Answered step by step

Verified Expert Solution

Question

1 Approved Answer

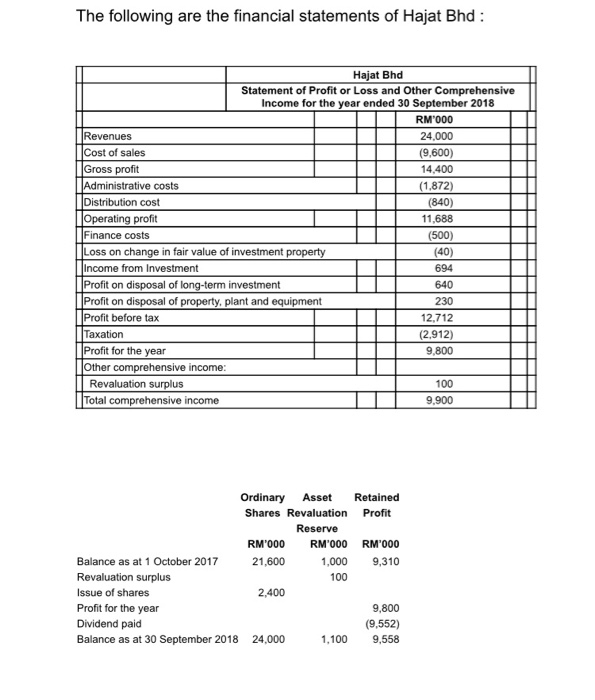

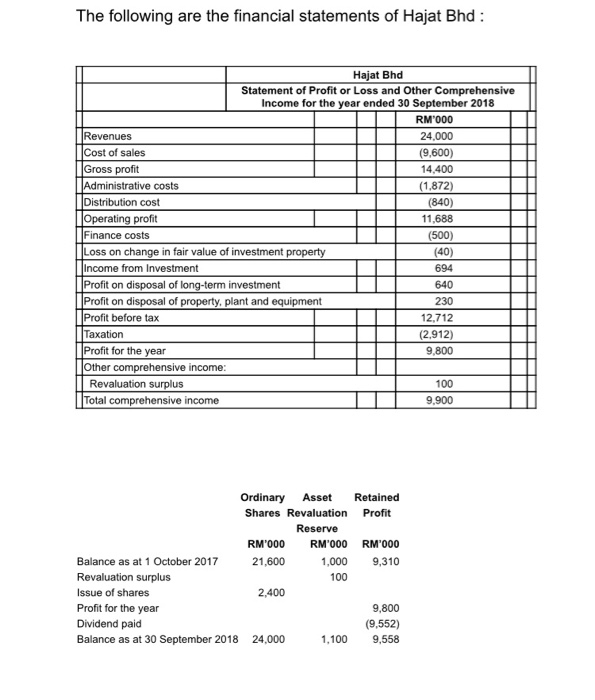

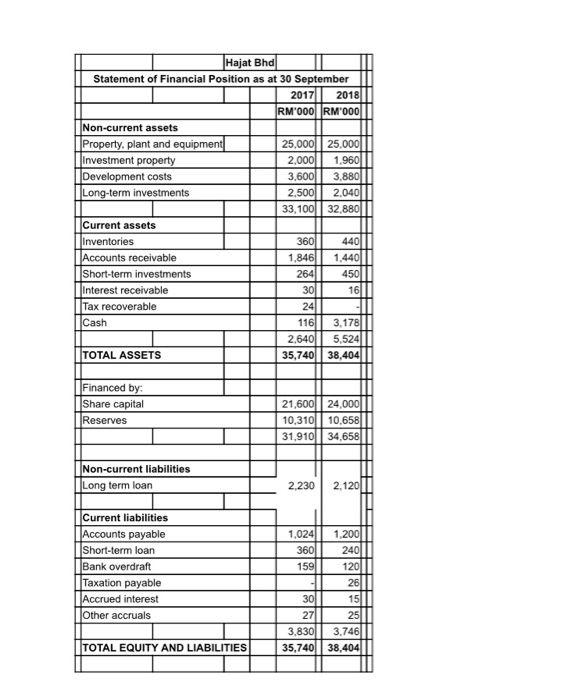

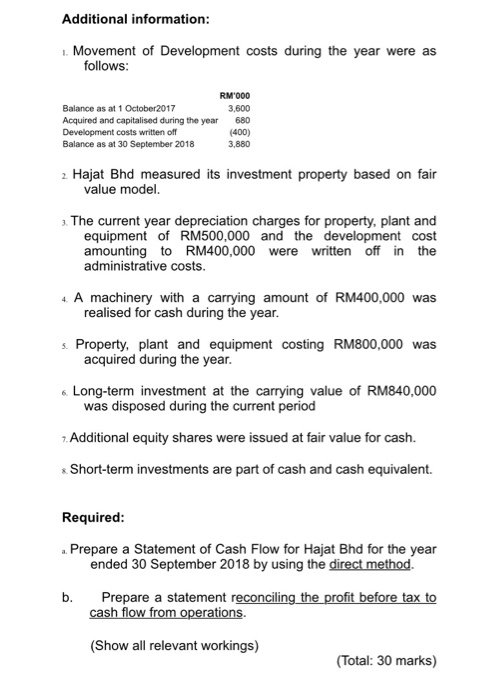

The following are the financial statements of Hajat Bhd : Hajat Bhd Statement of Profit or Loss and Other Comprehensive Income for the year ended

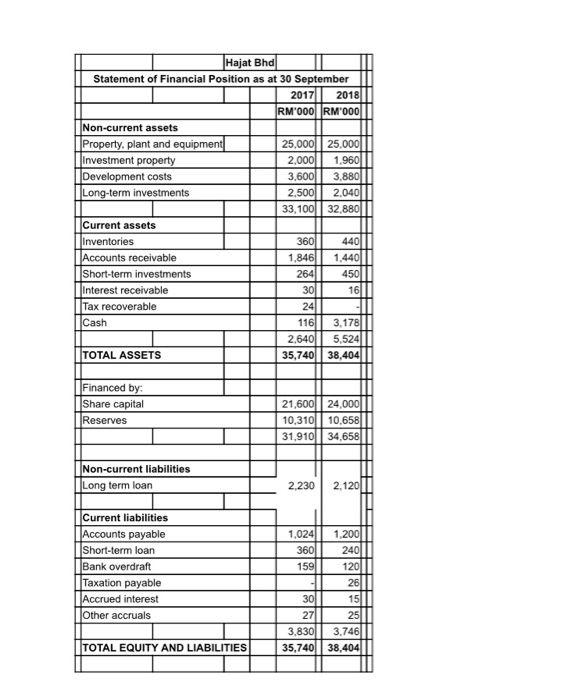

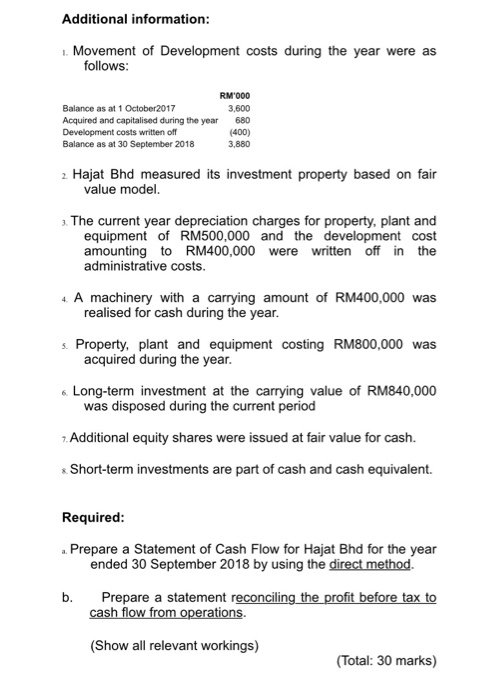

The following are the financial statements of Hajat Bhd : Hajat Bhd Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 September 2018 RM'000 Revenues 24.000 Cost of sales (9.600) Gross profit 14,400 Administrative costs (1,872) Distribution cost (840) Operating profit 11,688 Finance costs (500) Loss on change in fair value of investment property (40) Income from Investment 694 Profit on disposal of long-term investment 640 Profit on disposal of property, plant and equipment 230 Profit before tax 12.712 Taxation (2.912) Profit for the year 9,800 Other comprehensive income: Revaluation surplus 100 Total comprehensive income 9.900 Ordinary Asset Retained Shares Revaluation Profit Reserve RM1000 RM'000 RM 000 Balance as at 1 October 2017 21,600 1,000 9,310 Revaluation surplus 100 Issue of shares 2,400 Profit for the year 9,800 Dividend paid (9,552) Balance as at 30 September 2018 24,000 1,100 9,558 Hajat Bhd Statement of Financial Position as at 30 September 2017 2018 RM'000 RM"000 Non-current assets Property, plant and equipment 25,000 25,000 Investment property 2.000 1,960 Development costs 3.600 3,880 Long-term investments 2,500 2,040 33,100|| 32,880 Current assets Inventories 3601 440 Accounts receivable 1,846) 1,440 Short-term investments 2641 450 Interest receivable 300 16 Tax recoverable 24 Cash 116 3.178 2.6401 5,524 TOTAL ASSETS 35,740|| 38,404 Financed by: Share capital Reserves 21,600 24,000 10,310|| 10,658 31,910 34,658 Non-current liabilities Long term loan 2,230 2,120 Current liabilities Accounts payable Short-term loan Bank overdraft Taxation payable Accrued interest Other accruals 1,024 1,200 360 240 159 120 26 301 15 27 25 3,830 3,746 35,740|| 38,404 TOTAL EQUITY AND LIABILITIES Additional information: 1. Movement of Development costs during the year were as follows: RM'000 Balance as at 1 October 2017 3,600 Acquired and capitalised during the year 680 Development costs written off (400) Balance as at 30 September 2018 3,880 2. Hajat Bhd measured its investment property based on fair value model. 3. The current year depreciation charges for property, plant and equipment of RM500,000 and the development cost amounting to RM400.000 were written off in the administrative costs. 4. A machinery with a carrying amount of RM400,000 was realised for cash during the year. s. Property, plant and equipment costing RM800,000 was acquired during the year. Long-term investment at the carrying value of RM840,000 was disposed during the current period 2. Additional equity shares were issued at fair value for cash. Short-term investments are part of cash and cash equivalent. Required: .. Prepare a Statement of Cash Flow for Hajat Bhd for the year ended 30 September 2018 by using the direct method. b. Prepare a statement reconciling the profit before tax to cash flow from operations. (Show all relevant workings) (Total: 30 marks)

The following are the financial statements of Hajat Bhd : Hajat Bhd Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 September 2018 RM'000 Revenues 24.000 Cost of sales (9.600) Gross profit 14,400 Administrative costs (1,872) Distribution cost (840) Operating profit 11,688 Finance costs (500) Loss on change in fair value of investment property (40) Income from Investment 694 Profit on disposal of long-term investment 640 Profit on disposal of property, plant and equipment 230 Profit before tax 12.712 Taxation (2.912) Profit for the year 9,800 Other comprehensive income: Revaluation surplus 100 Total comprehensive income 9.900 Ordinary Asset Retained Shares Revaluation Profit Reserve RM1000 RM'000 RM 000 Balance as at 1 October 2017 21,600 1,000 9,310 Revaluation surplus 100 Issue of shares 2,400 Profit for the year 9,800 Dividend paid (9,552) Balance as at 30 September 2018 24,000 1,100 9,558 Hajat Bhd Statement of Financial Position as at 30 September 2017 2018 RM'000 RM"000 Non-current assets Property, plant and equipment 25,000 25,000 Investment property 2.000 1,960 Development costs 3.600 3,880 Long-term investments 2,500 2,040 33,100|| 32,880 Current assets Inventories 3601 440 Accounts receivable 1,846) 1,440 Short-term investments 2641 450 Interest receivable 300 16 Tax recoverable 24 Cash 116 3.178 2.6401 5,524 TOTAL ASSETS 35,740|| 38,404 Financed by: Share capital Reserves 21,600 24,000 10,310|| 10,658 31,910 34,658 Non-current liabilities Long term loan 2,230 2,120 Current liabilities Accounts payable Short-term loan Bank overdraft Taxation payable Accrued interest Other accruals 1,024 1,200 360 240 159 120 26 301 15 27 25 3,830 3,746 35,740|| 38,404 TOTAL EQUITY AND LIABILITIES Additional information: 1. Movement of Development costs during the year were as follows: RM'000 Balance as at 1 October 2017 3,600 Acquired and capitalised during the year 680 Development costs written off (400) Balance as at 30 September 2018 3,880 2. Hajat Bhd measured its investment property based on fair value model. 3. The current year depreciation charges for property, plant and equipment of RM500,000 and the development cost amounting to RM400.000 were written off in the administrative costs. 4. A machinery with a carrying amount of RM400,000 was realised for cash during the year. s. Property, plant and equipment costing RM800,000 was acquired during the year. Long-term investment at the carrying value of RM840,000 was disposed during the current period 2. Additional equity shares were issued at fair value for cash. Short-term investments are part of cash and cash equivalent. Required: .. Prepare a Statement of Cash Flow for Hajat Bhd for the year ended 30 September 2018 by using the direct method. b. Prepare a statement reconciling the profit before tax to cash flow from operations. (Show all relevant workings) (Total: 30 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started