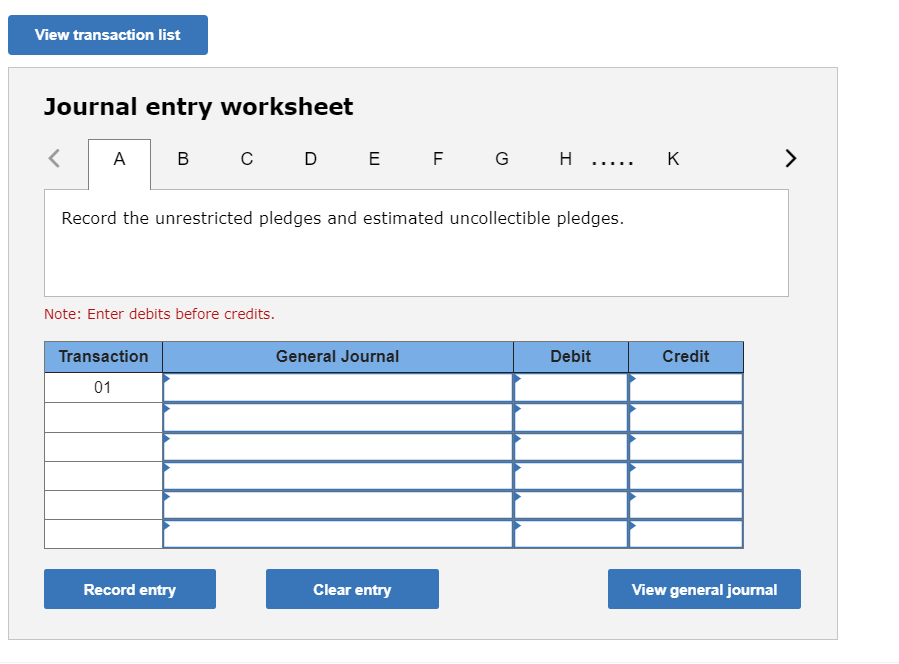

Required: a. Prepare journal entries for the transactions in 20X2. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

- Record the unrestricted pledges and estimated uncollectible pledges.

- Record the restricted use grants.

- Record the pledges collected.

- Record the write-off of the uncollected pledges.

- Record the purchase of office equipment.

- Record the unrestricted funds used to pay the mortgage payments.

- Record the investment income.

- Record the gain on the sale of the investment.

- Record the depreciation allocations.

- Record the operating costs.

- Record the fund-raising expenses against the donated services.

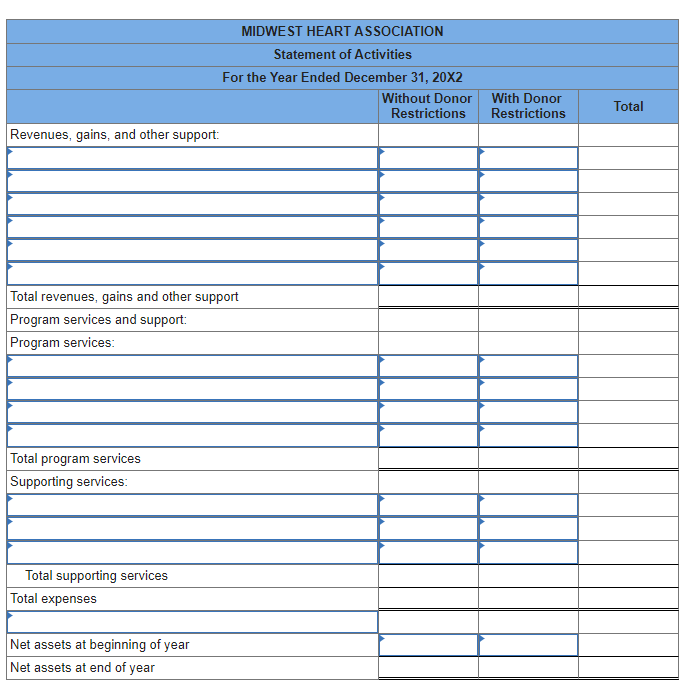

b. Prepare a statement of activities for 20X2.

b. Prepare a statement of activities for 20X2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started