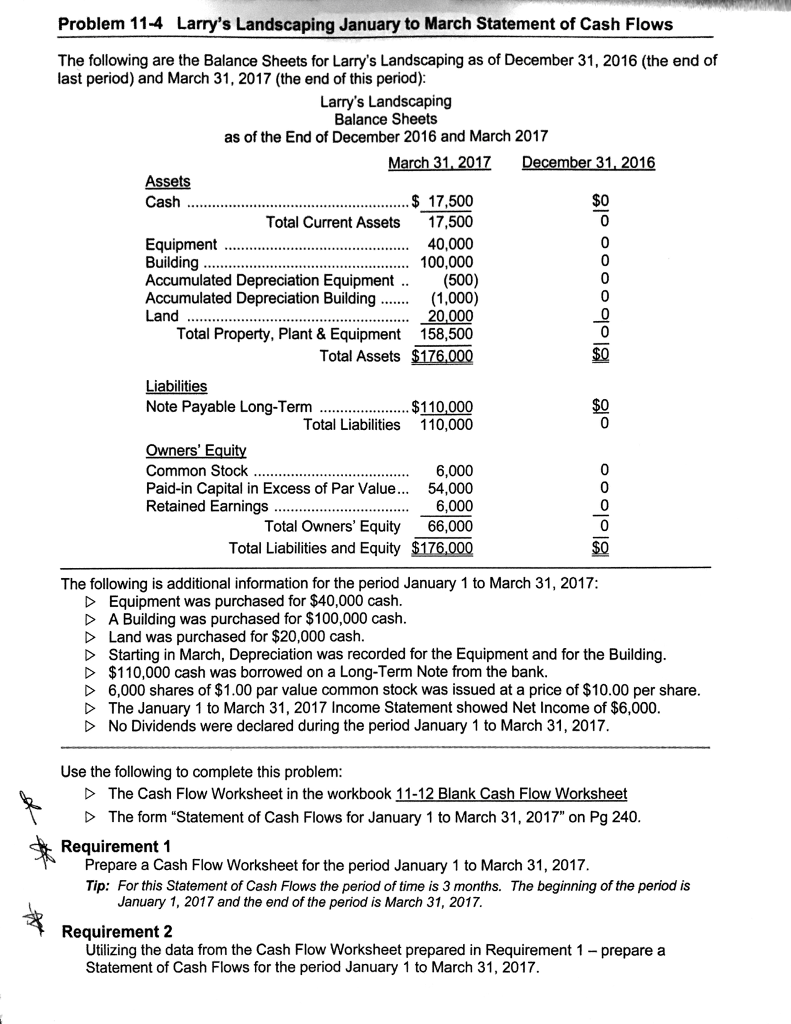

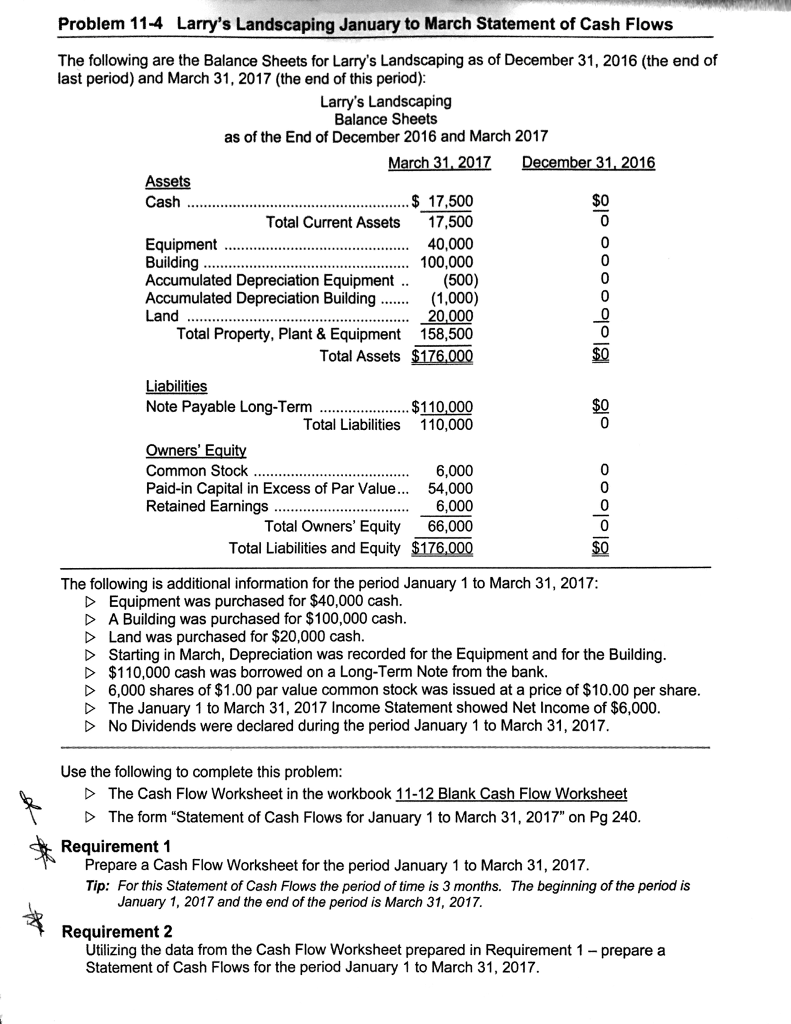

The following are the Balance Sheets for Larry's Landscaping as of December 31, 2016 (the end of last period) and March 31, 2017 (the end of this period): The following is additional information for the period January 1 to March 31, 2017: Equipment was purchased for $40,000 cash. A Building was purchased for $100,000 cash. Land was purchased for $20,000 cash. Starting in March, Depreciation was recorded for the Equipment and for the Building. $110,000 cash was borrowed on a Long-Term Note from the bank. 6,000 shares of $1.00 par value common stock was issued at a price of $10.00 per share. The January 1 to March 31, 2017 Income Statement showed Net Income of $6,000. No Dividends were declared during the period January 1 to March 31, 2017. Use the following to complete this problem: The Cash Flow Worksheet in the workbook 11-12 Blank Cash Flow Worksheet The form "Statement of Cash Flows for January 1 to March 31, 2017" on Pg 240. Requirement 1 Prepare a Cash Flow Worksheet for the period January 1 to March 31, 2017 Requirement 2 Utilizing the data from the Cash Flow Worksheet prepared in Requirement 1 - prepare a Statement of Cash Flows for the period January 1 to March 31, 2017. The following are the Balance Sheets for Larry's Landscaping as of December 31, 2016 (the end of last period) and March 31, 2017 (the end of this period): The following is additional information for the period January 1 to March 31, 2017: Equipment was purchased for $40,000 cash. A Building was purchased for $100,000 cash. Land was purchased for $20,000 cash. Starting in March, Depreciation was recorded for the Equipment and for the Building. $110,000 cash was borrowed on a Long-Term Note from the bank. 6,000 shares of $1.00 par value common stock was issued at a price of $10.00 per share. The January 1 to March 31, 2017 Income Statement showed Net Income of $6,000. No Dividends were declared during the period January 1 to March 31, 2017. Use the following to complete this problem: The Cash Flow Worksheet in the workbook 11-12 Blank Cash Flow Worksheet The form "Statement of Cash Flows for January 1 to March 31, 2017" on Pg 240. Requirement 1 Prepare a Cash Flow Worksheet for the period January 1 to March 31, 2017 Requirement 2 Utilizing the data from the Cash Flow Worksheet prepared in Requirement 1 - prepare a Statement of Cash Flows for the period January 1 to March 31, 2017