Answered step by step

Verified Expert Solution

Question

1 Approved Answer

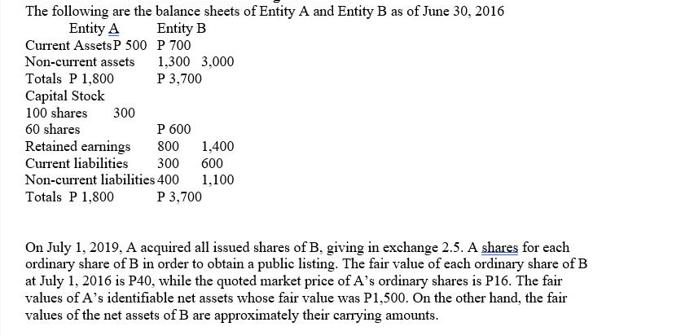

The following are the balance sheets of Entity A and Entity B as of June 30, 2016 Entity B P 700 1,300 3,000 P

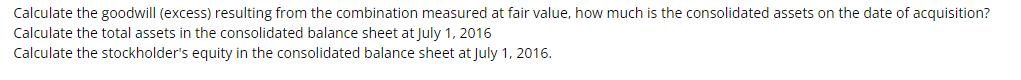

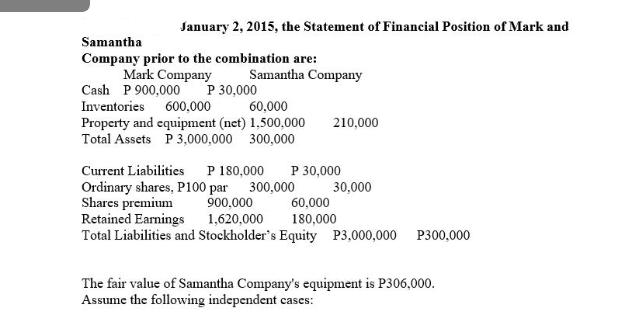

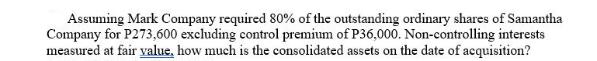

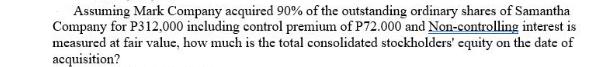

The following are the balance sheets of Entity A and Entity B as of June 30, 2016 Entity B P 700 1,300 3,000 P 3,700 Entity A Current Assets P 500 Non-current assets Totals P 1,800 Capital Stock 100 shares 60 shares 300 P 600 800 1,400 600 300 Non-current liabilities 400 1,100 Totals P 1,800 P 3,700 Retained earnings Current liabilities On July 1, 2019, A acquired all issued shares of B. giving in exchange 2.5. A shares for each ordinary share of B in order to obtain a public listing. The fair value of each ordinary share of B at July 1, 2016 is P40, while the quoted market price of A's ordinary shares is P16. The fair values of A's identifiable net assets whose fair value was P1,500. On the other hand, the fair values of the net assets of B are approximately their carrying amounts. Calculate the goodwill (excess) resulting from the combination measured at fair value, how much is the consolidated assets on the date of acquisition? Calculate the total assets in the consolidated balance sheet at July 1, 2016 Calculate the stockholder's equity in the consolidated balance sheet at July 1, 2016. January 2, 2015, the Statement of Financial Position of Mark and Samantha Company prior to the combination are: Mark Company Cash P 900,000 Samantha Company P 30,000 Inventories 600.000 60,000 Property and equipment (net) 1.500,000 Total Assets P 3,000,000 300,000 210,000 Current Liabilities P 180,000 P 30,000 Ordinary shares, P100 par 300,000 Shares premium 900.000 Retained Earnings 1,620,000 Total Liabilities and Stockholder's Equity P3,000,000 P300,000 30,000 60,000 180,000 The fair value of Samantha Company's equipment is P306,000. Assume the following independent cases: Assuming Mark Company required 80% of the outstanding ordinary shares of Samantha Company for P273,600 excluding control premium of P36,000. Non-controlling interests measured at fair value, how much is the consolidated assets on the date of acquisition? Assuming Mark Company acquired 90% of the outstanding ordinary shares of Samantha Company for P312,000 including control premium of P72.000 and Non-controlling interest is measured at fair value, how much is the total consolidated stockholders' equity on the date of acquisition?

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the goodwill resulting from the combination measured at fair value we need to find the difference between the fair value of Entity Bs identifiable net assets and the consideration ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started