Answered step by step

Verified Expert Solution

Question

1 Approved Answer

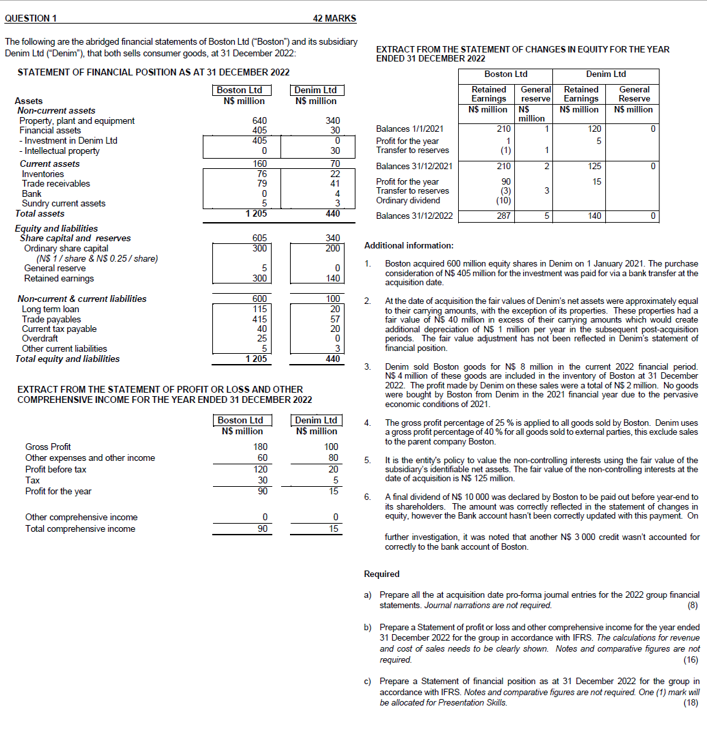

The following are the abridged financial statements of Boston Ltd (Boston) and its subsidiary Denim Lid ('Denim'), that both sells consumer goods, at 31 December

The following are the abridged financial statements of Boston Ltd ("Boston") and its subsidiary Denim Lid ('Denim'), that both sells consumer goods, at 31 December 2022: STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2022 EXTRACT FROM THE STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2022 EXTRACT FROM THE STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 DECEMBER 2022 Balances 1/1/2021 Profin for the year Transfer to reserves Balances 31/12/202 Profit for the year Transfer to reserves Ordinary dividend Balances 31/12/202 Additional information: 1. Boston acquired 600 million equity shares in Denim on 1 January 2021. The purchase consideration of N\$ 405 million for the imvestment was paid for via a bank transfer at the acquisition date. 2. At the date of acquisition the fair values of Denim's net assets were approximately equal to their carrying amounts, with the exception of its properties. These properties had a fair value of NS 40 milion in excess of their carrying amounts which would create additional depreciation of N5 1 million per year in the subsequent post-acquisition periods. The fair value adjustment has not been reflected in Denim's statement of financial position. 3. Denim sold Boston goods for NS 8 million in the current 2022 financial period. NS 4 milion of these goods are included in the inventory of Boston at 31 December 2022. The profit made by Denim on these sales were a total of NS 2 million. No goods were bought by Boston from Denim in the 2021 financial year due to the pervasive economic conditions of 2021. 4. The gross profit percentage of 25% is applied to all goods sold by Boston. Denim uses a gross profit percentage of 40% for all goods sold to external parties, this exclude sales to the parent compary Boston. 5. It is the entity's policy to value the non-controlling interests using the fair value of the subsidiary's identifiable net assets. The fair value of the non-controlling interests at the date of acquisition is NS 125 million. 6. A final dividend of N\$ 10000 was declared by Boston to be paid out before year-end to its shareholders. The amount was correctly reflected in the statement of changes in equity, however the Bank account hasn't been correctly updated with this payment. On further investigation, it was noted that another NS 3000 credit wasn't accounted for correctly to the bank account of Boston. Required a) Prepare all the at acquisition date pro-forma joumal entries for the 2022 group financial statements. Joumal namations are not required. (8) b) Prepare a Statement of profit or loss and other comprehensive income for the year ended 31 December 2022 for the group in accordance with IFRS. The calculations for revenve and cost of sales needs to be clearly shown. Notes and comparative figures are not required. (16) c) Prepare a Statement of financial position as at 31 December 2022 for the group in accordance with IFRS. Notes and comparative figures are not required. One (1) mark will be allocated for Presentation Skills. (18) The following are the abridged financial statements of Boston Ltd ("Boston") and its subsidiary Denim Lid ('Denim'), that both sells consumer goods, at 31 December 2022: STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2022 EXTRACT FROM THE STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2022 EXTRACT FROM THE STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 DECEMBER 2022 Balances 1/1/2021 Profin for the year Transfer to reserves Balances 31/12/202 Profit for the year Transfer to reserves Ordinary dividend Balances 31/12/202 Additional information: 1. Boston acquired 600 million equity shares in Denim on 1 January 2021. The purchase consideration of N\$ 405 million for the imvestment was paid for via a bank transfer at the acquisition date. 2. At the date of acquisition the fair values of Denim's net assets were approximately equal to their carrying amounts, with the exception of its properties. These properties had a fair value of NS 40 milion in excess of their carrying amounts which would create additional depreciation of N5 1 million per year in the subsequent post-acquisition periods. The fair value adjustment has not been reflected in Denim's statement of financial position. 3. Denim sold Boston goods for NS 8 million in the current 2022 financial period. NS 4 milion of these goods are included in the inventory of Boston at 31 December 2022. The profit made by Denim on these sales were a total of NS 2 million. No goods were bought by Boston from Denim in the 2021 financial year due to the pervasive economic conditions of 2021. 4. The gross profit percentage of 25% is applied to all goods sold by Boston. Denim uses a gross profit percentage of 40% for all goods sold to external parties, this exclude sales to the parent compary Boston. 5. It is the entity's policy to value the non-controlling interests using the fair value of the subsidiary's identifiable net assets. The fair value of the non-controlling interests at the date of acquisition is NS 125 million. 6. A final dividend of N\$ 10000 was declared by Boston to be paid out before year-end to its shareholders. The amount was correctly reflected in the statement of changes in equity, however the Bank account hasn't been correctly updated with this payment. On further investigation, it was noted that another NS 3000 credit wasn't accounted for correctly to the bank account of Boston. Required a) Prepare all the at acquisition date pro-forma joumal entries for the 2022 group financial statements. Joumal namations are not required. (8) b) Prepare a Statement of profit or loss and other comprehensive income for the year ended 31 December 2022 for the group in accordance with IFRS. The calculations for revenve and cost of sales needs to be clearly shown. Notes and comparative figures are not required. (16) c) Prepare a Statement of financial position as at 31 December 2022 for the group in accordance with IFRS. Notes and comparative figures are not required. One (1) mark will be allocated for Presentation Skills. (18)

The following are the abridged financial statements of Boston Ltd ("Boston") and its subsidiary Denim Lid ('Denim'), that both sells consumer goods, at 31 December 2022: STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2022 EXTRACT FROM THE STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2022 EXTRACT FROM THE STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 DECEMBER 2022 Balances 1/1/2021 Profin for the year Transfer to reserves Balances 31/12/202 Profit for the year Transfer to reserves Ordinary dividend Balances 31/12/202 Additional information: 1. Boston acquired 600 million equity shares in Denim on 1 January 2021. The purchase consideration of N\$ 405 million for the imvestment was paid for via a bank transfer at the acquisition date. 2. At the date of acquisition the fair values of Denim's net assets were approximately equal to their carrying amounts, with the exception of its properties. These properties had a fair value of NS 40 milion in excess of their carrying amounts which would create additional depreciation of N5 1 million per year in the subsequent post-acquisition periods. The fair value adjustment has not been reflected in Denim's statement of financial position. 3. Denim sold Boston goods for NS 8 million in the current 2022 financial period. NS 4 milion of these goods are included in the inventory of Boston at 31 December 2022. The profit made by Denim on these sales were a total of NS 2 million. No goods were bought by Boston from Denim in the 2021 financial year due to the pervasive economic conditions of 2021. 4. The gross profit percentage of 25% is applied to all goods sold by Boston. Denim uses a gross profit percentage of 40% for all goods sold to external parties, this exclude sales to the parent compary Boston. 5. It is the entity's policy to value the non-controlling interests using the fair value of the subsidiary's identifiable net assets. The fair value of the non-controlling interests at the date of acquisition is NS 125 million. 6. A final dividend of N\$ 10000 was declared by Boston to be paid out before year-end to its shareholders. The amount was correctly reflected in the statement of changes in equity, however the Bank account hasn't been correctly updated with this payment. On further investigation, it was noted that another NS 3000 credit wasn't accounted for correctly to the bank account of Boston. Required a) Prepare all the at acquisition date pro-forma joumal entries for the 2022 group financial statements. Joumal namations are not required. (8) b) Prepare a Statement of profit or loss and other comprehensive income for the year ended 31 December 2022 for the group in accordance with IFRS. The calculations for revenve and cost of sales needs to be clearly shown. Notes and comparative figures are not required. (16) c) Prepare a Statement of financial position as at 31 December 2022 for the group in accordance with IFRS. Notes and comparative figures are not required. One (1) mark will be allocated for Presentation Skills. (18) The following are the abridged financial statements of Boston Ltd ("Boston") and its subsidiary Denim Lid ('Denim'), that both sells consumer goods, at 31 December 2022: STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2022 EXTRACT FROM THE STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2022 EXTRACT FROM THE STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31 DECEMBER 2022 Balances 1/1/2021 Profin for the year Transfer to reserves Balances 31/12/202 Profit for the year Transfer to reserves Ordinary dividend Balances 31/12/202 Additional information: 1. Boston acquired 600 million equity shares in Denim on 1 January 2021. The purchase consideration of N\$ 405 million for the imvestment was paid for via a bank transfer at the acquisition date. 2. At the date of acquisition the fair values of Denim's net assets were approximately equal to their carrying amounts, with the exception of its properties. These properties had a fair value of NS 40 milion in excess of their carrying amounts which would create additional depreciation of N5 1 million per year in the subsequent post-acquisition periods. The fair value adjustment has not been reflected in Denim's statement of financial position. 3. Denim sold Boston goods for NS 8 million in the current 2022 financial period. NS 4 milion of these goods are included in the inventory of Boston at 31 December 2022. The profit made by Denim on these sales were a total of NS 2 million. No goods were bought by Boston from Denim in the 2021 financial year due to the pervasive economic conditions of 2021. 4. The gross profit percentage of 25% is applied to all goods sold by Boston. Denim uses a gross profit percentage of 40% for all goods sold to external parties, this exclude sales to the parent compary Boston. 5. It is the entity's policy to value the non-controlling interests using the fair value of the subsidiary's identifiable net assets. The fair value of the non-controlling interests at the date of acquisition is NS 125 million. 6. A final dividend of N\$ 10000 was declared by Boston to be paid out before year-end to its shareholders. The amount was correctly reflected in the statement of changes in equity, however the Bank account hasn't been correctly updated with this payment. On further investigation, it was noted that another NS 3000 credit wasn't accounted for correctly to the bank account of Boston. Required a) Prepare all the at acquisition date pro-forma joumal entries for the 2022 group financial statements. Joumal namations are not required. (8) b) Prepare a Statement of profit or loss and other comprehensive income for the year ended 31 December 2022 for the group in accordance with IFRS. The calculations for revenve and cost of sales needs to be clearly shown. Notes and comparative figures are not required. (16) c) Prepare a Statement of financial position as at 31 December 2022 for the group in accordance with IFRS. Notes and comparative figures are not required. One (1) mark will be allocated for Presentation Skills. (18) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started