Answered step by step

Verified Expert Solution

Question

1 Approved Answer

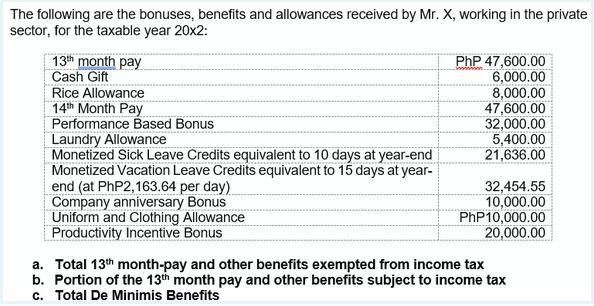

The following are the bonuses, benefits and allowances received by Mr. X, working in the private sector, for the taxable year 20x2: 13th month

The following are the bonuses, benefits and allowances received by Mr. X, working in the private sector, for the taxable year 20x2: 13th month pay Cash Gift Rice Allowance 14th Month Pay Performance Based Bonus Laundry Allowance Monetized Sick Leave Credits equivalent to 10 days at year-end Monetized Vacation Leave Credits equivalent to 15 days at year- end (at PhP2,163.64 per day) Company anniversary Bonus Uniform and Clothing Allowance Productivity Incentive Bonus PhP 47,600.00 6,000.00 8,000.00 47,600.00 32,000.00 5,400.00 21,636.00 32,454.55 10,000.00 PhP 10,000.00 20,000.00 a. Total 13th month-pay and other benefits exempted from income tax b. Portion of the 13th month pay and other benefits subject to income tax c. Total De Minimis Benefits

Step by Step Solution

★★★★★

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the sensitivity of the annual equivalent worth AE of the cash flow to the minimum attractive rate of return MARR we can calculate the AE for each investment alternative at different MAR...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started