Answered step by step

Verified Expert Solution

Question

1 Approved Answer

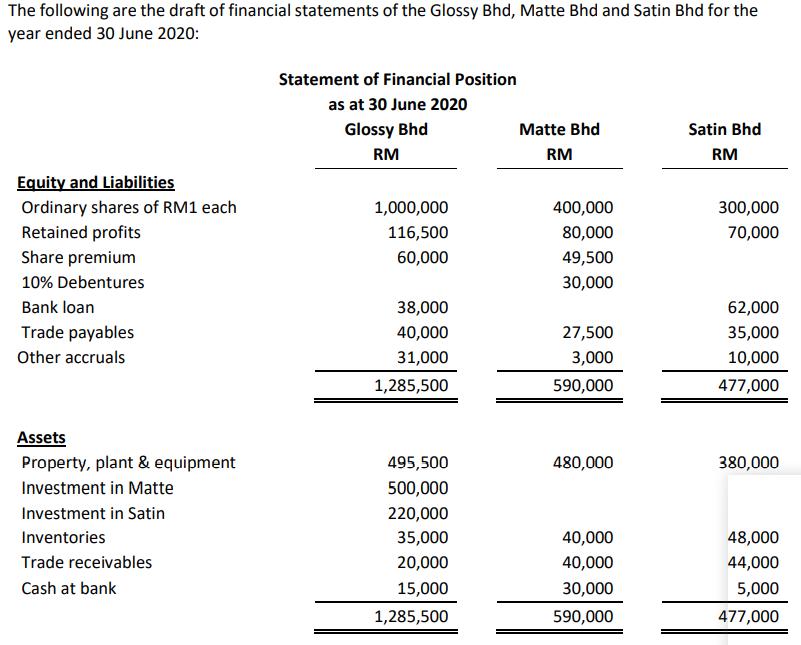

The following are the draft of financial statements of the Glossy Bhd, Matte Bhd and Satin Bhd for the year ended 30 June 202 The

The following are the draft of financial statements of the Glossy Bhd, Matte Bhd and Satin Bhd for the year ended 30 June 202

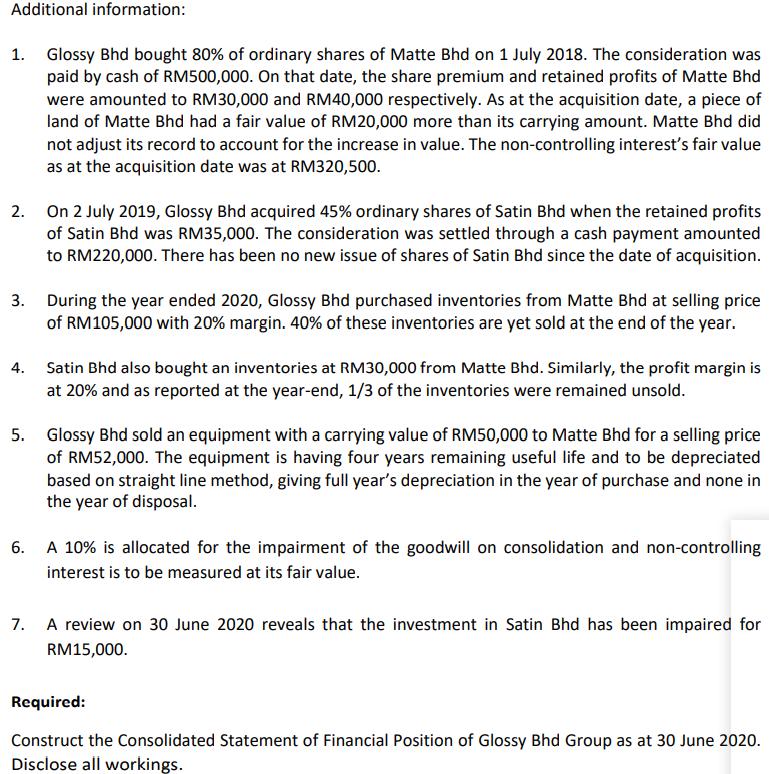

The following are the draft of financial statements of the Glossy Bhd, Matte Bhd and Satin Bhd for the year ended 30 June 2020: Statement of Financial Position as at 30 June 2020 Glossy Bhd Matte Bhd Satin Bhd RM RM RM Equity and Liabilities Ordinary shares of RM1 each 1,000,000 400,000 300,000 Retained profits Share premium 116,500 80,000 70,000 60,000 49,500 10% Debentures 30,000 Bank loan 38,000 62,000 Trade payables 40,000 27,500 35,000 Other accruals 31,000 3,000 10,000 1,285,500 590,000 477,000 Assets Property, plant & equipment 495,500 480,000 380,000 Investment in Matte 500,000 Investment in Satin 220,000 Inventories 35,000 40,000 48,000 Trade receivables 20,000 40,000 44,000 Cash at bank 15,000 30,000 5,000 1,285,500 590,000 477,000

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Matte Bhd Satin Bhd Total no of shares No of Shares acquired by Glossy Bhd Date of Acquisition Per...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started