Answered step by step

Verified Expert Solution

Question

1 Approved Answer

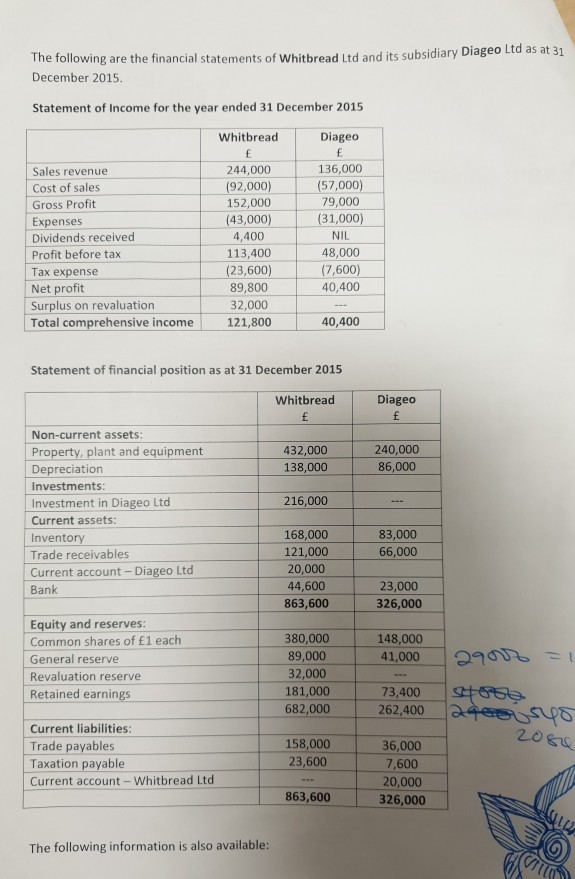

The following are the financial statements of Whitbread Ltd and its subsidiary Diageo Ltd as at 31 December 2015. Statement of Income for the year

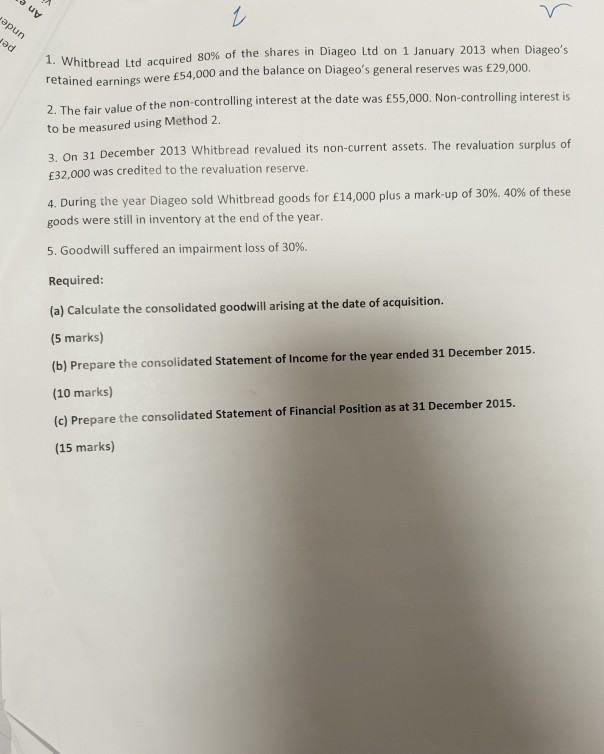

The following are the financial statements of Whitbread Ltd and its subsidiary Diageo Ltd as at 31 December 2015. Statement of Income for the year ended 31 December 2015 WhitbreadDiageo 136,000 57,000 79,000 244,000 Sales revenue Cost of sales Gross Profit Expenses Dividends received Profit before tax Tax expense Net profit Surplus on revaluation (92,000) 152,000 (43,000) (31,000) NIL 4,400 113,400 48,000 (23,600) 7,600) 40,400 89,800 32,000 121,800 Total comprehensive income 40,400 Statement of financial position as at 31 December 2015 Whitbread Diageo Non-current assets 240,000 Property, plant and equipment Depreciation Investments Investment in Diageo Ltd Current assets: Inventory Trade receivables Current account - Diageo Ltd 432,000 138,000 216,000 168,000 121,000 20,000 44,600 863,600 83,000 66,000 23,000 326,000 Bank Equity and reserves: 380,000 89,000 32,000 181,000 682,000 148,000 Common shares of 1 each General reserve Revaluation reserve Retained earnings 41,000 -I nov 0-1 73,400 262,400 Current liabilities: Trade payables Taxation payable Current account-Whitbread Ltd 20gu 158,000 23,600 36,000 7,600 20,000 863,600326,000 The following information is also available: d 80% of the shares in Diageo Ltd on 1 January 2013 when Diageo's 1. Whitbread Ltd acquire re were 54,000 and the balance on Diageo's general rserves was 29,000. 2. The fair v to be measured using Method 2. 3. On 3 E32,000 was credited to the revaluation reserve. 4. During the year Diageo sold Whitbread goods for 14,000 plus a mark-up of 30%. 40% of these goods were still in inventory at the end of the year. 5. Goodwill suffered an impairment loss of 30%. Required (a) Calculate the consolidated goodwill arising at the date of acquisition. (5 marks) (b) Prepare the consolidated Statement of Income for the year ended 31 December 2015. (10 marks) (c) Prepare the consolidated Statement of Financial Position as at 31 December 2015. (15 marks) alue of the non-controlling interest at the date was 55,000. Non-controlling interest is 1 December 2013 Whitbread revalued its non-current assets. The revaluation surplus of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started