Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following are the cash flows of two projects: The owner of a bicycle repair shop forecasts revenues of $ 2 3 2 ,

The following are the cash flows of two projects:

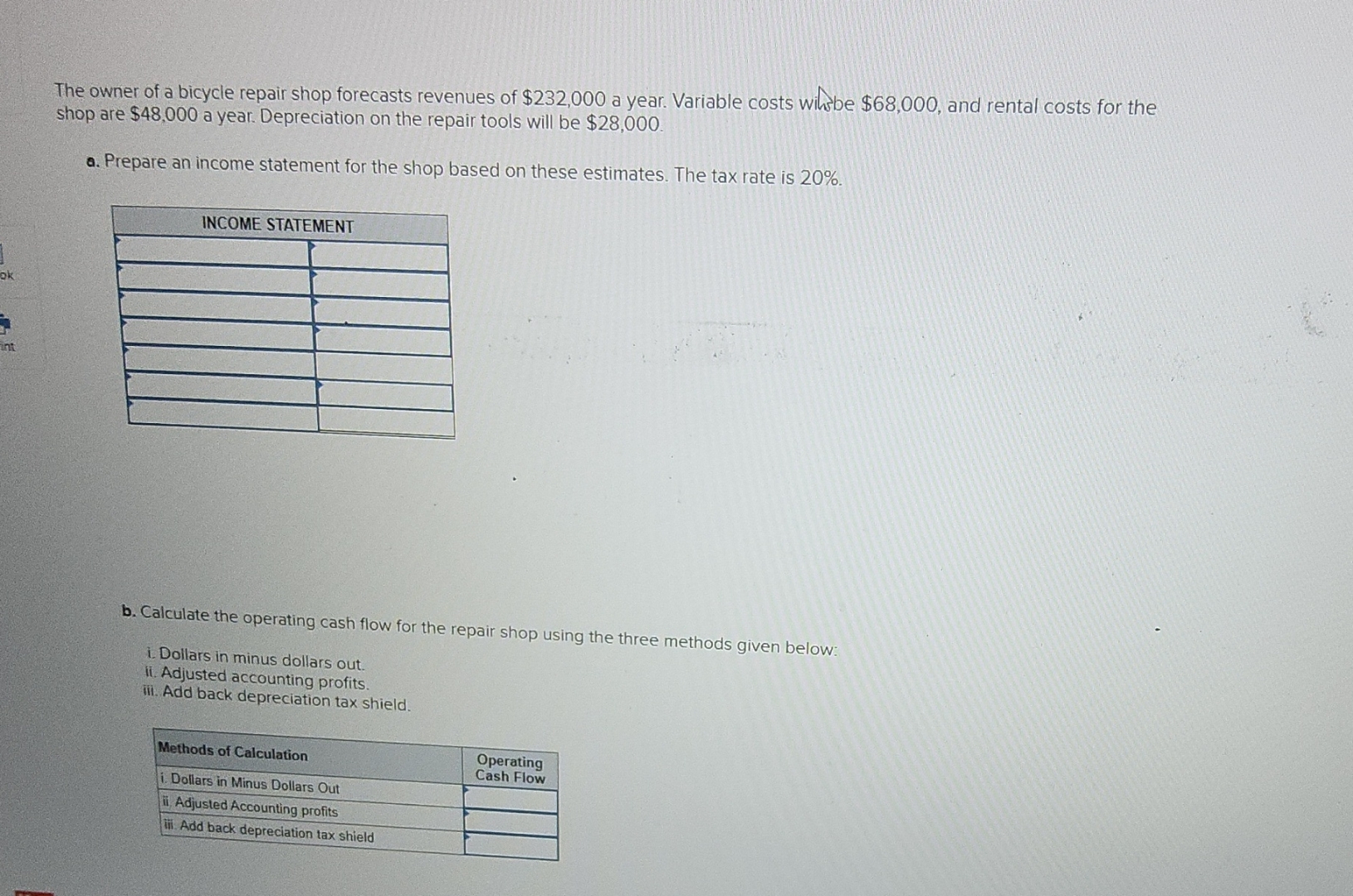

The owner of a bicycle repair shop forecasts revenues of $ a year. Variable costs wihbe $ and rental costs for the shop are $ a year. Depreciation on the repair tools will be $

a Prepare an income statement for the shop based on these estimates. The tax rate is

tableINCOME STATEMENT

b Calculate the operating cash flow for the repair shop using the three methods given below:

i Dollars in minus dollars out.

ii Adjusted accounting profits.

iii. Add back depreciation tax shield.

tableMethods of Calculation,tableOperatingCash Flowi Dollars in Minus Dollars Out,ii Adjusted Accounting profits,iii Add back depreciation tax shield,tableYearProject AProject B$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started