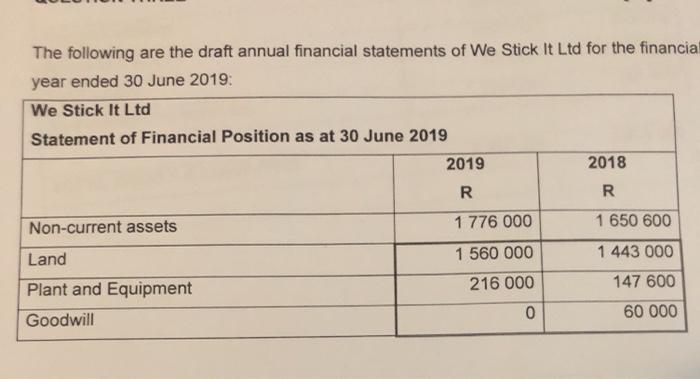

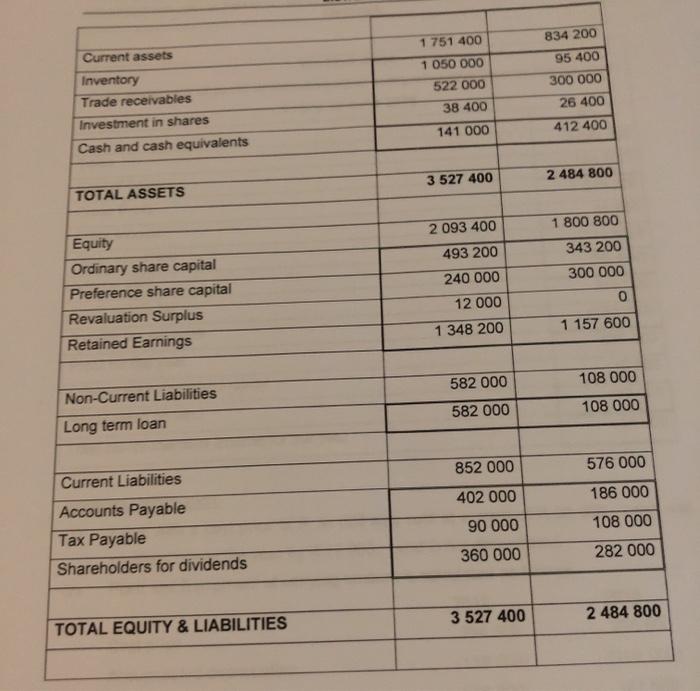

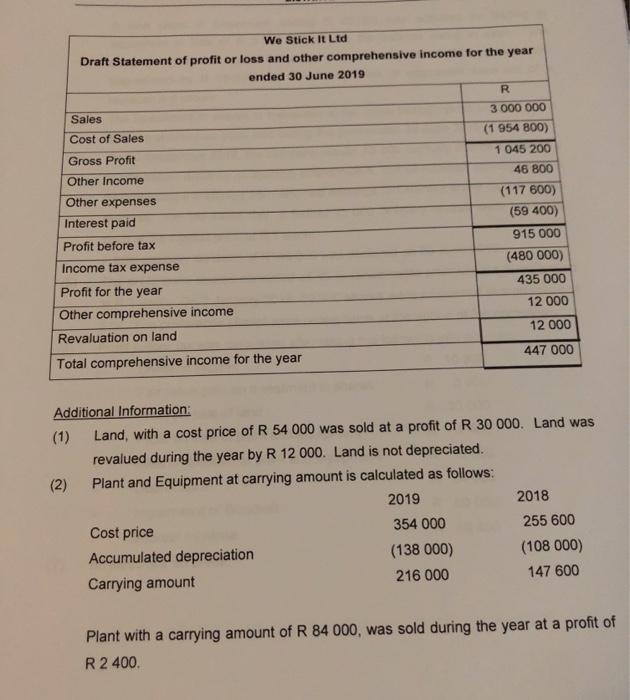

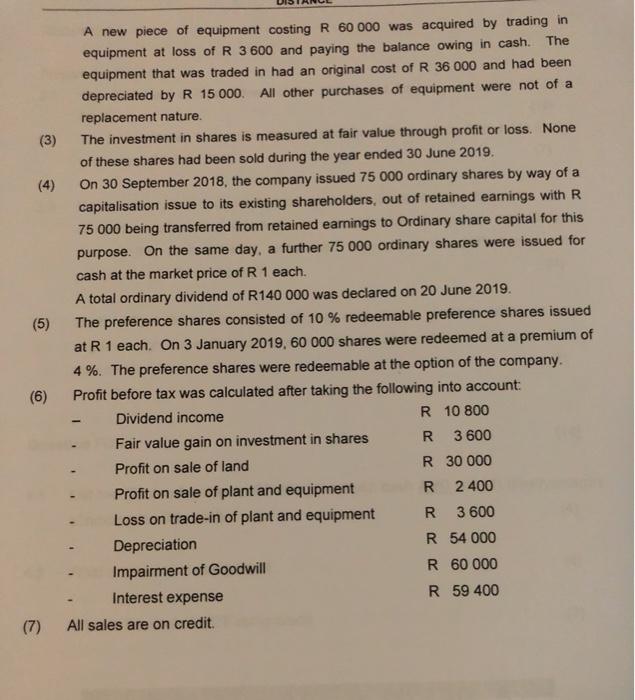

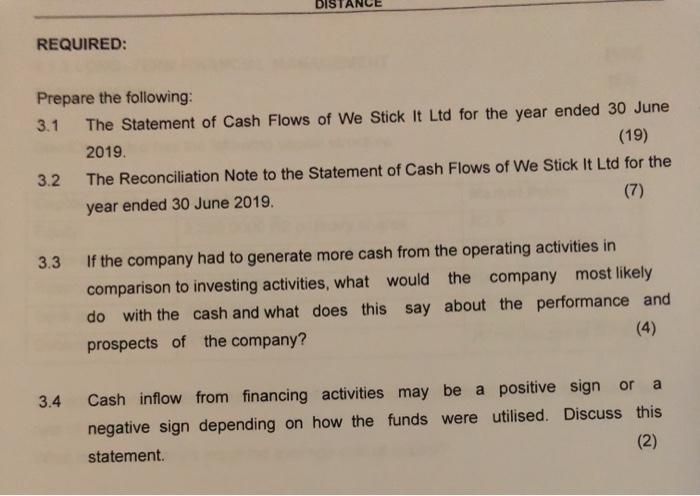

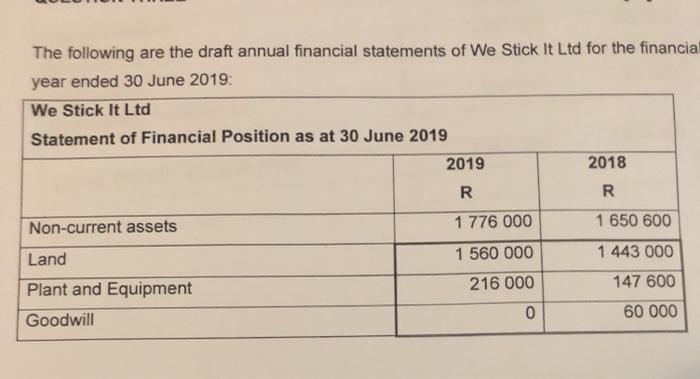

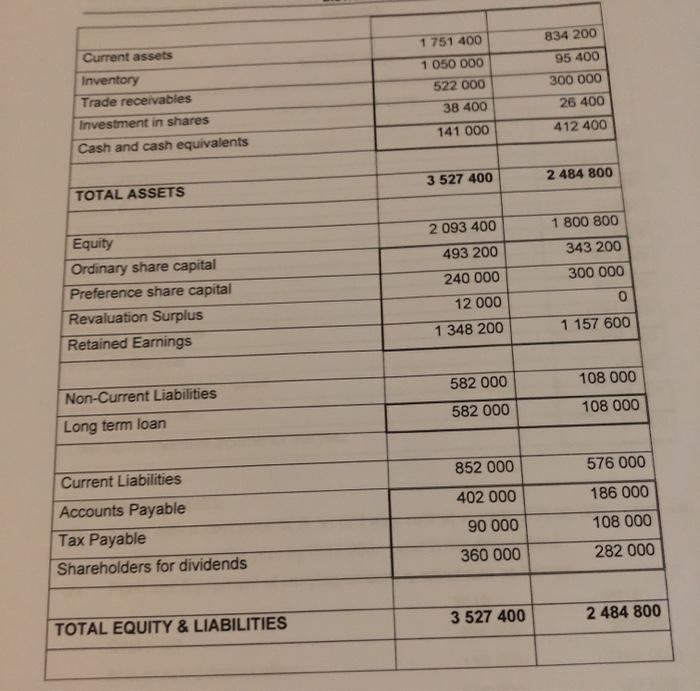

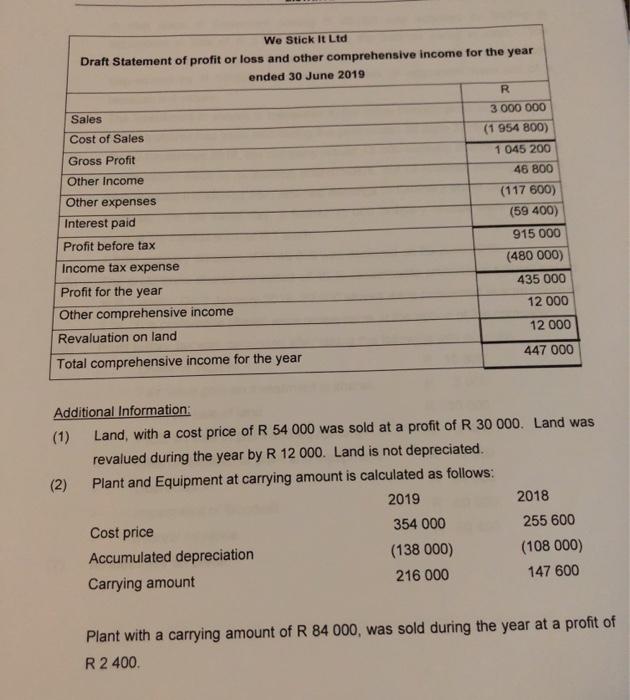

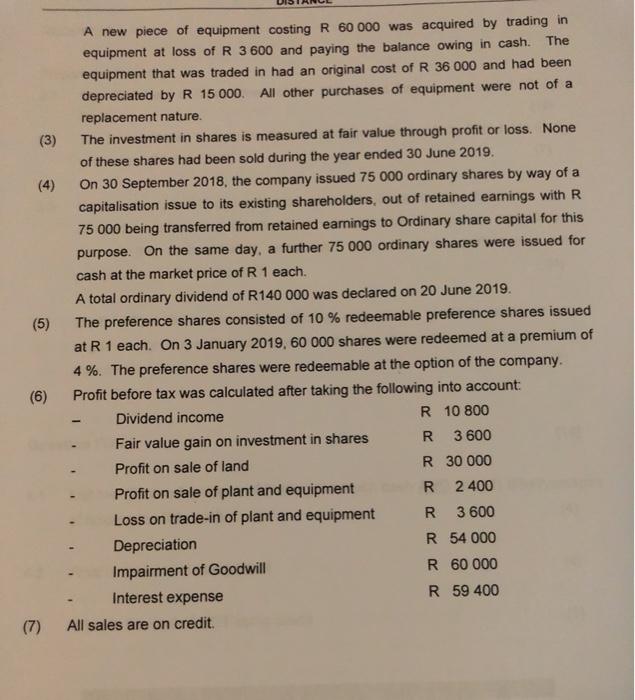

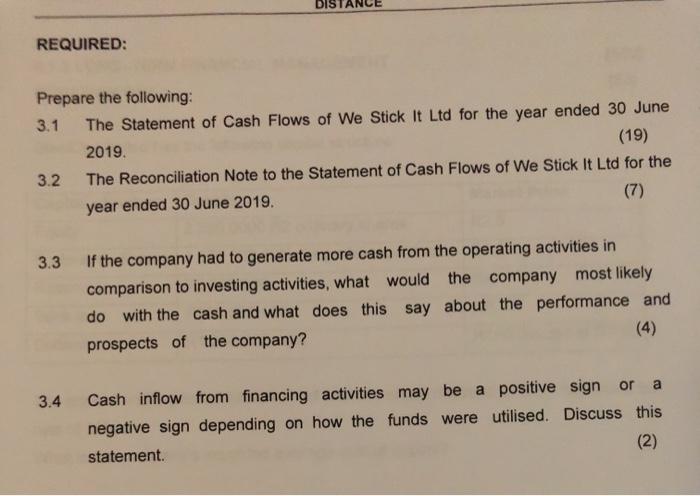

The following are the draft annual financial statements of We Stick It Ltd for the financial year ended 30 June 2019: We Stick It Ltd Statement of Financial Position as at 30 June 2019 2019 2018 R R Non-current assets 1 776 000 1 650 600 Land 1 560 000 1 443 000 216 000 147 600 Plant and Equipment Goodwill 0 60 000 834 200 Current assets Inventory Trade receivables Investment in shares Cash and cash equivalents 1 751 400 1 050 000 522 000 38 400 95 400 300 000 26 400 141 000 412 400 3 527 400 2 484 800 TOTAL ASSETS 2 093 400 1 800 800 343 200 300 000 Equity Ordinary share capital Preference share capital Revaluation Surplus Retained Earnings 493 200 240 000 12 000 1 348 200 0 1 157 600 108 000 Non-Current Liabilities Long term loan 582 000 582 000 108 000 852 000 576 000 Current Liabilities 402 000 186 000 108 000 90 000 Accounts Payable Tax Payable Shareholders for dividends 360 000 282 000 3 527 400 2 484 800 TOTAL EQUITY & LIABILITIES We Stick It Ltd Draft Statement of profit or loss and other comprehensive income for the year ended 30 June 2019 R Sales 3 000 000 Cost of Sales (1 954 800) Gross Profit 1 045 200 Other Income 46 800 Other expenses (117 600) Interest paid (59 400) Profit before tax 915 000 Income tax expense (480 000) Profit for the year 435 000 Other comprehensive income 12 000 Revaluation on land 12 000 Total comprehensive income for the year 447 000 Additional Information: (1) Land, with a cost price of R 54 000 was sold at a profit of R 30 000. Land was revalued during the year by R 12 000. Land is not depreciated. (2) Plant and Equipment at carrying amount is calculated as follows: 2019 2018 Cost price 354 000 255 600 Accumulated depreciation (138 000) (108 000) Carrying amount 216 000 147 600 Plant with a carrying amount of R 84 000, was sold during the year at a profit of R2 400 A new piece of equipment costing R 60 000 was acquired by trading in equipment at loss of R 3 600 and paying the balance owing in cash. The equipment that was traded in had an original cost of R 36 000 and had been depreciated by R 15 000. All other purchases of equipment were not of a replacement nature. (3) The investment in shares is measured at fair value through profit or loss. None of these shares had been sold during the year ended 30 June 2019. On 30 September 2018, the company issued 75 000 ordinary shares by way of a capitalisation issue to its existing shareholders, out of retained earnings with R 75 000 being transferred from retained earnings to Ordinary share capital for this purpose. On the same day, a further 75 000 ordinary shares were issued for cash at the market price of R 1 each. A total ordinary dividend of R140 000 was declared on 20 June 2019. (5) The preference shares consisted of 10 % redeemable preference shares issued at R 1 each. On 3 January 2019. 60 000 shares were redeemed at a premium of 4 %. The preference shares were redeemable at the option of the company. (6) Profit before tax was calculated after taking the following into account: Dividend income R10 800 Fair value gain on investment in shares R 3 600 Profit on sale of land R30 000 Profit on sale of plant and equipment R2 400 Loss on trade-in of plant and equipment R 3 600 Depreciation R 54 000 Impairment of Goodwill R60 000 Interest expense R 59 400 All sales are on credit. DIS REQUIRED: Prepare the following: 3.1 The Statement of Cash Flows of We Stick It Ltd for the year ended 30 June 2019 (19) The Reconciliation Note to the Statement of Cash Flows of We Stick It Ltd for the year ended 30 June 2019. (7) 3.2 3.3 If the company had to generate more cash from the operating activities in comparison to investing activities, what would the company most likely do with the cash and what does this say about the performance and prospects of the company? 3.4 Cash inflow from financing activities may be a positive sign or a negative sign depending on how the funds were utilised. Discuss this statement (2) The following are the draft annual financial statements of We Stick It Ltd for the financial year ended 30 June 2019: We Stick It Ltd Statement of Financial Position as at 30 June 2019 2019 2018 R R Non-current assets 1 776 000 1 650 600 Land 1 560 000 1 443 000 216 000 147 600 Plant and Equipment Goodwill 0 60 000 834 200 Current assets Inventory Trade receivables Investment in shares Cash and cash equivalents 1 751 400 1 050 000 522 000 38 400 95 400 300 000 26 400 412 400 141 000 3 527 400 2 484 800 TOTAL ASSETS 2 093 400 1 800 800 Equity Ordinary share capital Preference share capital Revaluation Surplus Retained Earnings 493 200 240 000 12 000 343 200 300 000 0 1 348 200 1 157 600 582 000 108 000 Non-Current Liabilities Long term loan 582 000 108 000 852 000 576 000 Current Liabilities 402 000 90 000 186 000 108 000 Accounts Payable Tax Payable Shareholders for dividends 360 000 282 000 3 527 400 2 484 800 TOTAL EQUITY & LIABILITIES We Stick It Ltd Draft Statement of profit or loss and other comprehensive income for the year ended 30 June 2019 R Sales 3 000 000 Cost of Sales (1 954 800) Gross Profit 1 045 200 Other Income 46 800 Other expenses (117 600) Interest paid (59 400) Profit before tax 915 000 Income tax expense (480 000) Profit for the year 435 000 Other comprehensive income 12 000 Revaluation on land 12 000 Total comprehensive income for the year 447 000 Additional Information: (1) Land, with a cost price of R 54 000 was sold at a profit of R 30 000. Land was revalued during the year by R 12 000. Land is not depreciated. (2) Plant and Equipment at carrying amount is calculated as follows: 2019 2018 Cost price 354 000 255 600 Accumulated depreciation (138 000) (108 000) Carrying amount 216 000 147 600 Plant with a carrying amount of R 84 000, was sold during the year at a profit of R2 400 A new piece of equipment costing R 60 000 was acquired by trading in equipment at loss of R 3 600 and paying the balance owing in cash. The equipment that was traded in had an original cost of R 36 000 and had been depreciated by R 15 000 All other purchases of equipment were not of a replacement nature. (3) The investment in shares is measured at fair value through profit or loss. None of these shares had been sold during the year ended 30 June 2019. On 30 September 2018, the company issued 75 000 ordinary shares by way of a capitalisation issue to its existing shareholders, out of retained earnings with R 75 000 being transferred from retained earnings to Ordinary share capital for this purpose. On the same day, a further 75 000 ordinary shares were issued for cash at the market price of R 1 each. A total ordinary dividend of R140 000 was declared on 20 June 2019. (5) The preference shares consisted of 10 % redeemable preference shares issued at R 1 each. On 3 January 2019,60 000 shares were redeemed at a premium of 4 %. The preference shares were redeemable at the option of the company. (6) Profit before tax was calculated after taking the following into account: Dividend income R10 800 Fair value gain on investment in shares R 3 600 Profit on sale of land R30 000 Profit on sale of plant and equipment R2 400 Loss on trade-in of plant and equipment R 3 600 Depreciation R 54 000 Impairment of Goodwill R60 000 Interest expense R 59 400 All sales are on credit. DIS REQUIRED: Prepare the following: 3.1 The Statement of Cash Flows of We Stick It Ltd for the year ended 30 June 2019. (19) 3.2 The Reconciliation Note to the Statement of Cash Flows of We Stick It Ltd for the (7) year ended 30 June 2019. 3.3 If the company had to generate more cash from the operating activities in comparison to investing activities, what would the company most likely do with the cash and what does this say about the performance and prospects of the company? 3.4 Cash inflow from financing activities may be a positive sign or a negative sign depending on how the funds were utilised. Discuss this statement (2) The following are the draft annual financial statements of We Stick It Ltd for the financial year ended 30 June 2019: We Stick It Ltd Statement of Financial Position as at 30 June 2019 2019 2018 R R Non-current assets 1 776 000 1 650 600 Land 1 560 000 1 443 000 216 000 147 600 Plant and Equipment Goodwill 0 60 000 834 200 Current assets Inventory Trade receivables Investment in shares Cash and cash equivalents 1 751 400 1 050 000 522 000 38 400 95 400 300 000 26 400 141 000 412 400 3 527 400 2 484 800 TOTAL ASSETS 2 093 400 1 800 800 343 200 300 000 Equity Ordinary share capital Preference share capital Revaluation Surplus Retained Earnings 493 200 240 000 12 000 1 348 200 0 1 157 600 108 000 Non-Current Liabilities Long term loan 582 000 582 000 108 000 852 000 576 000 Current Liabilities 402 000 186 000 108 000 90 000 Accounts Payable Tax Payable Shareholders for dividends 360 000 282 000 3 527 400 2 484 800 TOTAL EQUITY & LIABILITIES We Stick It Ltd Draft Statement of profit or loss and other comprehensive income for the year ended 30 June 2019 R Sales 3 000 000 Cost of Sales (1 954 800) Gross Profit 1 045 200 Other Income 46 800 Other expenses (117 600) Interest paid (59 400) Profit before tax 915 000 Income tax expense (480 000) Profit for the year 435 000 Other comprehensive income 12 000 Revaluation on land 12 000 Total comprehensive income for the year 447 000 Additional Information: (1) Land, with a cost price of R 54 000 was sold at a profit of R 30 000. Land was revalued during the year by R 12 000. Land is not depreciated. (2) Plant and Equipment at carrying amount is calculated as follows: 2019 2018 Cost price 354 000 255 600 Accumulated depreciation (138 000) (108 000) Carrying amount 216 000 147 600 Plant with a carrying amount of R 84 000, was sold during the year at a profit of R2 400 A new piece of equipment costing R 60 000 was acquired by trading in equipment at loss of R 3 600 and paying the balance owing in cash. The equipment that was traded in had an original cost of R 36 000 and had been depreciated by R 15 000. All other purchases of equipment were not of a replacement nature. (3) The investment in shares is measured at fair value through profit or loss. None of these shares had been sold during the year ended 30 June 2019. On 30 September 2018, the company issued 75 000 ordinary shares by way of a capitalisation issue to its existing shareholders, out of retained earnings with R 75 000 being transferred from retained earnings to Ordinary share capital for this purpose. On the same day, a further 75 000 ordinary shares were issued for cash at the market price of R 1 each. A total ordinary dividend of R140 000 was declared on 20 June 2019. (5) The preference shares consisted of 10 % redeemable preference shares issued at R 1 each. On 3 January 2019. 60 000 shares were redeemed at a premium of 4 %. The preference shares were redeemable at the option of the company. (6) Profit before tax was calculated after taking the following into account: Dividend income R10 800 Fair value gain on investment in shares R 3 600 Profit on sale of land R30 000 Profit on sale of plant and equipment R2 400 Loss on trade-in of plant and equipment R 3 600 Depreciation R 54 000 Impairment of Goodwill R60 000 Interest expense R 59 400 All sales are on credit. DIS REQUIRED: Prepare the following: 3.1 The Statement of Cash Flows of We Stick It Ltd for the year ended 30 June 2019 (19) The Reconciliation Note to the Statement of Cash Flows of We Stick It Ltd for the year ended 30 June 2019. (7) 3.2 3.3 If the company had to generate more cash from the operating activities in comparison to investing activities, what would the company most likely do with the cash and what does this say about the performance and prospects of the company? 3.4 Cash inflow from financing activities may be a positive sign or a negative sign depending on how the funds were utilised. Discuss this statement (2) The following are the draft annual financial statements of We Stick It Ltd for the financial year ended 30 June 2019: We Stick It Ltd Statement of Financial Position as at 30 June 2019 2019 2018 R R Non-current assets 1 776 000 1 650 600 Land 1 560 000 1 443 000 216 000 147 600 Plant and Equipment Goodwill 0 60 000 834 200 Current assets Inventory Trade receivables Investment in shares Cash and cash equivalents 1 751 400 1 050 000 522 000 38 400 95 400 300 000 26 400 412 400 141 000 3 527 400 2 484 800 TOTAL ASSETS 2 093 400 1 800 800 Equity Ordinary share capital Preference share capital Revaluation Surplus Retained Earnings 493 200 240 000 12 000 343 200 300 000 0 1 348 200 1 157 600 582 000 108 000 Non-Current Liabilities Long term loan 582 000 108 000 852 000 576 000 Current Liabilities 402 000 90 000 186 000 108 000 Accounts Payable Tax Payable Shareholders for dividends 360 000 282 000 3 527 400 2 484 800 TOTAL EQUITY & LIABILITIES We Stick It Ltd Draft Statement of profit or loss and other comprehensive income for the year ended 30 June 2019 R Sales 3 000 000 Cost of Sales (1 954 800) Gross Profit 1 045 200 Other Income 46 800 Other expenses (117 600) Interest paid (59 400) Profit before tax 915 000 Income tax expense (480 000) Profit for the year 435 000 Other comprehensive income 12 000 Revaluation on land 12 000 Total comprehensive income for the year 447 000 Additional Information: (1) Land, with a cost price of R 54 000 was sold at a profit of R 30 000. Land was revalued during the year by R 12 000. Land is not depreciated. (2) Plant and Equipment at carrying amount is calculated as follows: 2019 2018 Cost price 354 000 255 600 Accumulated depreciation (138 000) (108 000) Carrying amount 216 000 147 600 Plant with a carrying amount of R 84 000, was sold during the year at a profit of R2 400 A new piece of equipment costing R 60 000 was acquired by trading in equipment at loss of R 3 600 and paying the balance owing in cash. The equipment that was traded in had an original cost of R 36 000 and had been depreciated by R 15 000 All other purchases of equipment were not of a replacement nature. (3) The investment in shares is measured at fair value through profit or loss. None of these shares had been sold during the year ended 30 June 2019. On 30 September 2018, the company issued 75 000 ordinary shares by way of a capitalisation issue to its existing shareholders, out of retained earnings with R 75 000 being transferred from retained earnings to Ordinary share capital for this purpose. On the same day, a further 75 000 ordinary shares were issued for cash at the market price of R 1 each. A total ordinary dividend of R140 000 was declared on 20 June 2019. (5) The preference shares consisted of 10 % redeemable preference shares issued at R 1 each. On 3 January 2019,60 000 shares were redeemed at a premium of 4 %. The preference shares were redeemable at the option of the company. (6) Profit before tax was calculated after taking the following into account: Dividend income R10 800 Fair value gain on investment in shares R 3 600 Profit on sale of land R30 000 Profit on sale of plant and equipment R2 400 Loss on trade-in of plant and equipment R 3 600 Depreciation R 54 000 Impairment of Goodwill R60 000 Interest expense R 59 400 All sales are on credit. DIS REQUIRED: Prepare the following: 3.1 The Statement of Cash Flows of We Stick It Ltd for the year ended 30 June 2019. (19) 3.2 The Reconciliation Note to the Statement of Cash Flows of We Stick It Ltd for the (7) year ended 30 June 2019. 3.3 If the company had to generate more cash from the operating activities in comparison to investing activities, what would the company most likely do with the cash and what does this say about the performance and prospects of the company? 3.4 Cash inflow from financing activities may be a positive sign or a negative sign depending on how the funds were utilised. Discuss this statement (2)